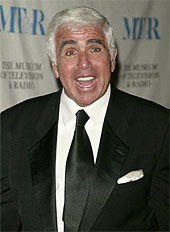

Karmazin Speaks – Will The Street Listen?

Sirius XM CEO Mel Karmazin spoke with Reuters today, and much of what he outlined should be seen as a positive for the company. However, the street needs more than good intentions and words, and even when a company delivers on their guidance, as Sirius XM did in Q3, people still look at anything with a jaded eye.

Karmazin made several statements, which in normal economic conditions would be enough to get some traction in the equity. Today, this news was simply absorbed with a shrug of the shoulders, and a show me mentality.

POSITIVE POINT #1

Karmazin sees double digit revenue growth on a percentage basis in Q4. Wonderful news that seems to have fallen on deaf ears. In a time when other media companies are seeing double digit declines, Sirius XM Radio is still growing, yet no one seems to care that Sirius XM’s revenue is a polar opposite to all of the bad news out there. Perhaps it is too difficult to grasp that there are still companies that are in a growth trend at this point in time.

POSITIVE POINT #2

Karmazin is confident the company can refinance debt due in 2009. Perhaps this issue is the overshadow that simply refuses to go away. Karmazin has been expressing confidence with this subject for a while, and this issue is where a “show-me” attitude is likely warranted. That being said, I have always felt that the company will indeed be able to get the debt issue resolved. I would have hoped that it would have been done by now, but still, it should get done. For the equity to see improvement, an answer on the debt needs resolution.

POSITIVE POINT #3

Karmazin has no immediate plans to cut its subscription prices, even in the midst of the economic recession. At a time when prices are being slashed left and right, you would think news that they will be able to hold the line would be news that is well received. Instead, the street barely reacts. This is substantial news. This means that churn is stable. It means that new subscriber numbers are satisfying the business model. It means that revenue can continue to grow. Perhaps the lack of a profit from Sirius XM tempers this news a bit, but with the continued positive trend shouldn’t the street give this a bit more weight?

POSITIVE POINT #4

“We did exactly what we wanted to do for Black Friday, which is not great news because we didn’t have high expectations,” Karmazin said, referring to the Friday after Thanksgiving, which kicks off the holiday shopping season.

While humble sales are not a positive point, the fact that the company was able to meet their expectations is stable. Had sales been shy of low expectations, the worry lines would rightfully appear. With the news being that holiday shoppers are being cautious, meeting your expectations is a small victory unto itself. On a side note, meeting those expectations did not come without an expense. Many retail radio’s came with free service for three months. Thus, you have a new subscriber, but n o revenue just yet.

POSITIVE POINT #5

Perhaps the biggest bit of news from the Reuters Media Summit was Karmazin’s statement that Sirius XM Radio is not for sale. “We don’t feel that we need to be acquired,” he said. “You should assume the company is not for sale.”

With stock prices at low levels, one distinct worry many may have is that the company sells itself. Investors who believe in the long term outlook of the concept of satellite radio would potentially be looking at a situation where they would not participate in the success of the company in the years ahead. Of course, there is no guarantee that the company will be an overwhelming printing press of cash, given that it has at times been a printing press of shares. However, those that have maintained faith in the concept should be able to reap the reward should it come.

In the end, it boils down to what transpires over the next few months. Will Karmazin’s outlook be realized? Will the street finally be able to digest good news? Will satellite radio be successful in refinancing their debt? There are a few questions that seem to be keeping many hesitant.

[Reuters]

Position: Long Sirius XM

it amazes me how people can still justify karmazin still being CEO of this company, and place the blame of his failures due to the economy, fcc,stern, etc.etc.

the fact of the matter is that just a few years ago xm and siri had a combined market cap of over 16 billion, and we all know where it is now.

with sirixm now trading at 16 cents per share,why not give some one new a try? lets face it, can someone really screw this up any worst the karmazin?

John,

Excuse me… Melvin was “confident” that the Merger would be completed by the end of 2007.

What else is Melvin confident about? His Salary and Bonuses?

To earn his keep, his main focus would have been to sleep on the F.C.C.’s Doorstep if that’s what it took to get them and others to do their jobs.

What is highly comical about Karmazin defenders is their knowledge of what a “hard-nosed” businessman he been reported to be… but, we cannot hold Melvin to the same standards as he holds everyone who reports to him equally.

Oh, I forgot, we only Praise His Arrival, but cannot anticipate his Departure.

So john, you feel that the auto industry is different than say, the airline industry? I’m not necessarily disagreeing with you however, why didn’t the airlines in bankruptcy just a mere couple of years ago keep their same stock issues instead of cancelling and reissuing new shares under new symbols?

siri will have to go up roughly %3500 just to get back to where it was when karmazin was named CEO. the man has been an absolute disaster

RUN – That is funny. It is actually one of most seldom looked at metrics when analyzing price movements. When something loses 50% of it’s value it requires a 100% gain to just get back to where it was. Very peculiar.

GIS- i believe that if people ever looked at the stock price with clear eyes, they would demand a change in CEOS. it is more then clear that karmazin does NOT look out for shareholders value. he has been with sirius for 4+ years and he has done nothing but DESTROY shareholders value

Yeah, that’s where a hard line gets drawn. If you look at it strictly from the point of view of Mel doing his job running the company without taking the stock price into consideration, who knows, we still have to wait to find out. He has successfully merged the two sat. companies. Where that will take us in the future is unknown.

From the perspective of Mel’s performance based on stock performance he gets an F-. And really, isn’t a CEO’s job to maximize shareholder value? So even though there are those that keep saying that things will be great in the future and the stock price will be up umpteen hundred percent that doesn’t change the fact that us shareholders with much higher entry prices have been beaten to a bloody pulp.

It’s not fun. It’s not funny.

the mistakes that karmazin has made are numerous, but none of them are as bad as taking over xm as a merger of 2 equals. xm shareholders should not have recieved 1 share. it is there debt ridden company that karmazin chose to ignore, and put on siri shareholders back that has lead to this disaster

Max…

I am sorry that you are offended. Certainly your comment was not the best to choose from, and your defense of it does not ring sincere. Holiday parties were indeed cancelled. There was not an exception made for Jewish holidays. Typically a company such as Sirius would have a multi-themed holiday event. In lieu of the Holiday Party, Mel gave all employees December 24th, 25th, and 26th off. You state that Mel cancelled the party as an example of synergies and cost cutting. Not the case. Here is the memo:

The CEO’s email to staffers says that given the “very difficult environment” for all companies, “satellite radio sales not growing as we would like”, the current layoffs (“eliminating many duplicate positions”) and the stock price – “I have decided that hosting the annual holiday parties this year would send a contradictory message.” He knows it’s disappointing – “if ever there was a time that I would like to celebrate and thank everyone for a great job, it would be this year.” But there is a Christmas, after all (just not a party) – “In addition to having Christmas Eve and Christmas Day as holidays, we will also have the day after Christmas this year, so that you can spend more time with your friends and family.” His final sentence – “I am very confident that not only will our company be successful, but also [that] we will be very successful.”

The fact is that the company is not having “other holiday celebrations” so your call to eliminate them is not needed. They were not there to begin with.

You say, “But, then, its always anti-semite, anti-black, anti-this and anti-that… too convenient of an argument, Tyler. You can do better.”

Sorry Max, I do not have to do better. Your comment was gratuitous, and not relative to the subject matter in any way shape or form. Simply stated, there was no need for you to make the comment.

The company based Sterns bonus on concensus analyst estimates for subscribers prior to the Stern announcement. They established targets above those estimates fgor each year of his contract. Sirius went over the bonus figure twice 2005 and 2006. they did not go above the higher number in 2007. Th reason Stern did not get a bonus in 2007 was because the auto industry was slower than the company anticipated, not because of auto subs.

You state, “Question remains, how did they come up with such a number to pay him that humongous bonus and the same for Melvin?”

Sterns bonus was determined by establishing a market for him. It could be argued that had Sirius not brought Stern on board, that they would have been in deep trouble.

Mels bonus was$3,000,000 in the first year and $4,000,000 in the second year.

You ask, “Are you an unsophisticated investor or day trader? Are we to believe guidance provided by a Company’s CEO?”

I am neither a day trader nor unsophisticated. The company has hit virtually every bit of guidance that they have put up, and if they were going to miss (2006 sub numbers for example) they have changed the guidance well in advance. For the most part the company has done very well by their guidance.

You ask, “Can you detail out what a Sophisticated Investor of Sirius is? Please differentiate between those who invested in 2004 vs. 2005, and those who invested in other years and timeframes.”

Why differentiate between the years? Investor savvy does not change because of the year. It changes with the market. A sophisticated investor is an investor who knows something about the company and risks prior to investing. Someone who follows their investment closely, and monitors the ongoing situation and market.

You ask, “I’d like to know just exactly what an unsophisticated investor is supposed to do to become less unsophisticated.”

Become aware and educated as to what they are invested in.

You ask, “And, while you’re at it, lemme know what your gains or losses have been, especially since you follow this company as close as anyone.”

I typically do not discuss my investments to this level. I bought a large position in 2003 and 2004 after the recap. Shares were very cheap, and Sirius had about 25,000 subs. I sold the bulk of my shares in the $7’s(after the Mel announcement and the stock running up to $9). I made a nice profit, and maintained a much smaller position ever since.

You ask, “Did you see the August mess coming?”

I was one who said that there would not be a massive run-up with merger approval. The financing to consumate the deal was not favorable, and the financial crisis made the situation worse. I would not have pictures this equity trading below book value, but then again, I did not picture th amount of banks going dow that did.

You ask, “Were you shocked when Stern immediately dumped all his Bonus shares?”

Stern did not dump all of his bonus shares. He sold enough to pay the taxes. I would suggest that you read up on this a bit. There is a stark difference between selling to cash out, and selling enough to pay the taxes due. His move did not shock me at all. If you won $1,000,000 uncle sam would want his cut.

You ask, “Did you put credence into Mel’s promise to get the Merger done by December 2007?”

The delay in the merger was unprecidented. It became the longest in history. In my opinion it should have happened by the end of the year in 2007. What should the company have done when it did not happen by then, walk away when they have done all of the work to make it happen?

Tyler

“The CEO’s email to staffers says that given the “very difficult environment” for all companies, “satellite radio sales not growing as we would like”, the current layoffs (“eliminating many duplicate positions”) and the stock price – “I have decided that hosting the annual holiday parties this year would send a contradictory message.” He knows it’s disappointing – “if ever there was a time that I would like to celebrate and thank everyone for a great job, it would be this year.” But there is a Christmas, after all (just not a party) – “In addition to having Christmas Eve and Christmas Day as holidays, we will also have the day after Christmas this year, so that you can spend more time with your friends and family.” His final sentence – “I am very confident that not only will our company be successful, but also [that] we will be very successful.”

There’s that “confident” insert again. In my opinion, Melvin stopped short of showing how SINCERE his decision are related to his decision about holiday parties. If the company is performing as badly as alluded to in his own memo above, then why isn’t the CEO taking a hit? Careful how this question is answered, it may have anti-something undertones to it.

Tyler, being naive is one thing, being totally naive about my comments may reveal a tendency to overlook everything vs. comfort-zone topics. I prefer to address them all, and not be censored for doing so. It’s your Board, your call.

You Said: “The company based Sterns bonus on concensus analyst estimates for subscribers prior to the Stern announcement. They established targets above those estimates for each year of his contract. Sirius went over the bonus figure twice 2005 and 2006. they did not go above the higher number in 2007. Th reason Stern did not get a bonus in 2007 was because the auto industry was slower than the company anticipated, not because of auto subs.”

The last sentence, confusing at best, but telling. If, as I surmise, many of Stern’s Bonus numbers INCLUDED simple Auto Subs, not related to Stern in any way, then calcs to determine his Bonuses are flawed.

“Mels bonus was$3,000,000 in the first year and $4,000,000 in the second year.” That’s a 33% Increase while the PPS went which way? Seems outrageous.

“Why differentiate between the years? Investor savvy does not change because of the year. It changes with the market. A sophisticated investor is an investor who knows something about the company and risks prior to investing. Someone who follows their investment closely, and monitors the ongoing situation and market.”

Investor Saavy DOES Change based on the information and its accuracy. For example, it appears as if your advance knowledge of Stern coming over to Sat Rad from Terrestrial made you saavy. Your reported profits followed.

Most followed the same logic during the halcyon days you were in play. Then came Karmazin. What changed? Did your read of the company’s performance change? Was Karmazin the greatest acquisition the company could have made? Well, the current MV and PPS is all I have to look at to answer that–if that makes me unsophisticated, wow.

Karmazin cannot dodge this glaring fact: he has spent more than he has taken in… for more than a few years. A sophisticated Investor, knowing Karmazin’s reputation in the business world would have taken that to mean he would have done the opposite. Instead, he spent, and spent and spent… perhaps time for Melvin to attend Budgeting 101?

August Mess. Many have said it and I concur… what did Melvin do for 17 Months in anticipation of an immediate approval? Well, for one thing, when the situation with the F.C.C. was +60 after DOJ approval, he had the authority and right to cancel the deal, pay a minor fee to XM, and gone on as a standalone company. He made a decision to roll the dice into the “financial crisis” as you put it, and protect, IMO, his tremendous ego. For that, shareholders of both former companies continue to suffer.

The Stern situation was good for Sirius, but his absence post-Bonuses is appalling. No 2nd Push, 3-4 day work-weeks, and apparently no intention of promoting the service independently. Where’s the incentive after having received over $300 million to date?

FYI… current PPS at 12:48 p.m. on Thursday is $.1706

ok max

Would you please give us a list of your entire portfolio so that we can see how the rest of your stocks are doing?

Apparently, by the way uou are talking, you are making a killing in every other stock you own. You have no need to call for the heads of the other CEOs in your portfolio, they must be doing absolutely wanderful.

After all, a CEO’s report card is ONLY the stock price… lets see how well your other CEOs have been doing on theirs.

I am done with this thread. You people are the unsophisticated investors that Mel was talking about. You are unable to look past the price per share to see what Mel has actually done since he has been CEO. You care nothing about how Mel has increased the subscriber count from 1.5 million subscribers to nearly 9 million prior to the merger, increased revenue, cut costs, got a merger passed that most said was impossible…

It doesn’t matter to you people. It doesn’t matter that the entire market is down. It doesn’t matter that the Dow Jones is down nearly 50%, and that all of those other stocks that I mentioned above are down HUGE. Nope, doesnt matter. To you unsophisticated investors, nothing matters except the stock price, and that indicates that Mel is a failure.

Some of you unsophisticated investors (MAX) still insist that Mel is the one that decided to give Stern his bonuses. Mel did not have a choice. Those bonuses were a part of a contractual agreement between Sirius and Stern PRIOR TO MEL EVER SIGNING UP FOR THE COMPANY. WHAT PART OF THAT DO YOU NOT UNDERSTAND?????????

As I said, I am done with this thread.

Newman – One last question – Why would we give Mel the credit for the subscriber growth? Was it really he who did this? If we are going to keep saying that Howard was with Sirius before Mel even got there how can we give Mel all of the credit?

If I make my living from trading/investing and I am also invested heavily in Sirius does that make me unsophisticated? I would like to know.

Because many of us individual investors along with all of the mutual funds invested make us unsophisticated since most of us have lost boat loads of money in it?

Or are we sophisticated because we are holding onto our positions for the future returns the stock will bring and therefor the money we’ve lost up until now is a non-issue?

Max…..

Several issues here.

Holiday party

Mel stated

1.“very difficult environment” for all companies

2. “satellite radio sales not growing as we would like”

3. the current layoffs (“eliminating many duplicate positions”)

4. the stock price

For those reasons, he felt said, “I have decided that hosting the annual holiday parties this year would send a contradictory message.” and “if ever there was a time that I would like to celebrate and thank everyone for a great job, it would be this year.”

“I am very confident that not only will our company be successful, but also [that] we will be very successful.”

From that you stated, “If the company is performing as badly as alluded to in his own memo above, then why isn’t the CEO taking a hit?”

You, nor I have no way of knowing whether or not he is taking a hit. He may not get a bonus, but then again he might. He is taking a hit with his investment. He is taking a professional hit as well. You want him to forego pay. That is outrageous.

You say, “Tyler, being naive is one thing, being totally naive about my comments may reveal a tendency to overlook everything vs. comfort-zone topics. I prefer to address them all, and not be censored for doing so. It’s your Board, your call.”

You are the one asking questions about how Sterns bonuses, etc. were structured. Who is naive here?

Clifying Sterns Bonuses.

1. Prior to the Stern announcement, analysts all had various projections for how many subscribers the company would have for the future years. The average was taken.

2. Sirius then cut a deal with Stern that included bonuses if the subscriber numbers were to beat those averages by accelerating numbers. The easiest bonus to earn was the first year. each year the delta between the aveage, and the Stern target became larger. The second year Stern made the bonus. At that time, the company said it “would be very difficult” for Stern to earn a third bonus. as it turns out, there was no third bonus.

3. The analyst numbers had expected a huge installation rate from companies such as Ford. It did not happen in the timeframe that analysts were projecting. Because those analyst anticipated installs did not happen, it became harder still for stern to get the numbers.

4. Simply stated, Stern got some of what was anticipated for auto sales, PLUS the other subscribers. However, by the third year, there simply was not enough auto penetration for Stern to make his bonus.

You say, “If, as I surmise, many of Stern’s Bonus numbers INCLUDED simple Auto Subs, not related to Stern in any way, then calcs to determine his Bonuses are flawed.”

Again, Sterns bonuses were the delta between analyst anticipated sales, and the actual numbers. think of it this way. An analyst anticipates that a restaraunt will sell 100 steak dinners. Then Wolfgang Puck is hired with great fanfare. Pucks pay has bonus clauses. They anticipate that the hiring of Puck will mean more steak sales in the area of 50 added steaks. They establish a bonus if he is able to better the 150 number by 25 more. Thus, if 175 steaks sell, he gets the bonus. Hopefully this example helps. Is this type of structure flawed? No, it is how many such deals happen.

You feel Mel’s pay is outrageous. That is fine. Would you feel the same if the stock were at $5.00 but the company was seeing no growth?

You say, “Investor Saavy DOES Change based on the information and its accuracy. For example, it appears as if your advance knowledge of Stern coming over to Sat Rad from Terrestrial made you saavy. Your reported profits followed.”

I did not have advanced knowledge of Stern or Mel coming to sirius. That would be insider trading.

You say, “Most followed the same logic during the halcyon days you were in play. Then came Karmazin. What changed?”

I sold after Karmazin was announced. The big run in the stock happened after karmazin was announced.

You ask, “Did your read of the company’s performance change?”

I was glad to see Karmazin on board. I was also aware that Sirius was overbought by a wide marin when it went through the $6 range.

You ask, “Was Karmazin the greatest acquisition the company could have made?”

In my opinion, yes

You say, “Well, the current MV and PPS is all I have to look at to answer that–if that makes me unsophisticated, wow.”

You should look at far more than Market Value and PPS. You should be going through the financials, understanding the deal structures, and the dynamics of the model. For example, if GM announced tomorrow that they were doing 100% installations, how would that effect cash flow? Revenue share? the balance sheet?

You say, “Karmazin cannot dodge this glaring fact: he has spent more than he has taken in… for more than a few years.”

A lot of the spending you are assigning to Karmazin is not money he is spending. It is money that was spent prior to his arrival. Sirius is a big ship. It does not turn on a dime.

You say, “A sophisticated Investor, knowing Karmazin’s reputation in the business world would have taken that to mean he would have done the opposite.”

I would suggest looking at the various cost lines since Karmazins arrival. Look at the metrics he had complete control over. Subscriber Aquisition costs, marketing, R&D, etc. I think you will be surprised.

You said, “Instead, he spent, and spent and spent… perhaps time for Melvin to attend Budgeting 101?”

Again, look at the metrics he had control of. I think it would be worth yourv time. It is better to have all of the information prior to arriving at a final opinion.

You said, “Many have said it and I concur… what did Melvin do for 17 Months in anticipation of an immediate approval?”

He has a very limited ability to do anything in those 17 months in relation to financing. He had limited access to XM’s books, and the market was changing. Even though the banks were not admitting it, they knew there was trouble. No one anticipated it to be as widespeard as it was. You act as if he did nothing. I can assure you that this is far from the case. You can not finance something that you do not know the value of. If you were a bank would you finance the deal in January of 2008 without knowing when the FCC will make their decision?

You say, “Well, for one thing, when the situation with the F.C.C. was +60 after DOJ approval, he had the authority and right to cancel the deal, pay a minor fee to XM, and gone on as a standalone company.”

You call Karmazins’s salary outrageous, but then call millions and millions to walk away a “minor fee”. Where do you think Sirius would be now without the merger. Chrysler, the largest installer for sirius is on the verge of going under. Ford has a 10% market share. GM, Honda, Toyota and Nissan all had factory deals with XM. The cost to walk away would likely have been even worse than where we are today. The FCC delay was a massive drawback for these companies, and the financial meltdown broke the camels back.

You said, “He made a decision to roll the dice into the “financial crisis” as you put it, and protect, IMO, his tremendous ego. For that, shareholders of both former companies continue to suffer.”

His decision was prior to the major financial crisis.

You say, “The Stern situation was good for Sirius, but his absence post-Bonuses is appalling.”

I do think Stern could do more.

You say, “No 2nd Push, 3-4 day work-weeks, and apparently no intention of promoting the service independently. Where’s the incentive after having received over $300 million to date?”

He received money for the previous promotion. He was not paid on future promotion. He does more than a 3 day work week.

Get It Straight…..

Howards deal was made a couple of months prior to Mel’s.

Mel’s start date was earlier than Howard’s.

Get It Straightr…..

Sophistication in investing comes with knowledge and understanding. Picking winners each time you trade does not measure your sophistication.

Unsophisticated investors make the following types of statements:

“mel made $32,000,000 in 2007” – he did not

“Howard made $500,000,000” – The deal was for Howard, his staff, his studio, and budgets for other programming such as Bubba, Ferrall, Miserable Men, Howard 100 news, etc.

“Sirius can go to $40 because XM did” – A lack of understanding of the outstanding shares.

“This is going to the moon…they just signed Martha” – Martha is but one piece of the puzzle.

“Howard is selling out all his shares. He must not believe in the company” – Howard sold enough to pay his taxes. He held the rest for at least a year because the SEC filings show it to be true

“Insiders are selling. Must not be good.” – The only insider sales relkate to paying taxes on options. Has nothing to do with compnay sentiment. Has everything to do with paying uncle sam

Unsophisticated investors say Mel has failed because the stock price is down.

Unsophisticated investors say that the stock is down because Mel failed, without realizing that many Forutne 500 companies and Blue Chip stocks are down well over 50% over the past 6-12 months.

Unsophisticated investors say that Mel failed, though every single number that relates to this company is BETTER than when he started, except the stock price.

Unsophisticated investors think that they are unsophisticated because they have lost money on a stock.

Unsophisticated sellers do not understand anything about the metrics behind a stock, simply looking at the stock price.

I am not saying that you are an unsophisticated investor if you are invested in Sirius… I am invested in Sirius and have lost a lot of money on it. What I do contend is that you are unsophisticated if you cannot see past the share price into the economy, the metrics, and everything else affecting the stock price. If you think the CEO is the only thing that affects the stock price? You migh be a redneck. Oops, unsophisticated investor.

Newnam, really it was just over 2 million to almost 9 million. Then again who is counting.

By the way Stern was then and is now still worth the cost. You cant blame Stern for the cost of the radios when he came to SIRI. SIRI also did not over pay for him they paid what they had to to get him from XMSR and terrestrial. They just did not come up with a figure of 500 million for 5 years out of the blue.

April 22, 2005: Share Price: $5.10

Mr. Karmazin, who recently hired two veteran radio executives to build a sales force, said Sirius will record ad revenue of up to $8 million this year, $50million in 2006 and $100 million by 2007.

J56D…..

To be fair, Karmazin did express in 2006 and 2007 that ad sales were not tracking to what he wanted.

Ad revenues

2005 – $6,131,000

2006 – $31,044,000

2007 – $34,192,000

For nine months of 2008.

2008 – $31,413,000 pro forma of $54,156,000

Well behind the original goals. Mel did back off those estimates after 2006.

Max, keep talking. You’re doing a great job of exposing Tyler as the unsophisticated bonehead pumper that he is.

Tyler, Karmazin’s TOTAL COMPENSATION for 2007 was valued at OVER $30 MILLION! I am so sick and tired of your bending and twisting of the truth. Grow up and start telling the truth or just go away.

StockLooker

Looks like Karmazin, from Tyler’s 5:22 p.m. posting, just kept all the Ad Revenues?

I got nothing against the Host. Just don’t believe in giving Melvin any more rope.

Stocklooker…..

Welcome yo the discussion.

So, you say his compensation was valued at over $30,000,000.

Let’s look at this, and also look why you feel the way you do. We will look at all of the facts and figures. We will look at the value for accounting purposes vs, the REAL value.

Karmazin’s employment contract shows base salary is $1,250,000. He can get bonuses at the direction of the compensation committee. He also received options to buy 30,000,000 shares of stock at a price of $4.74 per share.

Now, kindly take the time to review the employment contract, as well as the annual reports. You will see that you are not reding things correctly.

2006 annual report – http://files.shareholder.com/d.....2006AR.pdf

2007 annual report – http://files.shareholder.com/d.....Report.pdf

Karmazin employment contract – http://contracts.onecle.com/si.....1.18.shtml

So stocklooker. Please tell me how I am twisting and bending the truth. The FACTS ARE that the options are accounted the way they are because of GAAP. Please read note 2 which states that the options include all options awarded in the current year and years prior.

Lets see your level of sophistication. In the 2007 report it shows options for 24,118,312 shares for 2007 and options for 24,118,312 in 2006. Is it your contention that during those two years that he received opitions for 48,236,624 shares, or that his option shares remained the same 24,118,312 option shares?

What Karmazin has is the right to purchase Sirius stock at $4.74 cents per share. What do you value that right at today? Most people consider the value of these options as $0. However, for accounting, they need to carry an assigned value.

I await your response. If nothing else, perhaps other readers will gain an understanding of how these options work, and how they are accounted for.

AWFUL TIMING

MERGER CRITICS KEY ON KARMAZIN’S $31M PAY

By PETER LAURIA

April 29, 2007

As if the pending merger between satellite radio operators Sirius and XM didn’t face enough hurdles, news of Sirius CEO Mel Karmazin’s $31 million pay package has provided even more ammunition for the combination’s critics.

…………………

News of Karmazin’s compensation kicked off a harsh week for the Sirius-XM merger that included the release of several analyst reports that put the chances of regulatory approval at less than 35 percent and a lackluster earnings report from XM (Sirius reports earnings on Tuesday).

Only $4.25 million of Karmazin’s pay stemmed from salary and bonuses. The remaining $27 million came from restricted stock and options grants that were used to entice the former Viacom COO to join Sirius in 2004. Those options vest automatically on each anniversary after they were granted for the next few years.

Tyler, your little college boy games have grown old. Grow up and stop being a fact twisting asshole.

Stocklooker…..

Are you going to respond?

You called me a “unsophisticated bonehead pumper”

you said, “I am so sick and tired of your bending and twisting of the truth. Grow up and start telling the truth or just go away.”

Now that you have had a chance to see the numbers (which you should have done prior to now), will you grow up and admit your error?

Awaiting your response

stockholder…..

I give you the actual documents and asked direct questions. You will not answer.

College was years and years ago for me. Let’s see you stop playing the games. here is the question again:

Lets see your level of sophistication. In the 2007 report it shows options for 24,118,312 shares for 2007 and options for 24,118,312 in 2006. Is it your contention that during those two years that he received opitions for 48,236,624 shares, or that his option shares remained the same 24,118,312 option shares?

A direct answer would be appreciated

Hey Steve,

Just getting on a computer.

After going through the posts.

I want to say that I’m feeling better about my whining issue.

Take care.

Socal

Tyler, give it up. You can huff, and puff, but today your stock set a new low of .08 cents. The party is over.

I suggest you read the 10Q financial reports from August and November. They tell a much more telling story and are much more honest than the crap you write here. I had posted some of the factual information on the other Karmazin fluff piece that your buddy wrote, but he felt the need to delete them because they included the “bankruptcy” wording in them. Sirius’s words, not mine. You don’t ignore serious warnings about a possible bankruptcy filing, or the fact that they are continuing to lose more and more revenue, not only because of a decline in new and used car sales, but due to credit card payment defaults, effectively declining monthly autopayments by subsribers. Then again, people like you tend to ignore the truth while living with your head buried deeply in the sand. In the end, all the crap you wrote about this stock will prove just how much of an “unsophisticated bonehead” investor you truly are. Mel’s words, not mine.

Hey Socal,

I am now Steve O. Seems there is another Steve posting, so as not to create any confusion, Steve O will be my new moniker. I have been on this site for a long time (and others). I was formerly “Anonymous Warrior”, but I was getting in so many fueds with so many assholes that I decided to scrap that name. I just blew my cover, but who gives a shit.

Whats up with this “whining” issue? I don’t know what the hell you’re talking about. Give me the lowdown, my friend.

Socal,

Oh yeah…. you whine sometimes! Don’t worry about it – and there’s no need to apologize. A good whine is like a fine wine; it gets better with age. We are all whimpering little bitches when you come right down to it. Take it easy, and good luck to you and all the fellow whiners.

Stocklooker…..

The Fact is that the $24 million worth of stock options you see in 2007 is the same $24,000,000 worth of stock options from 2006. Pretty plain and simple.Those options were earned in 2005. Mel received no equity options for 2006 or 2007 at his own request. But then again, if you were reading documents you would know this.

You made an erroneous assumption, and now are not man enough to admit it. That is fine. You are asked a direct and simple question and do not want to answer. Your choice to be that way, not mine.

I do not ignore bankrupcty, nor do I remove posts that mention it. search this site and you will find many discuussions about bankruptcy.

If you are referring to the bankruptcy wording that is standard boilerplate language in EVERY 10Q for EVERY company that is publically traded, then I can’t blame a SiriusBuzz staffer deleting them. You can pull the same BOILERPLATE LANGUAGE from the 10Q of Sirius, Loral, GM, Honda, Ford, Google, Microsoft, Sun Micro, 3M, Gillette, Procter and Gamble, SC Johnson, yahoo, Hilton, Disney, United Air, etc., etc. etc.

If you feel the need, post the boilerplate again. I can assure you it wasn’t a censorship issue, but rather an issue of copy and pasting large chunks of info onto the site when a link to the actual document would have been sufficient.

Once again, I ask you to answer the question. Step up to the plate. Is it your assertion that mel received $24,0000,000 +/- in options in 2007?

Does Sirius lose subscribers because their credit card is cancelled? Sure. Self Paing churn churn is still at 1.7%. What is your point exactly with this? Will churn go to 1.8%? perhaps. We will know soon enough.

Newman. At 10:19 you wrote misleading facts regarding company share losses as compared to the drop in share price of Siri. Please see chart.

http://finance.yahoo.com/echar.....=undefined

Newman: As I have written previously. There is a big disconnect between users of this companies product and “investors” in this company.

My investment opinion is that PPS is “ALL” that matters. Today the share price dropped to .08. Unheard of really. On this companies ceo’s watch. That’s it Newman. Couldn’t care less about anything else written regarding this subject as an investor.

You, Brandon, John and others, continue to confront posters with your blantant disregard for the reality of the fact that, while you are posting this propaganda.

Your supporting cast is a share price that today hit .08. To unbelievable for words.

Sorry Steve.

Socalrunningfool, If you feel that way about SIRIXM or its CEO/ management, sell and stay out. If it does what I think it will, I will be saying “I told you so” and if you are correct you can do the same to me. If you are already out then why you are here spending so much time on a stock you dont own anymore is beyond my comprehension to be honest.

As for the PPS it also hit 9 for SIRI and 40 for XMSR, as you have noticed it did not stay there very long. Now many of us sold most of what we had before that because we saw it was worth nowhere near that ridiculous PPS for both. Now while I was more greedy then Tyler and started to buy back at 4, Many of the same people that sold at 5 and higher also feel .16 is as ridiculous as 9 and 40 was.

Tyler,

You made a lot of good points. I feel better about this company now. Who knows what will happen in the coming year. I hope we are close to bottom now. I got in heavy at around $3.00 and stayed in all the way down to our current $.15. It’s tough but I am still a believer.

John.

You don’t get it!

EOM……………..

SoCalRun…

How you doing..?

Tyler hit the nail right on the head. with the “Show Me” statement.

We have seen the demise of the stock price and all the reasons for it bad loan,to much debt,shorting,press,too many shares, etc etc.

Now is the time to sit back and wait. It is time for the SirusXm mangement to SHOW US all once and for all they can service the debt, continue the double digit growth, continue to cut costs,CFBE every quarter,then turn a profit every quarter, continue to grow,etc.etc

We all hope so

SHOW US

vaporgold

Vaporgold,

Doing good, thanks. How are you. Happy Fryday.

I have had a tough time the past few weeks getting on a thread that includes you, roadkill, hope, getitstraight, stocklooker and the other guys that we tend to hang out with.

The damn threads have been overrun by pumpers. Which I simply can’t believe.

Hey Vapor. Tyler is right. Show Me is all that’s left at this point.

Like a nice girlfriend would say. ” Shut up and _ _ _ _ Me!

Honestly, Vapor, I was thinking today that Tyler and Charles should take back their blogs, and be the only two that write articles.

I’m not being mean. I just honestly think that right now it’s an investment share price issue.

And content issues just simply are not in play at all.

Anyway, Steve will surely be shaking his head about now.

Vapor, I’ve done some trading in other stocks. How about you? Citi has been really working for the day trader if your interested.

Catch you over the weekend.

Socal.

I believe someone on last nights show was inquiring about the dept, and who owns the converts.

http://investor.sirius.com/sec.....23-08-8560

page S-33

http://investor.sirius.com/sec.....3-08-13641

page S-8

Hope this helps a few people, and credit goes to Mike Rehling on the google board.

long/7500/2.00

Also I was not the one flushing the toilet on last nights show. Though it was funny cause every stock I own right now is a turd. 🙂

Amazing! Nothing on the new line up disaster!

How he lied and told everyone when the merger happened no one would loose there favorite XM or Sirius channel. That is the main issue here!The new line up stinks!

hi socal…

been busy and also tired of reading those lonnnnnnnng basher blogs…take care socal and have nice weekend.

Socal:

I do not attempt to Pump Siri. I have posted some negative articles as well. I do not post baseless articles or comments, I do so with facts and numbers. It is my opinion that Sirius will be a winning stock, just not in the next 12 months.

It is simply my opinion, but I do not understand how these people can say that Mel failed simply because of the stock price. Look at the stock market in general, and look at countless other stocks that I mentioned above are doing. EVERYTHING is down. I just so happens that when Sirius dropped 90%, it put it at 15 cents and when google dropped 70%, it put it at $250. I have not read a single post calling for that guys head… and would not expect to.

People are frustrated with Sirius, and rightfully so. All of this pain and agony has been going on for way too long, but I hardly see that as Mel’s fault. 95% of the problems that Sirius has were started before Mel was ever on board, and he has worked to fix many of those. The stock price is rediculous at this point, but very little of that is Mel’s doing.

I also agree with you, vapor, and Tyler.

Im waiting for Sirius to Show Me.

Newman

I have read all of the back and forth about Mel and his management and the company’s stock price. The only item that comes to mind that Mel did that directly effected the price of the stock is making the deal to use shareholders equity to consummate the merger. The convertible bond deal that resulted in 260M shares being lent was a direct decision made by Mel. These shares, as everyone knows by now did not just dilute the common share, but also were to be used to short the common stock and reset the SP to $1.50 immediately when the deal papers were signed. Strike One and Two for Mel in making decisions to move his agenda forward (the merger) on the backs of the common shareholder. This fact cannot be denied. It can be rationalized, but not denied.

Having said that I am still a shareholder who is waiting for Mel to reconcile this wrong done to the long and faithful shareholder. I don’t care about the Merger Pop wanna bees, but the long and faithful were thrown under the bus and the wanna bees got caught up as collateral damage and many now are unwilling longs. Since the merger there hasn’t been anything good about SP, and as much as I hate to admit it, Cramer was the only one who got it right. The Bond Holders own this company’s stock price with all the shares lent now available to short the common mercilessly (outcome of the ugly deal).

Now throw in the economic melt down, financial crisis, and non transparent government intervention combined with a tremendous loss of jobs, and yes all companies have suffered, but not for the same reasons. As a result of the unexpected and not being able to hold a SP above a $1 due to these events, we are hit with the Proxy Statement and Annual Meeting. To the unwilling “Merger Pop Wanna Bees” now long, Foul is called and lawsuits follow. For the rest of us who believed in the Company, Mel’s Management, and the Content is King model to bringing the company to FCF positive, all we can say is: WTF.

With Mel and the Board looking for more incredible share dilution and a Reverse Split on the Common Share, the common share holder is going to take it up the arss again. So what is an investor to do? I myself have now churned my shares from the time of the Proxy Release to time over a short period of time to accumulate another 25K shares to my original position on the stocks up and downs between .26 and .40, and again between .14 and .21. I look at these additional share as lubricant to make the upcoming dilution less painful, but other than that, the pain is coming none the less.

For me the question of is it ALL Mel’s fault matter’s less at this Slice in Time. I do believe Mel’s decision to put the common shareholder in a position to be hurt is his alone to own and to have his performance evaluated harshly on. So there is the answer to your question, Newman. It will be up to Mel and his future decisions effecting the Common Shareholder on whether he hits a Home Run, or Strikes Out after the Annual Meeting.

Newman asked:

But on WHAT GROUNDS do you have to say that Mel has failed, OTHER THAN THE PRICE PER SHARE?

sorry 4th paragraph…… of the Proxy Release two times over a ……..

cos 1000

Thank You!

A few of those one liners are classics for the posters hall of fame. Too bad it’s such a sad subject…

Especially like the additional share lubricant line.

Everything you said is exactly the way it is, and exactly where we stand at this moment in time. And as you so rightly said. It’s this “slice in time”, that is ALL that matters.

In the moment. Current situation. We are down to the shareholder meeting and then the debt.

Many posters in my opinion, has joined the save sirius group. Thus, they are rarely if ever seen posting here or on other sites.

Thanks again cos. Take care.

Cos1000…SoCalRun…

Good post!

With all due respect, I do think some tend to be overly optimistic about Mel.

I do enjoy reading the various viewpoints.

I agree the threads have not been where we can interact with SRK,SH,GIS,and the rest.

Trading??

We sold every stock and various mutual fund holdings we had with the exception of Pepsi and Sirus two weeks prior to the first crash.That was the bulk of our holdings.

I changed companies and could not get my 401K liquidated and moved to my self directed before the first hit came.That cost me 4 grand. So over all we are very happy with our current position.

Cash is King.

Now,If only SiriusXM would not RS, Not issue any more shares,turn profitable each quarter.

I hate the idea of being wrong about this stock.So far I am as wrong as you can probably get without being completly wiped out.

As bad as it is I still think this stock should be a winner.I guess I like the product to much.

SHOW US

vaporgold

I had just posted and then got a call from Sirius marketing dept offering me a 2nd subscription with three months free, best of XM also and a radio for only $19.00 if I activate before the end of Dec.

Glad to see them pushing sales!!

I was thinking about getting my son a Stilletto SL2Pk or a XMP3.

I don’t know which would be best?

Any suggestions?

vaporgold

Tyler,

Have you been buying shares to average down on your LONG position.

Cos:

I agree that the financing at the end of the merger was Toxic. In a true sence of the word, the shares lent for shorting did not “dilute” as far as earnings are concerned, but that is still another 260 million shares trading on the market, diluting the share price.

That is honestly the only issue that I can fault Mel on. Perhaps you could go back and talk about some of the comments during his conferences, but that is hardly an issue and did not truely affect the stock price.

At least you are looking at this objectively, and I appreciate that.

Hey vaporgold,

The xmp3 looks pretty sweet!!