The History Of Converts

While today’s trading action would be cause for concern to any investor, it always helps to understand the full perspective of what happens with converts, and why. Even some well known financial publications and analysts had confusion over the activity surrounding the equity offering today.

While today’s trading action would be cause for concern to any investor, it always helps to understand the full perspective of what happens with converts, and why. Even some well known financial publications and analysts had confusion over the activity surrounding the equity offering today.

What investors should know is that holders of converts typically short the stock, thereby minimizing risk, and locking in the interest they are receiving as a profit. This strategy is not unique to Sirius, and in fact happens all of the time. Still, even understanding this likely does little to appease the frustration of investors who were hoping to see positive momentum on these equities.

Thus, if you are a frustrated investor, I do not blame you. But, lets take the next step and see what usually transpires. With the convert holders shorting, there are large numbers of shares hitting the market within a short period of time (from a few hours to a few days typically). This selling activity drives the price down, but in many ways, the sale is “artificial”. Think about it this way. The companies doing the selling are holders of converts. Because they have converts, they must have some interest in the company succeeding. Their sale is less about their sentiment on the company, and more about locking in a profitable position which allows them to continue to do business. Their play is the arbitrage of the trade.

This is all well and good, but in real terms there are only buys and sells. Sells take the price down, and buys bring the price up. From the perspective of the market, a sale by a holder of a convert is identical to a sale by someone who wants to simply get out of their position, or a sale by a short that believes that a company will fail.

With that background, there is a bit of a silver lining. When the holders of the converts finish selling, the “pain” is virtually over, and the stock will stabilize, or perhaps even rebound. With that in mind, let’s look at what happened with the last two converts issued by Sirius.

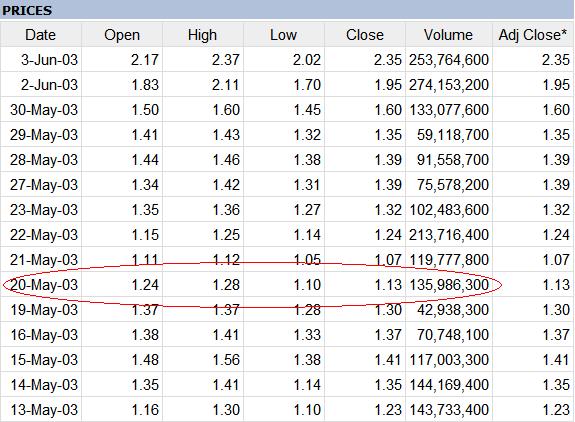

On May 20, 2003 Sirius offered converts. Notice the pricing activity just prior, just after, and then a few days down the road. The selling activity of the convert holders drag down the price. However, once that selling stops, the stock price stabilizes, and then recovers to an even higher price point.

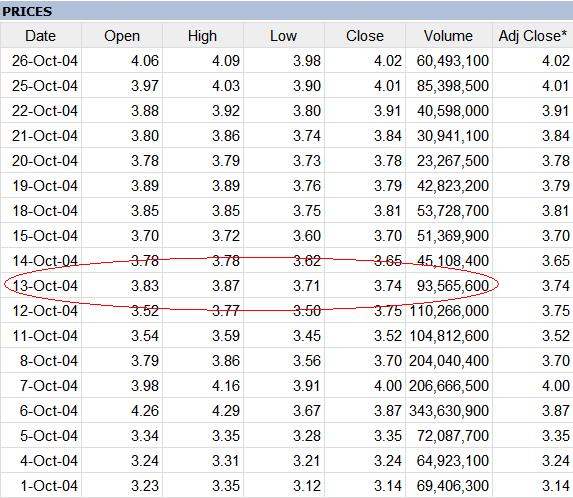

The next convert offered by Sirius came in conjunction with a secondary offering, but nonetheless, the converts would naturally short the equity. This convert happened on October 13, 2004. Notice that the trading days following the convert, the stock drifted down, but then recovered and stabilized. This convert happened just prior to the Howard Stern announcement. The stock obviously responded well to the Stern news shortly after the dates illustrated, but I wanted to show what transpired absent that news.

Many times converts are issued to raise capital, or restructure debt so that the company is in a better position. In this case, the converts are required to consummate the merger with XM. While there is some pain associated with them, the theory is that the results will deliver benefits. Sirius is taking steps to have a merger that promises synergies that will translate to the bottom line.

While this analysis is simple, the concept is sound. When the selling stops, the equity can balance, and take their next steps forward.

Thanks Phil

Position: Long Sirius, XM.

I would have spent all of the money I’ve put into Sirius into booze and hookers anyway.

So I’m still ahead.

That is the best explanation I’ve ever heard. That gives me hope as I believe we have to look at historical examples for guidance. Srew all these pundants that have no shame in being dark with the market. Thank you so much for your positive light.

Tyler thanks a lot for following up and clarifying this. Much appreciated.

Also thanks to Brandon and homer985 for their earlier comments on this subject.

It’s always something with this stock. Did anybody bother to think about this before the merger? Why was nobody saying, “Hey, this stock is going to take a shit if this merger is approved?” I mean, was Sirius ready for a giant pop without all these “converts?” I doubt it…it would have been some other reason it tanked. I wonder what the next three theories will be that drive the price down to 50 cents?

Let’s face it, we were all morons to invest in a company with no profits and ginormous debts. We can only blame our idiotics selves.

While those are nice, neither of those examples show a drop as absolutely drastic as today’s

Thanks Tyler for your insight and for giving hope that one will not have to hold forever in order to have the stock price stabilize. Another factor a lot of the press failed to mention today when the Sirius press release went our saying that Sirius was issuing more stock was that the stock was being used as collateral for a loan and would not be dilutive. Without that information being included in articles today, people were left with the wrong impression. Also, post approval, it seems the fashion to write “not out of the woods yet” types of articles, of which there have been several in the last few days.

After reading about this over 20 times today, I think I finally have a grasp of it. I was really angry with Mel for most of the day. Didn’t help that most of the reading left out the important parts you include.

Forgive me Mel.

Thanks Tyler. And thank Brandon too. It is crystal clear now. Will hang in.

And all of those posts that you have read today were written by who?

Oh yeah, publications that are members of the NAB. Strange how they leave out the important stuff.

Why can’t Tyler’s and Brandon’s stuff make it to the google and yahoo company headlines instead of that other load of crap that makes it there instead?

So I sold my entire position into this convert for no reason?

Kidding… I’d never sell. Just wish I had put a few more clever hedges into this position….

Thanks Tyler, nice explanation. Also, the reason the stock slipped as much as it did was because of today’s market performance. The truth is if it weren’t for the fact that most longs are just plain fatigued not to mention confused by conflicting accounts in the media (I mean one minute Cramer says Sirius is worth $6-7 if they merge and the next it’s a $2 lottery ticket…OK, there was weak auto sales data between those 2 predictions but still those numbers are wildly inconsistent), the current prices would actually be a great opportunity.

Thanks Tyler:

After listening to Cramer today I was hopelessly depressed.

I feel better now!

The problem is that we do not have another Howard Stern to pull out of the hat. . . . dream on folks. . . . . .RIP. . . .. Side note Yes I have stock like the rest of you . . .I am DOA too. . . . . Get Real and take off the SIRI glasses cause we are all going BROKE. The above writing doesn’t prove a thing. They issued more stock. . . What little it was worth (forget the small synenergies) is spread over alot more shares. RIP

AS was pointed out, in addition to the convert arbing going on, part of the reason for the decline today was the crappy market. But for the guy that said today was much worse than the other 2 converts, look at the first one — it was down almost 1/3 from the levels just prior to the convert offering.

I’m sorry Brandon. Todays action was the nail in the coffin for me as an investor. Battle fatigued is not a strong enough word. This stock is sheer insanity….and I am out with a HUGE loss. I was the most die hard long I know…but today was the absolute last straw.

Add to that…Jim Cramer’s TOTAL JUDAS MOVE today after he “championed” the stock only a couple of months ago. He basically BASHED the stock today. It made me sick to my stomach…and only added to the whole “conspiracy theory” surrounding this stock.

I have sat on the sidelines thru thick and thin….while EVERY other spec play i was interested in doubled, tripled and quadrupled….many times over during the same 2 year period.

Knowing all the $ I could have made in other stocks only added to my total disgust as I watched sirius do nothing but go down. Down on good news. Down on bad news. If they had GREAT news….Goldman Sachs would come out with an insane downgrade the VERY SAME DAY. It was relentless.

So…when this stock did what it did today….I lost all hope. I know it’s just “one” day. But I’ve said that 100s of times over the last 2 years. Where did this love of the product get me? EVERY TIME I had my hopes crushed.

I’ve never felt so beaten down. I’m no masochist but I kept telling myself I could take it. That it was WORTH it. So Like Rocky I just told Mick to “cut” me so I could get back in the ring and take more abuse.

But I’m done. Today’s action was a foreshadowing of more pain. Only this pain is even MORE brutal and demoralizing…because I know now that the “merger factor” is no longer a catalyst to move the stock.

No matter how bad it got before…I could always keep myself from selling because the spector of the “MERGER” was always out there….teasing me with HOPE.

No matter what anyone says now…I’m out of hope. I ain’t got nothing left in the tank.

Just the THOUGHT of trying to muster the courage to “HOPE”….makes me want to PUKE.

Sorry gents. I am cutting my losses and throwing my spec money into another play.

I really can’t believe that just 6 months ago I could have been in a spec car battery play VLNC that went from $1 to $5!!!!! Even tho it went down since then…it also went back UP again and again. Unlike Sirius which has gone nothing but DOWN. Even after the merger….DOWN. The only two times it “POPPED” this year….the pop was a BLINK AND YOU MISS IT affair.

This stock is dead to me. But I LOVE my Sirius radio. But as an investor? This is the single worst stock in the history of stocks and I gladly let it go….something I should have done a long long time ago. The only comfort is knowing that the pain I feel now is nothing compared to the pain I’ll feel later if I continue to hold.

We hear you. But I have to say, even the GS downgrade had SIRI at $1.75. Way I see, only place to go from here is up. I think we’ll stall for a day or two on account of the short selling and then back to $2.25…for starters.

hold 15000 shares at $6.00

sold 10000 shares because of the margin call

have 5000 shares left

what can I do???

….hold forever….!!!!!!

Here’s an excellent article by crfceo, folks.

Why No Pop This Morning In Sirius Shares?

)

I’m looking at the Sirius SEC filing from this morning and needless to say its very confusing. Here’s what I think it all means.

This filing coincides with an xm note offering. Sirius in fact has “lent” about 150 million shares for the purpose of shorting. They have created a hedge to the benefit of xm note holders, to help place these notes that otherwise may not have been placed.

“The existence of the share lending agreements and the short sales of our common stock effected in connection with the sale of the Notes being privately offered concurrently herewith could cause the market price of our common stock to be lower over the term of the share lending agreements than they would have been had we not entered into those agreements

…The effect of the issuance and sale of our shares of common stock pursuant to the share lending agreements, which issuance is being made to facilitate transactions by which investors in Notes may hedge their investments, may be to lower the market price of our common stock and the Notes.”…However, we have determined that the entry into each of the share lending agreements is in our best interests as a means to facilitate the offer and sale of the Notes pursuant to the related offering memorandum on terms more favorable to XM than could have otherwise obtained. ”

The offering also states that they will be buying in the open market following the offering, which gives sirius the green light to rise on those covering sales, although we may not see it until the offering is complete.

Some facts about Monday’s offering:

The 166.6 million UBS/MS shares priced late Monday afternoon, and the offering has closed (at least as to my broker). The price was $1.50 per share for Siri in the Secondary Offering, 75 cents less than the expected $2.25 per share. The dump in the market saved the purchasers of those shares $125 million, when the offering priced slightly less than the closing market price for the day.

From the Sirius Press Release, in part:

“It is estimated that, based on current market values, approximately $375,000,000 of SIRIUS common stock will be sold in a fixed-price public offering described below, and up to approximately $65,000,000 of SIRIUS common stock will be sold as described below from time to time at prevailing market or negotiated prices. The exact number of shares of SIRIUS common stock to be offered will depend on the terms of the concurrent offering of exchangeable senior subordinated notes described below and the hedging to be conducted by investors in such notes.”

Following from my prior post, immediately above, it appears that the anticipated $375M shares has been placed, netting only $250M less commission to the sellers because the market dropped, cauisng the offering price to price 75 cents lower than expected. (I have my theories about this, considering it saved the buyers $125M).

AS SUCH, IT APPEARS, IF I AM NOT MISTAKEN, THAT ALL OF THE $375M (REALLY 166.6M SHARES) HAS NOW BEEN PLACED.

Only the remainder of $65M remains to be placed, as needed.

So, if I understand this right, maybe the cause of the downward pressure we saw on Monday no longer exists.

liam, I was laughing my ass off on your comment.

“I was the most die hard long I know…but today was the absolute last straw.”

Then you said this.

“many times over during the same 2 year period”

Boy thats a long time. I have been in these stock or stocks for 7 years. I have been in others for over 20 years. I am sorry but if thats all you can take, then you are better off selling. LLLLLLOOOLOLLOLOLOL

Tyler — again, great article. It is beginning to dawn upon me that the 2 co’s are moving forward in a well-rehearsed, certain way which we may not understand at firtst glimpse.

Moreover I noticed in THR a good article on the subject as well, PLUS a positive analyst…

So for me – HOLD

Orford Ness, I am mad at you. I had my sell order in at 9.00 and it did not go through. DAMMMMM YOUUUUUUU, LOL.

Hey guys, look at the bright side at least Cramer said they would not go broke. There is some silver in that cloud.

Orford Ness, this is 163888. Now that last post may make sense to you.

John — what it shows is wisdom in that investor not to sell at any price right into the hands of the shorters.

Monday 28 was an erratic day to the background of Friday’s downgrade by Morgan Joseph(down to Hold), FCC approval (=> Up!), Earnings (less down!) Debt Refinancing (Incomprehensible for most, including me).

Sit back for this storm to wane.

Unless you need the money please do not (yet) sell.

Orford

WHEW! THANKS FOR SOME CLARITY. NO ONE SEEMED TO KNOW WHAT WAS HAPPENING. IT WOULD HAVE BEEN NICE TO KNOW THIS UP FRONT. AT LEAST THE STOCKHOLDERS AREN’T GETTING THE SHAFT. A LOT OF PEOPLE ARE GOING TO FEEL BETTER. I AM GLAD I DID NOT PANIC. I EVEN BOUGHT 2000 MORE SHARES JUST TO SEE IF I COULD. THANKS.

Great article and it does show proof.

Why don’t other analysts tell you this including that scum bag Cramer.

Mel is in at around $6 out of pocket so he must have something up his sleeve.

“LOSE MONEY” WITH JIM CRAMER

WAIT FOR THE SYNERGIES TO KICK IN FOLKS.

SIRI WILL BE AT $10 IN 2009.

THEIR NUMBERS ARE IMPROVING THIS IS ALL HYPE AND SHORT SELLERS TAKING AFFECT.

WE HAVE LITTLE COMPETITION.

WINK WINK

Jim Cramer is a show biz man – give him a week or two and he’ll be singing the stock’s praise.

Over this process he has been all over the place – he follows the trends and tells people what they want to hear. he’s all about ratings, not stock analysis.

2 big Siri myths

1. Sirius now has “4 billion shares on the float”–that is BS. Most of those shares are authorized to be issued. Before the merger, Sirius had 3.5 billion shares authorized, 1.5 billion 1ssued–actually being traded. After the merger, the will have more issued shares and more authorized shares, but the company will be larger. A lot of down talkers try to hammer this out to get long term holders down to panic and sell but this is not true.

2. Bankruptcy is imminent. Of course, none of us know exactly what the future holds, but bankruopcy it not just around the corner. It is highly unlikely that UBS or Chase would have done the finacing deal if this were the case. In fact, we on this website know a lot about these companies and the future potential. How many times have we read what these “experts” have to say and wanted to just strangle a lot of them for their lack of research and ignorance? The NAB would not have put up such a fight had Sirius been on the verge of bankruptcy.