SiriusXM Remains At Critical Point

SiriusXM can not seem to make the move needed to get into bullish territory. It even tested the waters below the 200 day EMA today. That is not good. It is important that we keep $3.40 on the radar screen, because it is very likely the next critical point for this equity. Yes, longer term there are many positives, but the short term challenges are not to be ignored.

The volume today was lighter, so that is a silver lining of sorts. However, the testing of the waters in the $3.40’s is concerning. What we want to see is this equity hold the line at $3.50. The company is in the midst of share buybacks, but right now, they are buying up Liberty shares, and that does not support the market because it is essentially a private transaction. Adding insult to injury, the Liberty shares are priced higher than current market prices.

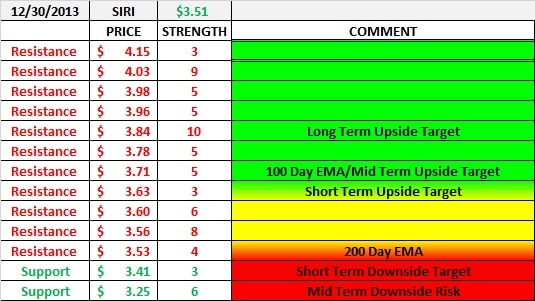

The EMA’s remain ugly. We have caution flags and warning flags across the board. We are looking for the EMA’s to coil up a bit and consolidate in the high $3.50’s or low $3.60’s. In order for that to happen, we need to see this equity hold $3.50. I have moved the short term downside target to $3.41. I have not yet adjusted the range in the support and resistance chart. I want to see what the action tomorrow brings.

If SiriusXM can not move up, the wall at $3.56 will gain strength and require a lot of effort to eclipse. For tomorrow, watch the volume at $3.50. If it is heavy, this equity could stumble. Be prepared.

Volume

Support and Resistance

Exponential Moving Averages

I don’t think u are right here. They liberty shares are priced and those transactions are set to go on specific days. So they are not busy buying up the liberty shares at this point. They can just write that check based in the 3.64 (I believe) price and be done with the first part if the three part(I believe) transaction. In fact it was stated that liberty could speed up the transaction dates if they wanted to. They have the credit lines avail to pay liberty and do the open market buybacks. If they have not been buying HEAVILY over the last two months in the open market then frankly it’s almost criminal of them

w…..

The liberty price was set by the 10 days following the quarterly call with a discount applied. That price applies to all three buys of the transaction. Buying Liberty shares does not help to support the stock. If the Liberty shares were done, the company could be on the open market with buys.

Yes that I know but I don’t understand why u think that they can’t buy on the market while closing the liberty deal. The liberty deal for all intents and purpose is a done deal. The price is set and the days for the transaction closing are set so it should have no bearing on the companies plans or abilities to also purchase in the open market. Correct?

w….

They can buy on the open market…but does the budget allow this? They do not have unlimited funds. They are committed to buy Liberty shares. The funds that they need to do this impede their ability to conduct open market purchases to a level that they otherwise could.

They had spent 1.6 billion of the original 2.0 billion before they announced the second buyback of 2.0 billion. The liberty transaction was only 500 million dollars so there should be in the ball park of 1.8 billion left to buy in the open market