SiriusXM Gets A ‘Lil Bit Bullish

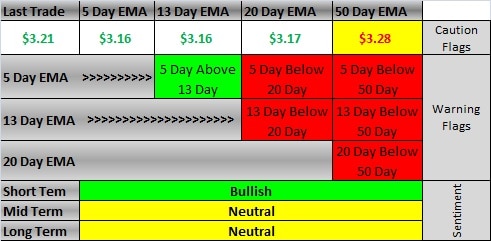

It has been quite a while since we have seen SiriusXM show some real bullish signs. The equity actually removed a few caution flags and a warning flag on the action in the late afternoon. Yes, this is good news, but let’s not get ahead of ourselves. SiriusXM moved up on the issuance of new debt today that should facilitate share buybacks. With the company being a bit uncertain lately, this move was a clear indication that the company will get back into taking shares off of the market.

The move today could be the first signs of a bullish run…OR…a temporary move up on excitement that will settle down with the close of the week. This equity wants to be bullish, but it is not having an easy time of it. Investors should bear in mind that the new debt will bring the EV/EBITDA valuation from about 16 to 17 if you consider the cash from the debt spent. Unspent, the valuation multiple is under 16. This means that the equity has gone from well below normal valuation levels to normal lows.

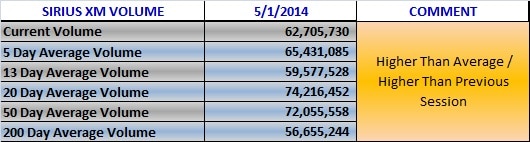

What we want to see here is the equity continue the afternoon strength of today into tomorrow. We want to see volume above normal, and want to see this equity test $3.60

Volume

Support and Resistance

Exponential Moving Averages

I’m ready for SIRI to test $6.30..

😉

I am a bull on this stock, but I would sell at $6.30. Strong hold at $3.30 to $4.00.

typo….$3.60