SiriusXM Update

Okay. By now we should all be aware of the situation with Liberty Media. Below is an article about Liberty that may get published on Seeking Alpha. As a member here, you get to see it first. Technical update after the Liberty article:

Liberty Media stock (LMCA) is down to nearly $141.50 after it became public that the media giant is proposing a stock transaction that would give Liberty control of SiriusXM (SIRI). The move, announced Friday after the close has investors in both equities experiencing some confusion.

With the close on Friday, the “value” of the offer was about $3.68 per share of Sirius XM. What investors need to understand is that the offer essentially is a ratio that relates to the price of Liberty Media more-so than the price of SiriusXM.

The easiest way to assess the offer is to take the price of LMCA shares and multiply it by 0.0253. On Friday that came to a “value” of $3.68. At the current $141.50 price, the new “value” of SiriusXM shares (according to the current offer) is $3.58.

This proposed transaction needs to be approved by Liberty Media shareholders, the independent members of the Sirius XM Board of Directors, and a majority of the minority of SiriusXM shareholders.

The easiest approval, for the current offer, would be the shareholders of Liberty Media. By many measures, Liberty would be getting a very good deal in obtaining SiriusXM for what is currently below market prices for SiriusXM. That component of the deal, for Liberty shareholders is a “no-brainer”. The part that Liberty investors will need to ponder is the concept that SiriusXM shareholders would essentially control 39% of the proposed Liberty Media class C shares. That is a big chunk of the new entity.

For SiriusXM’s minority holders, the proposed price is likely not something that will sit well. Investors in SiriusXM would be shifting from a pure satellite radio investment to an investment that is more of a conglomerate. The new stock would include stakes in Live Nation (LYV), Barnes & Noble (BKS), the Atlanta Braves, True Position, Charter Communications (CHTR), and Time Warner (TWX), and Viacom (VIA). Essentially, many SiriusXM investors feel that a premium is due to them if such a deal were to move forward. In addition, holding non-voting shares in Liberty Media series C stock would make an investor an even more silent partner than they already are.

Liberty Media is in the midst of a battle to gain a controlling interest of Time Warner, and having an entire ownership of SiriusXM may be advantageous to the financials of Liberty. SiriusXM is a cash cow of sorts, and control of that would give Liberty a lot more latitude in how to move forward.

The way I see this playing out is as follows.

- Liberty will likely need to revisit its offer ratio in the near term.

- SiriusXM’s independent directors will for a committee that will assess the value of SiriusXM in its current state, vs, the value of the company moving forward. This committee will be “charged” with brokering the best possible deal for SiriusXM’s minority stakeholders.

- Liberty Media, which essentially controls SiriusXM already, will continue satellite radio operations as has been happening in the past.

- Share buybacks that are already approved may or may not continue as this latest development is considered. In theory, there is a $500 million buy of Liberty shares of Sirius XM in the works, and about $1.5 billion in SiriusXM open market shares. That current ratio actually weakens the position of the minority. It may be considered that weakening the minority via buybacks that are not in proportion is not “kosher”.

- Activist Law firms will be jumping into and inserting themselves into this process.

- Active traders will need to assess their positions relative to the ongoing process. Being short SiriusXM will appear very unattractive at times, but also could be very attractive at others. Expect big volume and big swings in the near term as the playing field digests these new dynamics.

- Options market activity could get very interesting as players begin to essentially place bets on the outcome.

- The actual fundamental performance of SiriusXM will begin to take a back seat to the opportunities (both bullish and bearish) created by speculation.

- Volume on LMCA and SiriusXM will be volatile. After the initial news settles in, investors should watch to see where the street is placing money.

The “play” here is not yet developed or determined. Investors would be wise to monitor LMCA and SiriusXM closely. My strategy, which I entered into long ago, was to split my stake between Liberty media and Sirius XM. In doing this, I have removed some of the noise from the investment. There may currently exist a great opportunity for like minded investors to do just that in the near term, especially if you hold only Sirius XM stock at the moment. Since the announcement SiriusXM has traded substantially higher, while Liberty Media has traded down. Remember, that initial reactions to news (both positive and negative) are usually overblown. In this case, it could be argued that SiriusXM has reacted too positively to the early news and Liberty media too negatively. An active trader might do very well in playing these dynamics.

There will be a lot that needs to happen prior to anything concrete developing. Keep your mind open. There is likely a good deal in here somewhere!

Now to the SiriusXM technicals.

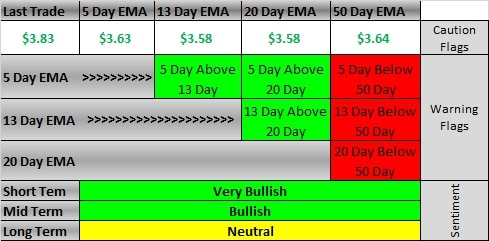

For the moment, I see SiriusXM trading above the 100 day EMA, but not yet setting a record in terms of the stock price. Whether we like it or not, there is now a perceived value from the Liberty media offer that we need to contend with. Unless Liberty announces a change to the offer, there is an argument that Liberty sees SiriusXM as valued at .0253% of the price of Liberty shares. That number currently stands at $3.59.

We have very strong support at $3.58, and very strong resistance at $3.84. Ironically, even with 400 million shares traded, we could not get past that resistance level today.It will be interesting to see if tomorrow can bring a normalized volume.

The EMA’s have shifted in dramatic fashion. All caution flags are gone and we have three warning flags. We should see the warning flags fall off tomorrow. That should also bring with it some added technical clarity.

Perhaps the biggest question I am getting is whether or not it is better to be in Liberty or SiriusXM. At the moment,m it would appear to be SiriusXM, but there is an attractiveness to the Liberty side of this as well. remember, a position in Liberty will garner you two shares of the new Liberty C. Personally I am in both equities and have been for some time.

What we want to watch for tomorrow is what happens with volume, and whether or not the wall at $3.84 can be overcome. If we can not break through $3.84, I see this equity ranging for a bit until the market sees a bit more clarity. I will have auto news soon, but at the moment it was on the back burner.

While this may not be popular here, I do not see the Q4 report as looking strong. Auto sales (specifically the negative impact on subscribers from the new GM deal), acquisitions, and satellite launches can mess with the numbers a bit. We may well have a great exit point on SiriusXM right now, with a buy-in happening at a lower price in the weeks ahead. As always, we will stay on top of this.

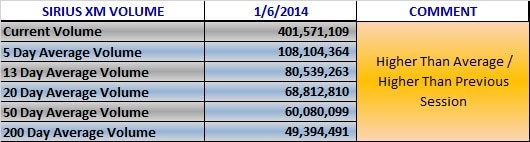

Volume

Support and Resistance

Exponential Moving Averages

Thanks Spencer for the update.

Do you have any take on the probable timing of the events that will unfold? If you don’t have time to answer now (or if it not yet clear), it would be helpful when you can.

Thanks!

siriuss….

I would think that Liberty would want to close this quickly, but quickly is a relative term. This process should take weeks at a minimum.

i bet we hear a counter offer tomorrow from Mr Meyer

and this will happen fast as every report seems to indicate a significant part of the motivation here is to be able to get the assets to be able to leverage enough loans for the time warner deal. the sooner this is done the sooner that is done

Thanks spencer . … Fo your insight …