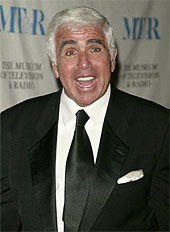

Karmazin Speaks – Will The Street Listen?

Sirius XM CEO Mel Karmazin spoke with Reuters today, and much of what he outlined should be seen as a positive for the company. However, the street needs more than good intentions and words, and even when a company delivers on their guidance, as Sirius XM did in Q3, people still look at anything with a jaded eye.

Karmazin made several statements, which in normal economic conditions would be enough to get some traction in the equity. Today, this news was simply absorbed with a shrug of the shoulders, and a show me mentality.

POSITIVE POINT #1

Karmazin sees double digit revenue growth on a percentage basis in Q4. Wonderful news that seems to have fallen on deaf ears. In a time when other media companies are seeing double digit declines, Sirius XM Radio is still growing, yet no one seems to care that Sirius XM’s revenue is a polar opposite to all of the bad news out there. Perhaps it is too difficult to grasp that there are still companies that are in a growth trend at this point in time.

POSITIVE POINT #2

Karmazin is confident the company can refinance debt due in 2009. Perhaps this issue is the overshadow that simply refuses to go away. Karmazin has been expressing confidence with this subject for a while, and this issue is where a “show-me” attitude is likely warranted. That being said, I have always felt that the company will indeed be able to get the debt issue resolved. I would have hoped that it would have been done by now, but still, it should get done. For the equity to see improvement, an answer on the debt needs resolution.

POSITIVE POINT #3

Karmazin has no immediate plans to cut its subscription prices, even in the midst of the economic recession. At a time when prices are being slashed left and right, you would think news that they will be able to hold the line would be news that is well received. Instead, the street barely reacts. This is substantial news. This means that churn is stable. It means that new subscriber numbers are satisfying the business model. It means that revenue can continue to grow. Perhaps the lack of a profit from Sirius XM tempers this news a bit, but with the continued positive trend shouldn’t the street give this a bit more weight?

POSITIVE POINT #4

“We did exactly what we wanted to do for Black Friday, which is not great news because we didn’t have high expectations,” Karmazin said, referring to the Friday after Thanksgiving, which kicks off the holiday shopping season.

While humble sales are not a positive point, the fact that the company was able to meet their expectations is stable. Had sales been shy of low expectations, the worry lines would rightfully appear. With the news being that holiday shoppers are being cautious, meeting your expectations is a small victory unto itself. On a side note, meeting those expectations did not come without an expense. Many retail radio’s came with free service for three months. Thus, you have a new subscriber, but n o revenue just yet.

POSITIVE POINT #5

Perhaps the biggest bit of news from the Reuters Media Summit was Karmazin’s statement that Sirius XM Radio is not for sale. “We don’t feel that we need to be acquired,” he said. “You should assume the company is not for sale.”

With stock prices at low levels, one distinct worry many may have is that the company sells itself. Investors who believe in the long term outlook of the concept of satellite radio would potentially be looking at a situation where they would not participate in the success of the company in the years ahead. Of course, there is no guarantee that the company will be an overwhelming printing press of cash, given that it has at times been a printing press of shares. However, those that have maintained faith in the concept should be able to reap the reward should it come.

In the end, it boils down to what transpires over the next few months. Will Karmazin’s outlook be realized? Will the street finally be able to digest good news? Will satellite radio be successful in refinancing their debt? There are a few questions that seem to be keeping many hesitant.

[Reuters]

Position: Long Sirius XM

Just another one of Mel’s smoke screen fluff-r-nutter feel good sessions. Let us not forget that it was Mel Karmazin who said that there was absolutely no interest in acquiring or merging with XM. How many times has this man said that things are looking good, only for the financial reports to tell another story? Mel has some slick legal people preparing his statements, so he can put up just enough smoke and still be able to hide behind safe harbor.

Excellent well-balanced article as usual! (Charles, give this guy a raise; if this guy leaves the site tomorrow I am gone with him).

Point # 5 is very interesting in deed:

“We don’t feel that we need to be acquired,” he said. “You should assume the company is not for sale.”

Lets hope that management is truly sincere in this statement . . . it is all too easy to go back to the public record and cite numerous contradictions worded in this now all-to-familiar “you should assume” refrain.

As to Point # 2, lets hope that management also remembers its prior statement of “that is not our interest” as relates to issuing new converts to the existing bond-holders.

It would be interesting to know if management has had any substantive discussions with the SEC regarding naked short sellers . . .

. . one more thought on the “don’t feel the need to be aquired” quote . . . one cannot rule out the possibility that this is “on-the-record” fodder for a pending litigation matter or simply damage control from an earlier quote in the Wall Street Journal in which management said “we would love to take this company private …”

Trouble is, which Mel do you believe?

Mel looks pretty slick in his black suit and tie…looks like a burial candidate with a shit eaten grin.

I always thought that Mel K was trying to make the point that the equity was substantailly undervalued when he made the comment about taking it private… It was a great example of why CEOS need to stay on message and not make quips during times like these. I am quite sure that the company is not for sale at this point, and I believe that Q4 will look good in terms of the metrics and FCF. Nothing, even good operating results will move the PPS much for the next 2-3 months. But I still think that the integration is doing well and we will eventually be north of 2.00 PS, hopefully without the necessity of the RS.

i still have doubts about #2 as many companies with EXCELLENT cash flow/balance sheets cant get any financing as credit is still scarce–Its the main reson why the auto sales have dried up–They can sell the cars but cant get financing for many people with a few hiccups in their credit

Great article Tyler.

All valid points. The debt has to be done.

Hey Kevin.

I’m in full support of all of the positive comments made by your “possible” fearless leader Mel.

I say “possible” as that you have yet to disclose your current shares owned if any.

Second roadkills statement with regards to T. Savery.

Love,

Socialrunningfool

At least Mel spoke. I read that the existing financing costs are better than the current market rates, so why do it now and pay more. And by May the stock price and the economy may be improving, giving more leverage. IMO he deserves a break. Very few gave the merger a chance. I’m betting that he finds another rabbit.

I think Sirius should go after some of this TARP money.

Social, I’m about 14000 shares long. Avg of 2ish. Havnt looked or figured my avg cause its so ugly. Peace

Every time Melvin opens his trap, things head South for the pps.

Just like Bernanke the other day, some folks should know when to speak, and, more importantly, when to remain silent.

One question which wasn’t addressed is his tenure as CEO. With performance like his, the Black Suit and Tie in the picture should mean the end (of his tenure) is near.

I have lost all faith in his statements since the announcement of the Merger and the resulting positive “synergies” which he foretold to be “immediate” upon approval by DOJ and FCC.

Turns out, they were SINergies, and the biggest Sin whas that stupid financing on August 2nd.

Most investors, myself included, have been abused by Karmazin’s role as CEO. From outrageous bonuses to Stern on Day 366 of his Contract, to outrageous statements about Positive Free Cash Flow (always the next quarter) to the aforementioned caustic August financing.

Most notable of all, however, is the outrageous compensation and bonus package Karmazin continues to enjoy. In times such as these, his continuance as CEO with the pay schedule attached, should be seen as obscene.

Hey, Melvin, wanna make Wall Street perk up and listen? Simply come out and do either one of the following:

1. Announce your resignation PRIOR to December 18, 2008, or

2. If you are so stubborn, forego your Salary and any other negotiated compensation until the company turns a profit, all debt is satisfied, and the Share Price gets back to where it was when you came aboard.

It’s the very least you can do, if you aren’t already putting the very least effort into your position currently.

Your turn, Mr. CEO.

Im out 6,000 shares at around 3.40 each. I know I’m small change compaired to some. It really hurts us though because we probably shouldn’t have invested that much to begin with.

This stock is so undervalued and it’s not funny anymore.

Expect a major, major, major move upwrad. I am talking about a 500-1000% move in a very short period of time.

max….

outrageous compensation? How so?

Kevin.

My apologies in advance for my whining. I expect it to continue until the decimal point on the share price moves over one.

At to your shares owned. I wish only great things for every shareholder of this company. And pray for help for all longs.

Good luck with your shares.

I was going to blame more things on my dysfunctional family and all……………lol……….just kidding.

I’ll try and drink more and whine less.

Take Care.

Socially yours.

Socal

Max, I beleive you should be offended. I do believe it was you that Mel was referring to when he mentioned “UNSOPHISTICATED INVESTORS.”

In regards to synergies, Mel stated that they would START TO REALIZE synergies from day one, he did not say “As soon as the papers are signed, we will have 7 billion dollars added to our bank account.” We HAVE started to see synergies. Just look at the Q3 CC. There are synergies on every line item.

You write: “Most investors, myself included, have been abused by Karmazin’s role as CEO. From outrageous bonuses to Stern on Day 366 of his Contract, to outrageous statements about Positive Free Cash Flow (always the next quarter) to the aforementioned caustic August financing”

Since you are apparently such a die hard Sirius investor, surely you are aware that those bonuses were written into Howard Stern’s contract, a contract which was MADE AND SIGNED before Mel was ever with Sirius, correct?

What rediculous statements has Mel made about Free Cash Flow? Was it in 2005, when the company was FCF positive for Q4, as he said they would be? How about for the entire second half of 2006 when they were FCF positive? What statement exactly was it that Mel did not deliver on based on FCF?

As far as Mel’s compensation: I agree, it would be a huge boost of confidence if he were to come out and state that he would only take $1 for 2008 and 2009 as salary. But you know what? Regardless of the PPS, the COMPANY has done nothing but grow since he has been CEO. Subscribers are still growing in the double digit percentages, revenue is still growing, losses are narrowing, and costs are being cut. Other than the PPS, what grounds do you have to say that Mel has failed? Sure, financing was toxic, but the merger took forever to complete, and when it finally did happen, the credit markets were crap. Who is to say that Mel did not have financing lined up in December of 2007 that had to be cancled because the merger had not been completed? You do not know what goes on behind closed doors, and neither do I. But on WHAT GROUNDS do you have to say that Mel has failed, OTHER THAN THE PRICE PER SHARE?

Absolutely none.

Unsophisticated indeed…

**As to the FCF statement: That may have been 2006 and 2007, my memory is a bit fuzzy right now, but the information is still correct. **

Social, I here ya. I believe one day we will actually make money with this crazy stock. I think we will get financing but the terms may not be favorable enough to move pps much. But if we can buy a year or so, investors will likely push us way north of 2 bucks. What we ALL forget is the time factor associated with good stock picks. 2 years is short term! Let’s try to stay a little more patient.

I am a shareholder and acquaintance of howard’s- from many years ago. I am placing my faith in the pure spirit of it all- all that I can say, is, don’t ever underestimate anything that Howard does or is involved with- and that may be more important than anything else. thanks, dean

Kevin,

Short-term is less than a year, anything more is long-term. FYI.

If you don’t believe me, wait until you have capital gains, once this stock soars (if it does). lol…

The long-term investors will be grinning they don’t have to pay short-term capital gains tax!!! I know I will 😉

SocalRun..

Whine all you want, you and every stockholder has a right to bitch at .17 pps Period. End of Story. I bet Mel is even bitching.

Wait until the stockholders meeting, you know some major bitching is going to be going on.

Vent, it is good for you.

It is nothing but a waiting game now. I would go along with a couple years time frame also.

So you see, if you try to hold in all that pent up frustration for another two years…You could explode.

vaporgold

Tyler…

Let me ask you and the rest of the posters a question.

Is anybody going to the stockholders meeting?

vaporgold

Newman,

Are you Sirius?

“WHAT GROUNDS do you have to say that Mel has failed, OTHER THAN THE PRICE PER SHARE?”

What more important metric is there than price per share?

And its not like the price per share is weak…its destroyed. With guarunteed dilution in the future. So you agree that Mel has failed (so far) in the ultimate catagory?

HOW PATHETIC A COMPARISON…

Looks like Sirius XM (SIRI) CEO Mel Karmazin won’t be taking the company private anytime soon, although given its current stock price there’s no reason he couldn’t. At its current value, you’d have to sell off more than 70 shares of SIRI to purchase a one-month subscription to Sirius Satellite Radio.

Zach – Short or long term I would love to pay any kind of capital gains on this dog. Who are you kidding?

Vapor – If we do the R/S we will have to wait more than a couple of years to get our original investments back (those at $2/share and higher).

vaporgold

I wish I could go to the meeting, just don’t have the time/money.

Great break down of the article Tyler!!

As far as Mel saying one thing, and then doing another.

Lie to me once, shame on Mel, lie to me twice, shame on me.

Lets hope the markets improve enough to get a good refi deal. 🙂

chazchem:

I am not disagreeing that Sirius stock price sucks right now. We are down 90% from our highs. Are you also calling for the CEO of GOOGLE to be fired? Google is down over 70% from it’s highs. How about Steve Jobs at Apple? Do you want him to step down? Apple is down over 60%. Ford’s CEO? Their stock is down over 75%. GM’s? They are down 80%. Microsoft? Down nearly 50%. Research in Motion? Down 70%. Sprint? Down 80%.

So I will repeat my original question for you to answer then:

But on WHAT GROUNDS do you have to say that Mel has failed, OTHER THAN THE PRICE PER SHARE?

Absolutely none.

vapor….

I am not going to the meeting. I will be off from December 19th through January 3rd. I have been to Sirius many times, and there is nothing new that I would obtain by going to the meeting.

GIS…

I hope the need for a RS does not happen.

I hope as some others have pointed out, that IF SiriusXM has a good 4th, 1st and 2qtr, they may have enough cash on hand to service the Feb.note.

That is assuming they don’t finance Feb or May before then.

Either way, I hope once the Feb note is serviced, the pps will get back over $1.00 and the need for a RS If you can belive Mel will not be necessary,Since Mel said the only reason for a RS was not to get delisted.

Mel has said he would rather service the debt sooner then later.People listen to what he says.The street and us are looking for the sooner.

If SiriusXM waits until the last possible moment to service these notes,I don’t think the street will find much confidence in that move either.

If the street does not agree, it may take servicing the May debt to get over a $1.00

I think Tyler pointed it out well in point 2 where he said “show me attitude”

Don’t talk…Show me

vaporgold

Newman, Mel specifically said that the share price was his report card. Period. Based on where the share price is today, he has failed. Until, and if, the share price recovers he needs to show that he, too, is willing to forbear on his aggressive pay packages and whatnot. Stop comparing the share price of SIRI to other companies. Let keep the conversation on SIRI.

Newman,

I guess you missed my point…you think that Mel is successfull in all aspects of being a good CEO except the most important one is OK, ridiculous….and by the way Apple and RIIM are horrible analogies…At this point Siri shouldn’t even be allowed to be mentioned in the same sentence as those companies…hopefully some day soon it will earn that honor.

Ok guys, I guess you do not hear me.

I know the PPS sucks. I dont like it.

BUT GIVE ME A SINGLE SHRED OF EVIDENCE OTHER THAN THE PPS THAT MEL HAS FAILED THIS COMPANY. ONLY ONE.

Everyone points to the PPS. I know what Mel has said. But why is it that absoultely nobody can answer my question about how Mel has failed without mentioning the PPS? Yes, it is important. I get that. But I still do not think that MEL failed the company. I think that he happened to take over at a bd time. He has done every single thing he has set out to do, except the PPS. EVERYTHING ABOUT THIS COMPANY IS BETTER THAN WHEN HE GOT HERE, except the PPS.

So I ask again: On WHAT GROUNDS do you have to say that Mel has failed, OTHER THAN THE PRICE PER SHARE?

Oh, and Chad: If those companies are SO MUCH BETTER than Sirius that “Siri shouldn’t even be allowed to be mentioned in the same sentence as those companies” why are their stocks down? Why are you not calling for the CEOs of those companies to be fired or replaced? They are SOOOO much better, yet their PPS has done horribly. PPS is the only way of measurng a stock you said, right?

UNCLE…one of us doesn’t get it…maybe its me.

Mel’s a great ceo….put that in your 401k and smoke it!

oh if you can read this

http://finance.yahoo.com/echar.....=undefined

Private Investor…..

What about the pay package do you consider agressive?

The annual report states, “The base salary of Mr. Karmazin was not changed in 2007.” I would imagine that it will not change in 2008 either. His base salary has been $1,250,000 for 2006 and 2007.

In February 2008 Karmazin got a bonus of $4,000,000 (for his 2007 accomplishments) in recognition of his performance and our corporate performance, including:

• the increase in our net additions and end of period subscriptions in 2007;

• achieving positive free cash flow in the second half of 2007 and fourth quarter of 2007, with greater positive free cash flow than in the fourth quarter of 2006;

• the increase in our 2007 revenues by 44.7% while total operating expenses (excluding depreciation and stock-based compensation) increased by only 7.6%;

• the performance of our average monthly churn as compared to the public guidance for such metric;

• his contribution to the Copyright Royalty Board proceeding;

• the negotiation, execution and pursuit of approval of our pending merger with XM Radio;

• the launch of SIRIUS Backseat TV;

• the securing of additional funding on favorable terms;

• the continued enhancement of our programming; and

• the execution of extensions to our agreements with various automakers, and the increased penetration rates secured from automakers.

In 2007 Mel made $5,250,000. His options that were granted are worthless, and will never be exercised unlessthe stock approaches $4 per share.

Sure, I can read that chart…

It says that Apple has lost 53% of its value, not 60% as I said previously.

Sorry.

Tyler: It does not matter. The PPS is his score card. Everything that he accomplished means absolutely nothing, because the share price is down.

Thats what those two want us to believe.

Oh, and PS: Dont mention that a ton of other BLUE CHIP stocks are down significantly as well. Apparently, Sirius is not supposed to be compared to the rest of the market.

PPS as a measure of performance. Yep, Mel said that. Those were different times though. that was before the market meltdown. Before the Credit collapse. Before nearly every equity anyone can name took a massive hit.

The street is not valuing anything even at book value anymore.

Think of it this way. If Mel were a chef, and he was making a cake, he would tell you to judgehis talent on the cake. He preheats the oven, mixes the batter, greases the pans, and puts the cake in the oven, confident that he will do well. After all, he has baked thousands of cakes. Then an earthquake hits, the building shakes, some buildings fall. The gas gets shut off, and the cake is a dusty mess. Would Mel have been a failure? After all, he said judge me on my cake.

A reasonable person would understand the dynamics of the situation, and reserve judgement until the emergency situation was resolved, and Mel could bake the cake under normal conditions.

These times are challenging. Mel can only do so much when an earthquake has rocked the markets.

“OTHER” blue chips…lol your killing me

Tyler Savery Says:

max….

outrageous compensation? How so?

Tyler,

I stand by my statement.

Mel may have worked his magic back at CBS/Viacom and been compensated for a successful venture and accomplishment. No such situation with Sirius/XM Radio.

Increase in subscribers by merging and maxing-out the company debt structure in a horrible August ploy is worthy of what? Not a dime, in my extremely humble and disgruntled opinion.

Stern’s pre-Karmazin bonus based on what numbers?? Does anyone really know how many converts came onboard as a result of Howie’s shift to Sat Rad?? I surely do not. I’d like to see actual internal numbers showing how many Regular Listener’s Howie had in 2005, 2006 and 2007, for example.

Interoperable hardware? Ha! This clown masquerading as a CEO blows more smoke up shareholder’s behinds at each opportunity its no longer entertaining.

The thrashing Melvin took by Martin at the F.C.C. was a joke. His continual “forced silence” routine during important phases of this company’s development smells of organic B.S.

Shareholder value? Has anyone seen any of that lately? $.17 per share, regardless of the economy is laughable and downright embarrassing. Yet, Melvin comes out and toots his spin as if we aren’t noticing how unsophisticated his pablum is.

Insulting shareholders while talking about dilution and reverse-splits? Talk about arrogance… No more dilution, no reverse split, no Executive perks, not even a holiday party for his Jewish pals.

Suspend all compensation for Mel and his immediate “C” level gang. There’s no more grain in the silos to feed these little piggies. A more appropriate action would be to send the management porkres off to the slaughterhouse on December 18th.

Compensation is available as long as there is reason to continue the relationship. For the foregoing reasons, any compensation awarded to Melvin Karmazin at this time is outrageous. Maybe he needs to hear it from the group on the 18th for it to sink in.

chazchem Says: “OTHER” blue chips…lol your killing me

Wow. Nice way to make a joke out of what was said while completely igoring the argument behind what was said.

You were on the highschool debate team, weren’t you?

Max:

Karmazin did not only increase subscribers by merging. Quarter after quarter, the company has been ORGANICALLY growing by double digit figures. The merger only took away part of the competition to allow that growth to happen faster and more cost effectively.

As far as “maxing out the debt structure”, he did nothing of the sort. The debt was already there. The terms of the debt were ugly, I will admit, but have YOU tried to get a loan lately? Anyone who does not have near perfect credit will be paying out the nose for any kind of loan, if they even get one. Sirius was the same way. The credit markets were collapsing, and Sirius did not have perfect credit. There were able to get those loans, luckily, and able to complete the merger.

As far as Stern goes, Mel had absolutely nothing to do with that bonus. It was a contractual obligation of the company because of a contract that was in place before Mel ever came to Sirius. Suspending any bonus would have been breech of contract, and Stern would have been free to renegotiate or leave. What would Sirius have been like then?

As far as insulting shareholders: It was you he was talking to, not us. You are the one that judges the company based soley on the stock price, ignoring any other metrics behind the company.

As I said, I agree that Mel should give up his paycheck and bonuses, and the rest of the board should as well, but if they dont, hell, I think they EARNED them by improving EVERYTHING about the company, EXCEPT the PPS. PPS can be changed, growth is hard to manufacture if you don’t know what you are doing. Obviously, Mel knows what he is doing.

BTW: EVERYTHING that is going on with the economy and the company right now is not Mel’s fault. There may have been things that could have been done differently, but hindsight is always 20/20. If Mel was thrown off the BOD and fired as CEO, who ever steps into this mess, will step into the same mess as Mel… and the PPS will still be the same.

The Economy has to turn around before the PPS can. I predict that that will be around March, and the company will start to prosper again, the PPS will rise, and you will be happy again, regardless of who is CEO.

hey Newman

I do believe that Apple, RIMM and Microsoft have no chance of going bankrupt anytime soon, Sirius does.

How you think that the PPS is not the most important measuring device for a CEO is just plain stupid, kind of like me riding this piece of garbage all the way down to .17

BTW I love the product

Newman.

We live in a “wait til next year” world with Karmazin. Investors (not hobbiest), have been given that line for three years running. The Merger, the financing, profitability… all “wait til next year” mantra.

The economy be dammed! This was the current Board and Management’s decision–the Merger. As I recall, Melvin spoke to shareholder’s on many occasions on how he would finalize this manuever by the end of 2007… well, guess what, a “wait until next year” scenario. (by the way, the economy had nothing to do with Karmazin’s inability to move this process along at the DOJ or F.C.C.)

Since 2005, profitability was to be seen in Qtr. 4 of each subsequent year… again, “wait until next Qtr./Year” Always seems to be some minor impediment to profitability–namely Management!

Now, financing is a “wait until next year” proposition. This is the only area where a “wait until next year” approach would have benefitted shareholders and what does Melvin do? He sells shares to be shorted “THIS YEAR” by the same folks who brought you these bad economic times, and drops HIS companies market value in a very sophisticated and methodical 90%+.

You see, Newman, the guy wants it both ways. Well, he’s giving it to shareholders in both ways plus some, and the shareholders have one thing to say to Melvin about his compensation: “wait until next year”. Wait until the company is back to where it was before it was dismantled and decimated by the “wait until next year” guy named Melvin Karmazin and his Management staff.

Better yet, let’s get something done THIS YEAR, and let’s start on December 18th with the decision on tenure for Mr. Karmazin and gang.

max….

First, YOUR ANTI-SEMITE COMMENT HAS NO PLACE HERE AND IS NOT WELCOMED.

I am sorry, but a salary of $1.25 million is not outrageous in my opinion.

Stern did not get a bonus in 2007, and for all practical purposes, may not see one in 2008. You ask what numbers, thy have been given in the past. Read the SEC filings and company SEC filings regarding the baseline of the bonuses. The first bonus gave the details. The second bonus we are unsure about, and there was no third bonus. You can begin to get an idea of what they were based on.

Did he bring subscribers. you bet he did. He is the #1 show on satellite radio by a wide margin. You want to see how many listeners he had in 2005. Go to CBS SEC filings and company reports. He was working for CBS at the time. His first year on SDARS was 2006.

What exactly is your issue about an interoperable radio. there were points in time where such a device would have been beneficial to XM and detrimental to Sirius….then points in time where it would have been beneficial to Sirius ad detrimental to XM. Rarely was there a point in time when one or the other company would not have suffered.

Insulting shareholders. Mel did say there were many unsophisticated shareholders. The point is true. Most invested in the market lack investment savvy and sophistication. The average person retail investor is typically uninformed, has no grasp of the company, and has not heard one conference call.The only ones who should be insulted by that comment are the ones who don’t even know he said it, and people who do not understand the deals, and how they work. I can’t tell you the number of unsophisticated people who spout off that “Mel made $32,000,000 in 2007.”

Sirius Roadkill, My god how many times does it have to be said yhat is not what Mel said about selling the company. He said that it would have to be profitable first and that would not happen til at least after 2009. Now there is a big difference there. There also would be a big difference in the PPS offer at that time.

As for the rest of the people here pissing and moaning about the PPS, it means nothing if it is being played with. There is a reason I started to sell at 5 and all the way up to 8, when Stern and Mel came to SIRI. Yes I thought it was a great thing for SIRI, just not that great of a thing. The same follows for the PPS being were it is at right now. This is hype that is driving the PPS at this point, one only has to look at many of the articles and analyst that came out and said Feb. debt could bring SIRIXM to bankruptcy. That was such a load of crap that many thought was true. The fact was and still is that, first of all the converts would have loved nothing more then to get Mel to reconvert at better terms. Second, THEY HAD ENOUGH MONEY ON HAND TO PAY IT OFF, WITHOUT ANY REFINANCING. (sorry to write it so boldly it is just that I have said it so many times for so long I felt people must not have seen it before.) So how the hell could anyone say bankruptcy like they all did. Once again I have never been a believer in stock price manipulation beyond a few points but after the false crap I have seen come out of some very respectible agencies I have to wonder.

Max Stern has brought at least 2.8 million subscribers to SIRI. Most came in 4th Q 2005, and all of 2006.

john – watch how the GM scenario plays out in the next few weeks. We are potentially going to see how a chapter 11 bk works and how the equity holders get wiped out. GM won’t stop operations. They’ll just reorganize all of their debt wiping out shareholders.

I’m not saying SiriusXM will BK. That would be a huge loss to all of us shareholders. But truth be told I’ve already lost a ton of dough on this dog. I’m just saying that it is a possible scenario.

“max….

First, YOUR ANTI-SEMITE COMMENT HAS NO PLACE HERE AND IS NOT WELCOMED.”

Tyler, I am offended at your need to make the above statement.

My comment reflects the FACT that all CHRISTMAS Holiday Parties at Sirius/XM Radio were cancelled this year by Melvin, as yet another example of the benefits of “synergies” and cost-cutting going on at Sirius/XM Radio. My call to eliminate “other” holiday celebrations is not what you claim it is.

Additionally, this fits in perfectly with my repeated calls for Melvin to forgo his compensation package as well. Cut back on the rank and file’s perks and still fund a big, private bash? No way.

But, then, its always anti-semite, anti-black, anti-this and anti-that… too convenient of an argument, Tyler. You can do better.

Stern’s numbers are no longer an issue. My concern about Bonus #1 reflects an desire to know how many “adds” were exclusively because of Stern, and not just auto subs that happened to be activated during the same timeframe. I know when I signed up for service on a Sportster 5, no one asked me why or what Channel I will listen to when I activate my receiver.

Question remains, how did they come up with such a number to pay him that humongous bonus and the same for Melvin? Hey, while we’re at it, remember that 2nd Push Howie and Melvin were going to do? I guess that’s another “wait until next year” deal?

Tyler, defending Melvin’s comment about unsophisticated investors is funny.

Are you an unsophisticated investor or day trader? Are we to believe guidance provided by a Company’s CEO?

Can you detail out what a Sophisticated Investor of Sirius is? Please differentiate between those who invested in 2004 vs. 2005, and those who invested in other years and timeframes.

I’d like to know just exactly what an unsophisticated investor is supposed to do to become less unsophisticated.

And, while you’re at it, lemme know what your gains or losses have been, especially since you follow this company as close as anyone.

Did you see the August mess coming?

Were you shocked when Stern immediately dumped all his Bonus shares?

Did you put credence into Mel’s promise to get the Merger done by December 2007?

If these are examples and traits of unsophisticated investors, then God help us all.

GetItStraight, I have already seen how filing for bankrutpcy protection has worked out. The results depend on the abilities of the companies to pay back their debt. Take Kmart for example, most people dont even know that they actually filed for bankruptcy protection twice before the last time inwhich the shareholders kept their shares. How many airline companies did the same basically to force the unions to take less. The shareholders did not lose their shares in those ether. So in the end it depends really on the judge and how he feels on how well the company is positioned to pay back the debt. That judge is looking for the best possible way to not screw over everyone. If he feels the company is able to pay off the required debt if given enough time then he can require the banks to extend agreements if they are able in anyway. Look at Northwest they got a judge to tell the unions they were going to have to settle for less.

Max you can start by getting things right first off. Mel never promised to get the merger done by Dec. 2007. The most he ever did, was to say “we expect to close the merger by the end of the year”, and why wouldn’t he that was at the end of the 180 day FCC clock (what a joke that is).