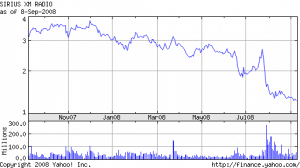

Why Is Sirius XM Stock Going Down?

To those that did not and want to know what happened today, it can be summed up simply. Mel Karmazin, in my humble opinion, gave the worst speech of his life. Despite a lot of good news coming forth from the conference, Mel made a few statements that would have been better kept to himself.

When asked about financing of the 2009 converts Mel initially was adamant that no dilution would occur. He offered up an exceptional plan that outlined the company’s ability to use cash on hand together with bank loans. Later however, he went a little farther into detail, making the statement that he hopes he does not have to lend the company money out of his own pocket.

Excuse me? Mel just told Wall Street that he believes in Sirius XM so much, that even he does not want to lend the company money! How then can he expect a bank to do the same? A slip of the tongue? An accidental joke gone astray? Absolutely, but the effects were seen in the stock price depreciation today.

The other huge mistake was reporting low-ball estimates so low for 2009, that most analysts will have to lower their forecasts. Mel might as well have said not to bother to buy the stock until 2010, because he was so conservative with the subscriber estimates for the year, that he inadvertently lowered guidance.

Of course Sirius XM will sign more than 2 million subscribers next year, but Wall Street can only go on the data provided by the CEO of the company. Mel in effect stated that the company would see ZERO subscriber growth in 2009. In fact, his estimate for 2009 will be less than the expected total of 2008. All this on the heels of an exceptional presentation outlining increases in OEM penetration rates.

Another mistake? Of course. Any idiot could see that. The problem is there are not that many idiots on Wall Street. When Mark Wienkes and Jim Cramer get a hold of this, there will be hell to pay.

Disclosure: No Position

And why did he go into the dreadful situation regarding advertising on terestrial radio. He was quoted on this!!!!! Why didn’t he just say he did not think advertising would affect the bottom line for Sirius XM in the immediate future. It was almost as if he forgot he had a lot of investor and analyst listeners. It has the same effect as the politicians who say something, thinking the mike has been turned off. It’s one thing to be “conservative” in one’s estimates, but it is important to know when NOT to say something that the press will take and run with. I think part of the shock is that everyone knows that Mel knows better.

Brandon,

So, I agree that Mel didn’t hit it out of the park. I hate to even go down this path, but with the PPS flirting with the dollar menu, I have to. So where are the suitors for this company…at this price! Now I am fully aware of the debt mess; however, it is managable, and even better so for companies in a better position than Sirius. Yeah, the names are familiar–MSFT, GOOG, etc. I remember when the, I mean THE, major issue in the spring was if Siri/Xmsr would have to give up spectrum to get the deal done. Well they didn’t, and look where we are. My question to you, Brandon, is what is value of the spectrum? Shouldn’t that be a great asset to someone…maybe someone that can justly fix this company? Look, I do believe in Mel and co. in the long term; however, I’d like to see something positve. I’d like to read your thoughts…..thanks.

Tyson

Steve and Tyson….

You ask for honest answer so I’ll give it to you. I think the company will be bought out soon. The combined company can now be bought for less than Sirius paid for XM alone…and that includes a premium.

Maybe Mel wants to start a bidding war. It’s inexplicable any other way…

BM,

Why did you sell out then? The downside cannot be much lower than a $1.00. I think $3.00 is the selling price.

Oh GREAT! So is THIS the “new” great white hope? A BUYOUT???

Is THIS what we are going to hang our Sirius hats on now????

PLEASE FOR THE LOVE OF GOD…ENOUGH ALREADY!!!

There is no Knight in shinning armor. There are NO SUITORS, BUYERS or INTERESTED PARTIES.

THE ONLY THING that is going to MOVE this stock UP higher is years and years of PROOF of PROFIT.

When will my fellow LONGS just GIVE IT UP???

I’m not saying we trash the company like bashers or shorts. But I think the time is due for ZERO EXPECTATIONS. NONE. NADA. ZILCH. ZERO.

Wake up people. Don’t even HINT about a buyout. Cause it ain’t gonna happen.

I say this because this BULLSHIT is EXACTLY what the shorts will use now against you.

The sooner we just SELL or HUNKER DOWN FOR THE LOOOOOOOONG HOLD the better.

STOP this endless what if speculation ok?

I really don’t want to hear it anymore. It serves NO purpose other than to give people false hope of a short term pop that is NOT gonna happen.

siriusXM..

because 1.20 to 1.00 is a 20% loss. I’d rather save that 20% and use it to by 25% more shares later.

If I miss, oh well…I suck….too bad..

But after today I expect a downgrade from every firm on the street…I’ll know its bottomed this time because the downgrades that will surely come will stop affecting the price.

Oh…by the way…CNBC just hinted about Cramer having a HUGE new “Mystery” addition to the Mad Money CEO wall of shame tonight that is going to be a REAL SHOCKER.

How much you wanna bet it’s Cramer’s old “buddy” Mel???

Noman, If you still rely on Cramer to give you tips you are indeed an amateur that will lose any pennies you have been holding on to.

FEAR MAKES “FOOLS” OUT OF INVESTORS

“FEAR” is your worse enemy! Our two amateur website leaders haven’t learned that yet!

What if Mel is downplaying the guidance to keep the stock low while he does present the “REAL” more positive guidance to the potential BUYERS like GOOGLE, MICROSOFT, etc behind the scenes?

It’s an interesting theory. Mel has always said he doesn’t run companies, he’s a deal maker. And his ultimate goal is to sell Sirius for a profit down the road.

Maybe now really is the best time for someone to buy Sirius while it’s down and on the verge of going positive.

If Sirius is selling for nearly a buck now…WHAT do you think Mel would sell it for? What price should shareholders REALISTICALLY hope for?

Dumb question, why doesn’t Mel take $150 million of the $425 million in synergies and pay down half the $300 million due in Feb? He would then only have to refinance $150 million. Is that to simple or dream of a thought?

You should only be angry with Mel if you are a trader (which you are, if you believe in BS like technical stats and stop losses). If you are an investor, you need all the HONEST information you can get without the pumping. That’s what Mel gave today. If you don’t like it, maybe we can put Clayton or Panero back in charge to lie to shareholders again. Otherwise, quit bitching and let the long-term financial results take care of the stock price.

Maybe because the $425 million are “unrealized” and “projected” synergies. They can perhaps use this “potential” as a bargaining chip when trying to refinance…but the way this market is going, I wouldn’t hold out hope.

Mel said he closed the merger under “UGLY” market conditions and he was forced to do it that night. He also said today that the debt due in February would be a different story…but how can he be sure? How can he be sure what the market will be like then?

He SAYS he wants to take care of it soon. But the market sucks even more than when he closed the merger. What if it gets worse the closer we get to February?

Eventually he may be “FORCED” into another gotta close the deal scenario.

Ugh.

When will this nightmare end?

Cause after Feb debt, we have XM debt in May….and then MORE debt in winter of 09…which Mel said he won’t deal with for now. LOL…good thing too….there is so much short term debt due coming up it’s enough to drive an investor INSANE.

What impact do you guys think a reverse split will have on the pps in the short term. I know in the long run the pps will decrease. But what happens in the short run? With this approaching $1.00 territory I can see Mel and the board doing a reverse split.

Well said JB. I like SiriusXMInvestor comment about using the synergies to pay off some of the Feb. debt. Im no accountant but why not pay off the whole 300 mill due in Feb.? Maybe the stock would actually hit $2

My track record with Sirius so far:

Originally bought 1300 shares at $6.5 back in 05.

Then bought 1350 shares at $3.22 in November of 07.

Then bought 675 shares at $2.66 in April of 08

And lastly just bought 1500 shares at $1.32 in August of 08.

Thats a total of 4825 shares.

LOL…and now it’s dropped to $1.13. Thats a unrealized loss of…um…around $11,000 so far.

If I am lucky enough to get a pop back into the $1.20 range, I’ll sell like Brandon did and either invest elsewhere while watching Sirius. Hopefully to get back in if the stock later drops to $1 or below.

Or if there is no pop back up…I’ll just hold on LOL…like I have…and perhaps average down some more if the stock drops to $1 or below.

At this point, I’m not going to panic anymore. 🙂

How long does it take for “unsophisticated” SIRI investors as Mel likes to call you, to wake the hell up and realize that there is no pot of gold at the end of the Sirius rainbow? How can any of you ignore the warnings about Bankruptcy in SIRI’s latest 10Q? You think they said that to be funny? Take what Mel said today along with the BK warning in the 10Q and you should begin to get a pretty good idea of what Mel’s intentions are next year. You should all take Norman’s advice, there is NOT going to be a buyer for this company except maybe after it emerges from a chapter 11 filing and that’s only after they have the common shares cancelled like Kmart did so they can do a new IPO, pay off the debt and then attract a good suitor.

I agree with Norman, I’m sick and tired of listening to the unreasonable pie in the sky predictions for this company that NEVER materialize, EVER. The business model for this company is severely flawed and based on robbing Peter to pay Paul, which has now caught up to them and time is running out because their cash reserves is once again dwindling. If Mel says no more dilution and the banks will not infuse anymore working capital loans into the company then the only solution to stabilize this company is the BK they warned about.

For those of you who took Brandon’s advice and set your stop losses, it’s about time you took some good advice. For those of you who bash the bashers and the shorts, perhaps you should have listened to them because they don’t get all emotional icky in love with stock, they just go out and do exhaustive due diligence, which is something that all of you should have done before deciding to invest in any stock, period.

I’m also tired of the blame game you longs do. It’s the DOJ’s fault, it’s the politicians, fault, it’s the FCC’s fault, it’s Cramer’s fault, or it’s Wienkes fault. As Brandon dared to say today, it’s all Mel’s fault, which is exactly who all of you should be holding responsible for the bad management of Sirius. Was the merger anything at all like Mel described in the proxy statement? What has Mel done to protect shareholder value? When they did the offering at $1.50, were you shocked that right after the merger, Mel would do something to pull the plug on the pps? Yes, that’s correct, your CEO helped to tank your stock instead of protecting it. You don’t reward incompetence and you especially don’t reward someone such as the CEO, who has done nothing to protect shareholder value and everything to skuttle the value of the company. It’s oh so clear that the shorts were right, the acquisition would not help Sirius. The marriage of two money losing pigs creates one gigantic money losing pig, AKA, Sirius XM.

So far my “averaging down” has brought my pps average down from $6.50 a share to around $3.43 a share.

Wow. There was a time that I thought $3.43 was a STEAL.

Its amazing how many things can go wrong in a couple of years.

On train home. dying to know who Cramer put on the sell block. was it mel?

Update: Goldman Sachs analyst Mark Wienkes this afternoon told clients the 2 million net subscriber additions Sirius is indicating for 2009 is below the 2.1 million he had been modeling, and the 2.5 million consensus estimate of net adds on the Street. The disappointing outlook for both subs and revenue, writes Wienkes, “imply another round of estimate reductions for the third consecutive year heading into 4Q.” Wienkes has a “Sell” rating on the stock and says shares will continue to be under pressure as investors take a “show me” attitude toward the planned cost cuts, and wait to see how Sirius will raise necessary capital for investment in a tight credit market through 2009.

forgot the link…

http://blogs.barrons.com/techt.....hoobarrons

Plowboy…feeling bad is ok…but to say shit like MEL IS PART OF THE CRAMER/GS “SCHEME”….is just bitter bullshit talk that is about as far fetched as the 9/11 conspiracy nuts.

I mean COME ON. Are you serious? If you are, you shouldn’t be investing, because thats just crazy talk.

Yeah, Mel is “shorting” his own stock. This is Mel’s swan song doofus. If you knew anything about the man’s track record with other companies you wouldn’t talk such shit.

Hey, say you don’t like the man, fine. But to spout such obvious lies only shows your ignorance.

We’re all hurting here. If you’re gonna bash Mel tho…bash him on facts. Not made up shit.

instead of bashing and freaking out why dosent everyone generate more subs – activate service in your car, your families for christmas etc. proof in terms of numbers is all that will move the stock.

Ride the wind. Think long-term. The prospects are getting better. Nothing said today was negative. The outlook is improving. Advertising will improve with the number of subs above 20 million. Refinancing will be easier with the credit rating improved. This time next year, with some minor surprises, will make you wish you held on.

Brandon – stock is going down because people are selling & your included in that group.

How come NO analyst at the conference today asked if there will be ANY commercials aired on tv promoting the October 6th launch date of the BEST OF and new a la carte radios?

Are the analysts retarded? Or just stupid?

Um…don’t answer that.

All I know is that if it were a SHAREHOLDER conference, you’d get GOOD friggin questions!

I mean, WHERE is the TV campaign??? Please don’t tell me Sirius is waiting until the friggin SUPERBOWL????

We need the word out NOW dammit!

Especially since the NFL season just started. Wheres the commercial promoting this? And the new Mad Dog show? And the Best of options?

Wheres the Sirius version of XM’s EVERY TEAM EVERY GAME? commercial?

I can’t for the life of me remember ONE Sirius commercial besides the domino ipod one. Which told me NOTHING about Sirius and what it offers.

This is really inexcusable on Mel’s part.

We need a damn commercial. Now more than ever. A really creative fun one that highlights the NFL, the MERGER and the COOLNESS that is SIRIUSXM.

How friggin hard is that to do?

I bet if you walked up to the average joe on the street they wouldn’t even KNOW that Sirius and XM merged! Let alone that the NFL is on both with the BEST OF option.

But I bet they’d know about EVERY TEAM EVERY GAME and Big Poppie on XM.

THIS my friends is the power of advertising, and for the life of me, I am SHOCKED that 2 months after the merger there has been not ONE FRIGGIN COMMERCIAL CELEBRATING THIS GREAT MERGER OR WHAT THE COMBINED COMPANIES OFFER.

All I know is that Mel BETTER FRIGGIN HAVE A COOL COMMERCIAL for the BEST OF LAUNCH ON OCTOBER 6th!

If sirius is going to receive a bunch of downgrades from the analysts, when is the next time we will hear some good news, 3rd quarter results? My investment is down 70%, fak it, i’m holdin on til the end. Just like George Costanza in the Stock tip episode, “Like the captain, I’m going down with the ship.”

Am sure Mel will advertise Oct 6. A cool commerical would be all the celbs form sirius/XM hanging out – Howard, Oprah, Martha, Nacsar, MLB, NFL – showing that the two companies are now one. I think it is lost on the average consumer how much content they are receiving for $12 a month. The picture/slide of todays webcast with all the celbs on Sirius XM channels was an awesome image to see.

Below $1 soon?… Come to papa!

Friggin…

reason you have seen no commercials…no radios in stores yet.

Investor…people are selling because of Mel’s accidental lowered guidance. I just happened to be one of them.

Chizzle…herein lies another problem. Q3 will not be good. Merger expenses should weigh down the quarter. Also new radios coming out on the 6th mean increased chip subsidies and SAC…

Plowboy…

Your post was deleted. Racist posts are not allowed.

Tyler of this website said this yesterday: “Thus, I feel it important that sector followers listen to the speech, but temper enthusiasm for announcements with the realization that this conference is not a Sirius XM Radio conference, but rather a general media conference.”

Did Tyler have a hint of the overexpectations by his readership and at least one of his partners?

Did we forget about the retail end for 2009. With new sub plans and devices I think the 2 million net 2009 subscribers is wayyyyyyyyyyyy off.

Brandon-

Thanks for your response.

I really think Mel let his emotions get the best of him today. Instead of staying cool and answering questions succinctly, he harped on commercials on terrestrial radio decreasing (which got quoted as if he was saying revenue for Satellite would be down as a result) and made a quip about financing the company himself. I think after having to put up with a year and a half of having to bite his tongue, he finally lashed out. Unfortunately, he did this publicly.

sirius…

absolutely….WAAAAAAYYYYY OFF! But now a problem. Values and earnings are calculated based on that growth. When he lowballed it, he low-balled the stock price also.

He forced every firm on the street to go back and redo their models, and EVERY ONE of them will come out lower.

Even Wienkes had them at 2.1 million subs. The average was 2.5. Mel comes out and offers 2.0.

That’s the crux of the problem now.

Steve…

You’re welcome. Delving further into your earlier question consider the following. Mel said he had received calls from people who wanted to invest in the company.

Think about that and how ridiculous that statement is. The translation of that is someone wants a controlling interest as in buying out the company.

That is why it has not been done.

Last week … on Tuesday … at 2 pm … while scheduling a large tablet PC rollout project I started feeling ill. After emptying my guts out both ends I felt a little better and was able to sleep that night. Next morning, though, I started feeling sick again and by noon was passing bright red blood. BAD sign. A fast trip to the ER and an admission later I had six docs puzzling over what it could be. E.coli? Salmonilla? Four days and LOTS of IV’s and blood draws later I got released. Still have no clue about what caused the problem–but no doubt it was an evil bastard of a bug. Know what I thought about mostly while going through the episode above? Sirius XM … okay actually all I wanted to do was get well. But I thought about SIRI a lot. In an earlier post I said I came in as a trader but decided to invest instead because it will be a year and probably longer until the company will, if it does not melt down entirely, realize free cash flow and other significant fundamentals that will do for the stock price what strong antibiotics just did for me. I use chart patterns as well (thanks Thomas N. Bulkowski) but stopped tracking technicals because–and also as I said in an earlier post–events are driving an innordinate amount of what is happening. EVENTS LIKE THE ONE THIS MORNING THAT DROVE WHAT HAPPENED TO THE STOCK PRICE TODAY. The company makes products that users love. It provides an awsome variety of programming content. It is an SEC and FCC blessed monopoly. Sirius XM has tremendous business-to-business partnerships (admittedly with some that are suffering badly due to economic conditions). Ah! The economy. What is going to happen when the economy recovers? The bottom has already been called in various affected sectors and industries. So, I picked up 600 more shares and averaged down again, to 1.50 and two insignificant additional decimal points. Stupid me? Or contrarian me? Let Cramer flame Mel. So what? And what about Mel’s mea-culpa today? He is on plan. So stop the whining and hand wringing. Either get out or don’t. If you don’t, though, plan to go way long. My strategy is simple. Keep picking up shares as the price continues to slide. The share price is down, down, down, but the company is not sinking–struggling as any merged entity does to shake out–but dot going down. And while I’m at it, what about the products and services to come? They are coming after all, and I can’t wait for them and what they will do for this troubled stock.

I will be calling Blalock tomorrow asking how Mel came up with that 2 million 2009 sub total.

Brandon-

Do you think that Mel’s mention of investing interest was to indicate a possible buyer, or just to indicate that the company, if the credit markets were bad, would have options? Also, what do you mean when you say “That is why it has not been done?”

Also, the fact that Mel announced curtly something to the effect of “the call is over” adds to my gut reaction, that he was just pissed off at the questions and kind of lost his composure. Any thoughts on this?

One possiblility of such a low 2009 sub guidance is that the company will now count new subs as they activate, not as they are installed–Just a thought but it does seem to be a low number designed to be beaten easily

Yes, those are mistakes that could have had something to do with todays down turn in price or, it could be that MLB is not offered to Sirius subscribers and it constatutes a re-vote for the FCC to approve or dispprove the merger and I strongly believe that many of the supporters of the merger were under the assumption that the MLB was included in ” the best of XM,” and now that it is not, “WHO CARES!!!!!!!!!!”

Just an observation: In analysts looking for subscriber numbers for 2009 and making predictions, and Mel also predicting them, isn’t all a little bit rediculous? How can one predict a year from now what new technology will exist for Satellite radio (and what that technology will lead to in terms of radio prices and availability, what the public’s listening interets will be, if the public will continue to be fascinated by Howard Stern, if football teams have exciting games which stir up increased interest, etc., etc. All these and so many more variables, and everyone is so hung up on 3.73743 as opposed to 3.81357, or any such numbers. I wish Mel had stated a range of what he saw as possible, as even he can not predict. A restaurant puts a new item on the menu, and based on their experience they think it will be successful for the next year. But they can’t know for sure. What folly all of this is!

I missed that ending, so no thought there.

On the investing interest: If he had someone willing to pump money at the problem, he could do it. He could have done it before. He could have done it when the price was 2.50 and they did that deal that cost the company billions in value. The credit markets were bad then.

Why isn’t he now? Because of the pps, he’d be selling the company for 1.00 a share.

The biggest problem facing shareholders is that as the price continues to drop, it becomes an attractive hostile takeover target.

They could come in now and buy the company for 1.50 a share. That would be a 40% premium that the board would be forced to accept. Whoopie. I know I would not be happy with that. These are dangerous times. Who would be happy with 2.00? 2.50? I’ll tell you who. The people that will be buying at 1.00.

The company is 14 cents away from potentially being delisted. If a reverse split was not an option a week ago, its certainly becoming one now.

Where mind you, is a near term catalyst to prevent this? Q4? The stock will be below a dollar by then. He certainly can’t come out tomorrow and say “whoops, I meant 2.7 million subs in 09.

For the sub totals, could there be a concern that the Best of and Ala Cart could increase churn in short term ? Meaning, drop Sirius or XM if you have both and just keep the one service with additional package from other service.

I personaly would not do it because I have a portable Inno & Sirius Sportster 5. I might opt to pay for additional ‘Best of’ on 1 or both, but not all are like me. It also depends on the extent of the content offered – waiting on more details.

Finally an article that makes sense. Let me add that Mel thinks by having these bondholders on board the stock price can be trashed. He sold us all down the river. Never once alluded to his complete sell out financing deal. And here we go under a dollar. Wow. Isn’t it lovely.

Thanks Brandon-

I am really at a loss to explain the tone of todays question and answer section. It was as if Mel lost it, and Mel being such a seasoned veteran and obviously brilliant, makes it even harder for me to figure out.

Thanks again for all your insights and feedback.

This is where I think they got the Sub Guidence of adding 2 million in 2009:

19.5 million – start of ’09

-4.2 million (avg churn of 1.7%/mth X 12 months on weighted avg of 20.5 million during year of ’09

+3.5 million OEM’s 14 million cars X 50% penetration X 50% conversion

+ 2.3 million retail subs 400k (1st -3rd quarters & 700k 4th quarter)

I think these are reasonable assumptions and it gives a net add of 2 miillion sub estimate.

Each year churn will increse if % churning stays constant, so it’s important OEM penetration increases 10%/year to offset and retail needs to improve. At some point subs will hit a level that there will be no way to increase net adds. Maybe it’s 35 million or 40 million, but it will happen. You will hit a point where you churn the same # you add.

*** Correction to previous post

+ 2.3 million retail subs 500k (1st -3rd quarters) & 800k 4th quarter

Now because of the way subs are counted by certain OEM relationships, with a high # of OEM’s in promotional periods, the 2 million additions could be beat and if retail improves a bit, then maybe they could end at 22 million by end of ’09.