SiriusXM Getting More Bearish

Whoever is doing this selling is being very strategic about it. Instead of having the price tank throughout the day they are dumping near the close. The closing bell is actually offering downside protection of sorts for these sellers. We saw the equity move down on higher volume. We are not seeing a massive sell-off, but rather a well timed selling plan in action. As long as this continues, we will see the downside pressure on this equity remain. The positive is that absent this pressure the equity was actually behaving like one that carries an upward bias.

Volume

Even a student of watching volume has to be frustrated by this action. You could be an active trader and make the right call only to have it foiled by a bigger player with an agenda different than yours. The key here is learning from what you witness. We now see the downside weakness brought on by an active seller or sellers. We see that this action transpires late in the session. We also see an underlying strength absent these sales. That should help you become a better trader. If you are looking for an entry point you may simply want to wait until late in the session. If you are looking to flip, you could be a seller early in the day when the bulls run the table and a buyer later on when the bears take over.

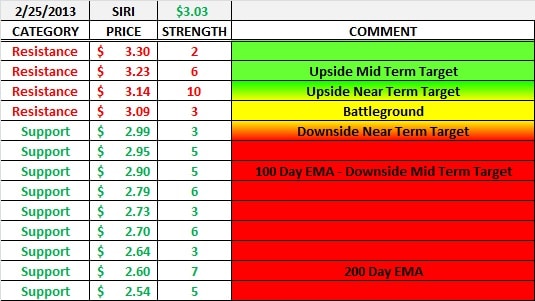

Support and Resistance

These past few sessions have made some minor alterations to the S&R chart. Yesterday I warned about the possible breaking of $3.05 and what it could mean. I believe we were “saved by the bell”. There is a pressure on the downside happening here and the next support is at $2.99. Be wary if that breaks because the next stop down after that is the 100 day EMA at $2.90.

Watch the action closely, but hold your cards close to the vest for the possible return of the late afternoon seller.

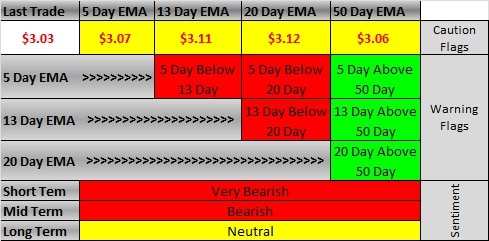

Exponential Moving Averages – EMA’s

We got another warning flag. Worse yet, the sentiment shift has changed as well. The equity is trading below all EMA’s and the next shoe to drop is a 4th warning flag. That will happen if this equity closes below $3.00. After that there is some breathing room, but not much. If we touch $2.98 look for $2.90 and yet another warning flag.

What you want to do is develop your strategy based on what you know. Yes, the company is speaking this week, but that does not typically reverse the course. It would take a compelling announcement to see the shift in sentiment take hold. I think we are in for an organic correction followed by a new foundation to build upon. We should hear some results relative to the 7% tender offer this week or early next. If the company has to sweeten the offer it will be good for the long term but bad for the short.