SiriusXM Adds Caution Flag — Time to Worry?

What could make this equity test $3.00? From a technical standpoint, if SiriusXM breaks $3.09 the likelihood of testing $3 increases. There is the 7% note tender offer that can potentially put 320 million shares on the table that previously did not exist. Then there is the news flow. I do not see negative news on the horizon, but one never knows. What could take this equity to $3.25? The company can defend the stock price with share buybacks, or the news flow. The key is paying attention and keeping a sharp eye on the subtle nuances of the market and the stock.

Volume

SiriusXM traded well off of yesterday’s volume and at 48 million shares was below average. Essentially we saw the equity go down on lower volume. That would tend to support the theory that there is not a ton of selling pressure. What I would like to see is this equity keep above $3.15 and get to a volume that is more along the lines of 65 million shares. The equity is getting tight in terms of EMA’s, so watching the volume at key levels is important. I do not see a fast drop, nor a fast spike as yet.

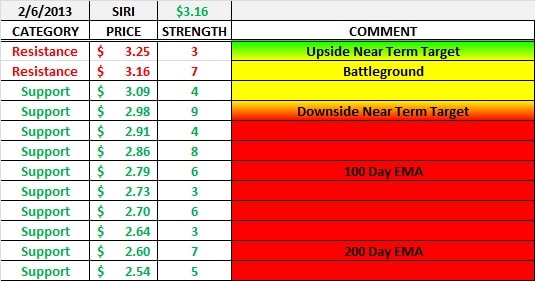

Support and Resistance

Support and resistance remains stable. Key levels are $3.09, $3.16, and $3.20. As you know the equity sits right in the middle. Break $3.09 and there could be a test of $3.00. Break $3.20 and we could test $3.25. Remember, when looking at this chart that the key EMA levels are offering a lot of support as well. SiriusXM has loved to trade just above the 5 day EMA on the high side and down to the 13 day EMA on the low side. The problem is that these EMA’s are pretty tight. The equity has a bias to the high side right now. There are some cautions though. Read on.

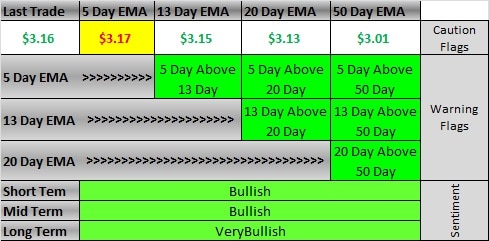

Exponential Moving Averages

The EMA chart has a caution flag. The equity closed below the 5 day moving average and just above the 13 day. There is not a lot of wiggle room here, and any time a caution flag arises it is important to assess the downside risk. What we want to see is the equity bounce off of key levels. In this case the 13 day EMA sits at $3.15. Watch for the volume if we approach that level (which we are right on top of.

My suspicion is that SIRI will range trade a bit, but that it will keep above $3.10. This means we could see another caution flag or 2, although there is wiggle room (a little bit) before warning flags develop. The EMA’s will usually be the first signs of a technical break down or up. In this case we see the first step down. Closing above $3.17 tomorrow will carry some weight and remove a caution flag. A dip to $3.14 will add a flag,m and a dip to $3.12 will add yet another.

Stay tuned!