U.S. Auto Sales Still Bad but SDARS has a Bright Side

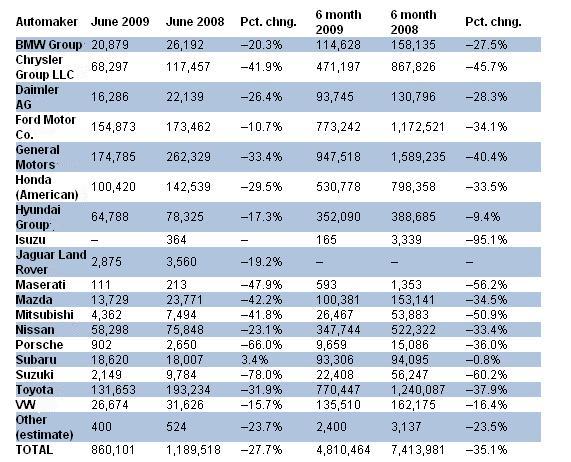

While the headlines read about a small recovery in the OEM channel, the reality is that the news is still not good. Year over year comparisons are still down, and that is dismal considering that last years sales were already down. Thus, the 2008 numbers should be easy to beat, and yet nearly the entire channel is still seeing decline. For satellite radio this is not good news, and there is nothing that will improve it any time soon.

Sirius XM Radio relies heavily on the OEM channel for exposing consumers to satellite radio, and hopefully converting those that are exposed into full time subscribers. As penetration rates increase, many naturally think that the number of subscribers will follow suit. This however is not the case. Differing OEM deals count subscribers in different ways. The big contributors to subscriber rolls have been on the sidelines for much of the second quarter, and this will once again Sirius XM will deliver a negative subscriber number for Q2. I have some additional data to collect, and more calculations to run bad the subscriber number will be for Q2.

Overall, sales are off from 2008 totals by over 35%, and the annualized realistically looks to be below 10 million cars sold for 2009. So how does the continued bad news in the auto channel translate into good news for SDARS? The answer is that it is not the number of subscribers that really matter as much as the average revenue derived from each subscriber, and that costs are under control. The auto sector brings in the bulk of subscribers, but it is also responsible for the bulk of costs.

A slower OEM channel means fewer costs. Combine that with additional revenue due to the price increase, and from Internet subscriptions, and you will see the bottom line of Sirius XM Radio have continued improvement.

Sirius XM will for the first time in a long time be able to offset some royalty costs above and beyond what they have been able to do in the past. The company will also enjoy the fruits of the iPhone app because it requires an Internet subscription, thereby adding $3 per month to the subscription price. A consumer like me gets the standard Sirius package, plus the Best of XM, plus the Internet feed. Instead of being a $13 per month sub, I am now a $19 per month sub for the balance of my current subscription, then a $21 per month sub going forward. This additional revenue will begin to show up beginning this quarter, and will continue to grow for the next year.

In the end, the company will have yet another good news vs. bad news situation on their hands. The good news will be in the cost cutting and revenue line. The bad news will be the subscriber number. Overall, the quarter should be decent, but as usual, it depends on what the mainstream media focuses on as to how the perception of the quarter is received. Investors who know now how some of these numbers will shake out have the advantage of being able to determine an investment strategy before the company announces. Look for great cost cutting, revenues that beat expectations, and bad subscriber numbers, and pay close attention to how the mainstream media reacts to the news.

Position – Long Sirius XM

So it seems the bottom line on Sirius Xm from here out is waiting for an economic recovery which of course relates to an increase in auto sales. The cost cutting is what has helped this stock perform so well in the last few months. It seems moving sideways until a economic recovery might not be so bad considering where this stock was @ the beginning of the year. I do believe that when the economy recovers this company will be one of the first to benefit.

True, but Tyler pointed out that auto OEM’s are the majority of the costs and with Stern’s contract coming to an end, Sirius Xm still needs to find ways to get its product to consumers. ( Need to make a Blackberry and Windows Mobile App.)

I too feel that a Blackberry and Windows ap would be welcomed by the public, but I sense that Sirius-XM is giving Apple a sort of temporary exclusive while they work out the kinks of the ap and guage the overall demand. You can bet that the two other aps are in the works though for a later release.

To have added subs this quarter will send this stock price much higher. Even if its one sub. I dont expect them to add subs this quarter. They will lose around 100k. But Im hoping for only 5 or 10k of those to be self pay. Hopefully the added revenue will impress the street, and reveal what will happen once auto sales do rebound. Can anyone say cash cow?

Tyler, 9 million estimated from end of Q1. We should touch 10. 1 million more. 2008 wasnt as bad as 09, because thats how a recession works. Of course it got worse, and no one was surprised. ONce again , 9 million estimate going from Q1 on. New numbers are actually good news. Thanks for killing it.

Relmor…

In Q1, the annualized rate barely touched the 9 million mark, but no one ever expected it to stay there. 10 million has pretty much been what has been expected. The fact that sales continue to decline despite having easier comps is not a good thing. Look at my june 2008 oem article. The trend is still down.

Tyler,

I think the article, on balance, is fair.

However, it is premature to be counting increased revenue from ANYTHING at this point.

While short-term cash flow is helped by the OEM decline, this isn’t good for SIRI in the long haul.

Total subs and the revenue per sub are the numbers to be watching.

Tyler,

I think too much emphasis is being placed on OEM. We already know it’s going to be off this year. What about all of the preowned cars that have been sold. Lots of dead radios out there that will be reactivateed. Pre-owned sales are doing well. Another thing that I heard is that rental car companies have been purchasing late model pre-owned cars to fill their fllet due to factory shut downs. A lot of those cars with satrad will probably be reactivated. Let’s not put all our eggs in one basket.

you guys want a mobile app there has been one for sometime and it works great http://www.selectradio.com/ind.....ex.html and guess who’s on this app Howard Stern

Sirius XM is on the right path and needs to grow by being successfull on two fronts.

1. Business must be profitable. Profit must increase as subscribers increase. This will come in the form of better contract negotiations, additional consolidation (between Sirius and XM), refinancing of debt, tiered services (getting more $$$ from from existing members…Best Of, Internet, Etc.) All of which are currently taking place!

2. Grow Subscriptions. Differentiation needs to continue. Stern is important. Resigning him (with a fair contract) would be good. Continue with specials. The Michael Jackson tributes were exellent in domonstrating how quickly Sirius XM can react to real situations. Not simply status content, but major exlusive.

3. Explore better advertising models. I don’t know the best way to accomplish this, but Sirius needs to figure out how to get something out of the 20 million inactive radios. I don’t know if I like the “Some Channels Free” approach, but what about working deals with New and Used Car Dealers, where lifetime subscriptions are built into the price of the car? I like the “Free Weekends Approach”, and I would like the idea of makeing the traffic feeds free (it would give people a season to push the Sirius XM button on occasion. Also, deactivated radios should have one channel that always plays when the radio is turned on. It should be filled with ads about sirius XM and their exclusive content, and should provide them with phone numbers to sign up.

Note that I didn’t list Short Selling or anything like that. Whese people are dead enders, who will be left with nothing in the end. no need to worry about them anymore.

Success in these three areas are the ticket to $5. With the bad economy, #2 is difficult, but we should see improvements in #1 and #3.

I think we are well on our way to over a buck by end of summer.

James P, I’m with you on doing something w/ idle radios. The fact that they have not puzzles the hell out of me. I’m like everyone looking from the outside in, so it’s a guessing game. They either have a plan that they think will make the idle radios valuable in some way or they are in my humble opinion r missing the boat on these million upon million little power house devices that have much more potential than to collect dust. Of course I’m hoping they have a plan that’s coming and I’m way off base. These are smart people so I gotta believe somethings in the works.

whats with this company and the piggy back with direct tv ?

if you get direct- you will know what i am asking

what is the contract with them???- if they increased my direct tv bill in order to sustain the 100 channels of music sent to my tvs 5 or 7 bucks a month……..

Id glady pay it- (i think we just solved the subscription problem)

anyone?

more gloom and doom posting from boo boo i see……

boo boo should be a writer for motley fool. they never have anything positive to say about sirius over there either.

knowing the people own the stock and are “long” is of some comfort

But how “long” would be of better comfort -and would add prespective to the writers opinion whether its Sirius buzz/ motley fool , sirius fool or motley buzz

For example Mr Savary- Long? Ummm Holding out to break even? Holding on even when break even and buying more? In it until an IRA matures regardless?You see the ambiguity here.

Other then for obvious resons of disclosure- I dont really care what stock the writers own-They could have straddled their already “long”position, headged their position with shorting the issue directly or just by buying naked puts- yet hold the commity as “Long”

Direct tv issue?

dead elvis…..

Regular readers are well aware of my position. I traded Sirius XM actively for a long time. In the run up after Howard and Mel were announced, I sold most of my position. I held some shares, and stopped active trading when I began writing. I have never carried a short position in either Sirius or XM.

I have held virtually the same position ever since I began writing. There have been a couple of accasions where I have added to my position, but have always done so by taking a break from writing for at least 3 days prior to adding to my position.

I have a firm belief that actively trading this equity while writing about it can present a conflict of interest. This is something I am very concious of. I can not say the same for some other writers out there.

Long means I hold the equity. If I trade, I implement a self imposed quite period. Even though I have broken off my relationship with Seeking Alpha, I still adhere to their writer standards with regard to trades.

Mr Tyler,

My comment should be taken globally-you wear your emotions on your shoulder- this was not personal slander or breach of any of your intregity.

You (anyone who states their disclosure) can own one share and call it Long or own 500,000 and be long

Regardless- that disclosure really has no meaning

continue your good work

good cut and paste

how bout u road kill- whats your take on direct tv

whats their contract with sirius?

Hey E . . . I will have to defer to HOMER985, john or Tyler on the contract question . . john in particular stays pretty up-to-date with contractual obligations . . .

What?????????????????????????????

You “defer”???????????????????

Damn it SRK. I was certain you had all the answers. lol.

The loan from DTV and the iPhone app along with the already enormous customer base will ensure this stock has a nice return for those who aren’t short sighted. It’s a revenue monster and the cashflow will keep this company alive. As the economy returns and car sales rebound it will only help. People like boo boo can’t/won’t see that because they lost their ass on the stock and probably bailed for a loss thinking the company was going under. 🙂

Stay tuned…

A revenue Monster?

FROTFLMAO!!!!!

You must be sniffing glue.

SIRI is awash in red ink and NOTHING in the foreseeable future will change that.

Sure thing there Boo Boo. Nothing will change that for about another month or so. You should buy some shares, this stock really gets you going…

When the stock can break 50 cents, then talk.

Until then, you’re just another member of the endless parade of cheerleaders who can’t see the forest for the trees.

The mainstream media is primarily made up of NAB members, is it not? And Sirius has built the better mousetrap, as it were, so you can be rest assured that they will paint the picture with as bleak an outlook as is possible. We have seen this from quarter to quarter. But, the one thing that they cant spin is the upward trending revenue line, the lower trending expense line, and when Sirius reports its first ever quarterly profit, and I do not care if that profit is $100,000, it will be like Amazon.com back in the day.

What I am curious about is how the new apple app is going to factor into the mix. I do not have an iphone (I do not like AT&T; had them once, I was “roaming” in my driveway; and I do not believe in the ipod, the stiletto blows that away. The fact is, Sirius didnt come out with an app for the iphone and itouch without it being able to generate new subs and more revenue. That was not addressed in the article. Is that becuase it was released so late in the quarter? Would love to know your thoughts on that one, in addition to what you believe will happen if the RIA is successful and Congress decides that like Sirius, free radio should also pay royalties on the music it plays. I see that as a major plus for Sirius.

Ride with the Big Dog.

you amuse me boo boo. 🙂

Your ignorance amuses me. 😛

The stock is dropping, proving, yet again, SIRI is still a shorts paradise.

http://finance.aol.com/quotes/.....c/siri/nas

this stock has gone up and down for the past 3 months einstein. what’s your point? it was as high as $.56 not long ago. it’s a volatile time for sirius but they are far from done. if there was an award for ignorance on this forum, you’d be the people’s choice i think. 🙂

The only ignorance here is yours.

I have CORRECTLY predicted SIRI here time and time again.

You cheer leaders are still wishing for that big move to $1.00 that will never happen.

Delisting here we come! 😛