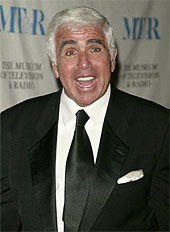

Karmazin Speaks – Will The Street Listen?

Sirius XM CEO Mel Karmazin spoke with Reuters today, and much of what he outlined should be seen as a positive for the company. However, the street needs more than good intentions and words, and even when a company delivers on their guidance, as Sirius XM did in Q3, people still look at anything with a jaded eye.

Karmazin made several statements, which in normal economic conditions would be enough to get some traction in the equity. Today, this news was simply absorbed with a shrug of the shoulders, and a show me mentality.

POSITIVE POINT #1

Karmazin sees double digit revenue growth on a percentage basis in Q4. Wonderful news that seems to have fallen on deaf ears. In a time when other media companies are seeing double digit declines, Sirius XM Radio is still growing, yet no one seems to care that Sirius XM’s revenue is a polar opposite to all of the bad news out there. Perhaps it is too difficult to grasp that there are still companies that are in a growth trend at this point in time.

POSITIVE POINT #2

Karmazin is confident the company can refinance debt due in 2009. Perhaps this issue is the overshadow that simply refuses to go away. Karmazin has been expressing confidence with this subject for a while, and this issue is where a “show-me” attitude is likely warranted. That being said, I have always felt that the company will indeed be able to get the debt issue resolved. I would have hoped that it would have been done by now, but still, it should get done. For the equity to see improvement, an answer on the debt needs resolution.

POSITIVE POINT #3

Karmazin has no immediate plans to cut its subscription prices, even in the midst of the economic recession. At a time when prices are being slashed left and right, you would think news that they will be able to hold the line would be news that is well received. Instead, the street barely reacts. This is substantial news. This means that churn is stable. It means that new subscriber numbers are satisfying the business model. It means that revenue can continue to grow. Perhaps the lack of a profit from Sirius XM tempers this news a bit, but with the continued positive trend shouldn’t the street give this a bit more weight?

POSITIVE POINT #4

“We did exactly what we wanted to do for Black Friday, which is not great news because we didn’t have high expectations,” Karmazin said, referring to the Friday after Thanksgiving, which kicks off the holiday shopping season.

While humble sales are not a positive point, the fact that the company was able to meet their expectations is stable. Had sales been shy of low expectations, the worry lines would rightfully appear. With the news being that holiday shoppers are being cautious, meeting your expectations is a small victory unto itself. On a side note, meeting those expectations did not come without an expense. Many retail radio’s came with free service for three months. Thus, you have a new subscriber, but n o revenue just yet.

POSITIVE POINT #5

Perhaps the biggest bit of news from the Reuters Media Summit was Karmazin’s statement that Sirius XM Radio is not for sale. “We don’t feel that we need to be acquired,” he said. “You should assume the company is not for sale.”

With stock prices at low levels, one distinct worry many may have is that the company sells itself. Investors who believe in the long term outlook of the concept of satellite radio would potentially be looking at a situation where they would not participate in the success of the company in the years ahead. Of course, there is no guarantee that the company will be an overwhelming printing press of cash, given that it has at times been a printing press of shares. However, those that have maintained faith in the concept should be able to reap the reward should it come.

In the end, it boils down to what transpires over the next few months. Will Karmazin’s outlook be realized? Will the street finally be able to digest good news? Will satellite radio be successful in refinancing their debt? There are a few questions that seem to be keeping many hesitant.

[Reuters]

Position: Long Sirius XM

Socal, If it hit .08 it was for a nanosecond. It was charted @ .01 a couple of days ago too. I think those were mistakes made by computor or human error. But if it makes you happy you would be technically right. Look over the historic charts and tell me when it hit .08. I saw the 52 week High & Low(.08) but can’t find when it hit your low of .08. See you on the way up.

max….

Lets look at the metrics and keep on things that matter.

1. Are you happy with the churn rate? If not why?

2. Are you happy with SAC? If not why?

3. Are you happy with revenues? If not why?

4. Are you happy with marketing savings? If not why?

5. Are you happy with marketing efforts? If not why?

6. Are you happy with capex costs? If not why?

7. Are you happy with programming? If not why?

8. Are you happy with debt levels? If not why?

9. Are you happy that the CEO is making 1.25 million in base salary? If not why?

10. Are you happy that a-la-carte is happening? If not why?

11. Are you happy with ad revenue? If not why?

12. Are you happy that the company no longer has to pay Maxim, etc.? if not why?

13. Are you happy that $90 million of the $300 million in Feb debt has been paid down? If not why?

These are the types of things you will want to watch. These are the type of things, going forward, that will get the company to profits.

3.

Chris Dodd and Barney frank are a couple of shrubs!!

Not to mention Greenspan, with his little experiment playing with interest rates.

Those 3, plus a few more organizations including Acorn need to be made an example of. (Yeah, we are going to sue your bank if you don’t give mortgages to people who can’t afford them. We consider it a form of racism.) What a joke!!!

I am completely against all of this P.C. Political Correctness garbage. I still have people come up to me and say, oh, you can’t say that. And I just laugh in their faces and tell them to @%#$*&!! off!!

On a side note: 12/7 the day Pearl Harbor got hit, I would like to thank all of our brothers and sisters who have/are serving to protect of country. THANK!!YOU!!

I haven’t been following Sirius stock, but yesterday a friend told me his tale of woe and I decided to check into it. I’m always in the market for a good stock in a distressed situation. I’m no pro, but over the years I’ve bought stocks now and then when they took a hit, and sold for a profit after they recovered. I considered buying some Sirius with that goal in mind, but without digging very far, I’m disturbed by their 5-year history. Most other solid stocks were going up from 2006 to 2008, before this collapse started. But not so with Sirius. That’s enough to scare me away. Maybe I’m missing a big opportunity here, but it’s more of a gamble than I’m willing to take. I wish all of you the best and hope you all make a fortune.

Hey can anyone confirm if Bubba the money sponge is out?

The rumor mill is turning away.

Thanks in advance!!

Neal,

I’ve been unable to chart the .08 as well. It simply show up on the year low. Dread was actually the first to see it, maybe he picked it up on level 2.

Neal, if we RS times 50, and then lose half our pps, are we still close to a bottom?

Here is the only chart I could find.

cos1000 (D), I am not arguing the details of the financing both you and I have gone over them for some time (reading homers post, ect.) and know full well what they are. That is not the question at hand, we both know and Mel said they were bad, but the best he could get at the time. The question at hand is was it better to deal with the financing or a delay that would have come. Just emagine what would have happen to the PPS if they were still not approved by this time. All the crap with the economy and the autos and the financial break down would have still happened and effected them, but I believe even worse. My point is the company at this point is in the best position they have ever been in, in the entire history of the company. Financing is the only obstacle left. The other way they would not only had to deal with financing but in SIRI’s case a major problem of one of their OEMs falling apart. Look at it this way if the financial free fall did not happen which is the better position to be in merged or still in court trying to get merged. Like I said if Mel would have waited the same people would be blaming him for not doing what ever financing he could to get the merger done.

Max as for how much Mel got paid if he was fired today or just quit. he would have been paid a total of about 1,280,000 for the 3 years he has been at SIRI that is what his over 20 million investment into SIRI is worth today. his options would expire worthless. Also out of that 1,280,000 take another around 850,000 off, because that is about how much more after his salery and bonuses, of his own money he put into the stock. So in the end Mel was paid about 500,000 for the 3 years he was at SIRI.

Tyler Savery Says:

max….

Lets look at the metrics and keep on things that matter.

1. Are you happy with the churn rate? If not why?

2. Are you happy with SAC? If not why?

3. Are you happy with revenues? If not why?

4. Are you happy with marketing savings? If not why?

5. Are you happy with marketing efforts? If not why?

6. Are you happy with capex costs? If not why?

7. Are you happy with programming? If not why?

8. Are you happy with debt levels? If not why?

9. Are you happy that the CEO is making 1.25 million in base salary? If not why?

10. Are you happy that a-la-carte is happening? If not why?

11. Are you happy with ad revenue? If not why?

12. Are you happy that the company no longer has to pay Maxim, etc.? if not why?

13. Are you happy that $90 million of the $300 million in Feb debt has been paid down? If not why?

These are the types of things you will want to watch. These are the type of things, going forward, that will get the company to profits.

Tyler: Thanks for the 13 days of WishMas above. Happiness is defined by the PPS, period. All those metrics have done zero to stop the decline of the PPS.

On December 18, 2008 some will get happier, most will not.

Individually, line-item by line-item, I’m going to be Clear, Concise, Correct, Complete and Courteous in my response: I do not believe what Melvin says anymore.

By the way, are you Happy with the PPS?

max…..

forgive me for being blunt, but there is far more happening with this equity than the pps. Most stocks have taken a beating and Sirius is not exclusive in that department.

You don’t want to believe Mel, that is fine. Look at the numbers. That is something you need to consider when making your unvestment decision. If you don’t believe in management, you have a chance to vote about it on December 18th. If you do not like the direction of the company, perhaps you should consider not being invested in it.

Thus, once again, you are avoiding answering questions. This is odd behavior. we still do not know whether you have a clear understanding of mels compensation, and now we do not know how you feel about the metrics. all we know is your disdain for Mel.

Am I happy with the PPS? I am actually indifferent to it. I understand that my whole portfolio is taking a hit. With regard to Sirius, I made my play in it long ago. The shares I hold are not going to change my lifestyle no matter what happens. Perhaps that gives me the latitude to be indifferent.

On December 18th, the Board will go in as suggested in the proxy, the additional shares will be approved, and the reverse split autorization will be approved. If you are against those positions, you should prepare yourself for these things happening.

Why do I say all of these measures will pass?

1. The board votes all shares that did not fill out a proxy vote.

2. The company needs latitude in trying to refinance. Getting delisted is not an option. If a reverse split is needed, most shareholders, and the board will approve giving this latitude. This is not a Mel thing. If Mel resigned tomorrow, this measure would still be on the table.

3. Having shares authorized, and adding them to the float are differing matters. No oine like dilution, but if the isswue becomes BK or dilution, dilution will win…..unless they do not have the authorized shares to do it.

John,

You seem to think that I am arguing a point regarding the merger and the Wisdom of the decision. I am simply stating an an analysis of that is yet to be performed. What you and I have agreed on in the past, is that it will take at least 2 full quarters to see the merged metrics and probably 4 or 5 quarters to establish the new company’s actual performance post merge. As you know it will take 5 quarters of merged performance to get the first YOY comparison of the metrics and other important data points that Tyler outlined for Max above. When we make it to 2010 (see I can be positive by saying When instead of If), the YOY comps should be favorable.

On the debt, I have recently updated my understanding since our discussions with Homer, to include information in the recently updated prospectus for the Lent Shares and 7% converts, the “ugly deal”. Their is a very good Debt Chart based on guarantor withing this release, breaking down debt secured with Xm holdings asset s vs debt secured by Sirius Xm Radio Parent assets. A read of the Risks Section are now more specific to the merged entities than previously released, especially regarding Xm’s debt.

In support of my position on Melvin’s compensation and/or possible bonus(es), more fuel for the fire… or firing, if you like. Nice blog following the story as well.

HEADLINES

NY’s Cuomo: Merrill’s $10 mln bonus for Thain ‘unjustified’

SAN FRANCISCO (MarketWatch) — New York Attorney General Andrew Cuomo told the board of Merrill Lynch & Co.on Monday that a reported bonus of $10 million for Chief Executive John Thain “appears unjustified.” Cuomo said in a letter to the board that Merrill Lynch has lost more than $11 billion over the year and that “the performance of Merrill’s top executives throughout Merrill’s abysmal year in no way justifies significant bonuses for its top executives, including the CEO.”

link: http://www.marketwatch.com/new.....E2C2DCC%7D

Seems to be the coming trend. In the UK, I believe that its call “say about pay” legislation whereby shareholders increasingly have a say about the negotiated compensation packages awarded to CEO’s by the company’s B.O.D.

Attaching performance measures to compensation of top executives just may be what the economy is in need of. A slight shift of the Risk from shareholders to CEO’s seems healthy, IMO.

Coming to a Satellite Radio provider near you… 12/18/2008

max….

With all due respevt you do not seem to comprehend Mels package.

His base pay is $1,250,000

His annual bonuses are discressionary

The vast majority of his compensation is in options. Those optins are worthless because of where the price of the stock is.

Look at it this way. If we assume an average bonus of $3,500,000, and an annual salary of $1,250,000. His cash income would be just under $24,000,000 for five years. This is less than $5,000,000 per year for the CEO of a major media company.

His other “compensation” is in options. 30,000,000 of them at a cost of $4.74 each. That is $142,000,000 in whta you want to call compensation, but what is in reality Mel buying those shares.

So, in your understanding of compensation, Mels total compensation would be $166,000,000 over five years. Thus, 85% of his “pay” is based on the stock price. What more are you looking for?

Even if the stock price were to hit $4.74, Mel would only have broken even. He will have paid $4.74 to get stock shares worth $4.74. Thus he would not see profit until the stock went above. Lets assume it went to $5.74. His profit on the shares would be $30,000,000.

Again, I would suggest that you have a better grasp of the compensation package prior to having thyis conversation.

Thains pay at Merrill was a minimum of $70,000,000 in 2007 (the year he started)

“Mr. Thain’s initial pay includes a salary of $750,000 and an unspecified bonus; restricted stock worth $28 million at current market values; and a three-tier grant of 1.8 million stock options worth about $20 million, by conservative valuation assumptions.The big option grant is intended to encourage him to bolster Merrill’s share price, while shielding him from the risk that the job is a bad fit. When he takes over in December, his first allotment — of 600,000 stock options — will vest over two years. The second portion vests only if Merrill’s share price rises $20 from its price on his start date. The third set of options vests if Merrill stock climbs $40 a share.

Though it will be a formidable challenge to realize all three tiers, Mr. Thain could be paid as much as $120 million if he hits all the performance targets.”

Mel has not received a 2008 bonus as yet.

max….

look at this article on Thains pay.

This guy was critical of it last year saying the targets were not high enough:

“MER will be up $20 and $40, even if Thain has sat in his office twiddling his thumbs (apparently he isn’t a golfer). If things turn even uglier, so will MER. Anyone thinking that Thain’s pending decisions will materially impact whatever transpires in “the great credit market resolution” should email me whatever they are smoking.”

Look at the chart:

http://finance.yahoo.com/echar.....R;range=1y

Tyler

Just took a gander at both Merrill and Sirius ONE YEAR Chart.

In 2007, on or around this date, Merrill, a Financial Company acquired by BOA, was trading at $21.50, today $14.91 or 69% of ’07 value

In 2007, on or around this date, Sirius was trading at $3.50, today, around $.15 (fifteen cents) or a mere 4% of its last year value.

Thain is being thrashed for a 30% drop in his companies performance year over year.

Karmazin, Melvin to those of you who prefer the more personal touch, took his company down 96% during the same timeframe.

Where is the outrage?

Thain is gone, Karmazin is still lurking, and asking for dilution and reverse splits along with a whole host of prerequisites, I would imagine.

The looking glass looking different now?

max…..

Acxtual numbers vs. expectations are part of the equation.

Assets held are another.

Max, you hate Mel. We get it.

You don’t want to acknowledge any metrics. We get it.

You want Mel fired. We get it.

Fire Mel, and replace him with who?

Your solution is not a solution. It is just bringing about another problem.

On December 18, the proxy measures will all pass. If I were you, I would get in tune with that and get your strategy together. Whining and complaining will get you nowhere. If you are that distressed, I would suggest that you reconsider your position in the company now.

Max: The fact that Thain’s company during that same time lost tens of BILLIONS of dollars and all metrics looked like crap, while Mel’s company lost substantially less than that, while improving every other number (including the ammount lost) does not factor into your argument at all does it?

The fact is, as you have stated, you care about nothing more than the stock price, and there is absolutely nothing that anyone can do or say to change your mind.

I get it.

Lets go back to Tyler’s question:

Fire Mel, and replace him with who?

Do you think that if anyone else in the world was put in charge or Sirius XM, it would raise the PPS and you would feel confident that they could run the company successfully? Start naming names… perhaps you could suggest this to the BOD.

Newman.

Anyone can run a company better than a CEO who reduces the value in one year by 96%. Bring in the chimpanzes.

The BOD is probably in Melvin’s back pocket, unfortunately… that’s business.