Is The Combination of Pandora and iHeartRadio a Threat to Sirius XM?

Pandora (NYSE:P) has now gone public and the comparisons between the Internet Radio provider and Sirius XM (NASDAQ:SIRI) have moved to a brand new level. The comparisons are warranted, as audio entertainment is an evolving medium that now includes streaming music through the Internet. This truth is undeniable when you consider that Sirius XM’s upcoming Satellite Radio 2.0 will rely heavily on features that will be delivered via the Sirius XM Internet Radio and apps platform rather than from the company’s satellites.

Pandora (NYSE:P) has now gone public and the comparisons between the Internet Radio provider and Sirius XM (NASDAQ:SIRI) have moved to a brand new level. The comparisons are warranted, as audio entertainment is an evolving medium that now includes streaming music through the Internet. This truth is undeniable when you consider that Sirius XM’s upcoming Satellite Radio 2.0 will rely heavily on features that will be delivered via the Sirius XM Internet Radio and apps platform rather than from the company’s satellites.

There are a couple of ways to look at the competitive landscape in audio entertainment. One is from a business perspective and the other is from a consumer perspective. Pandora is oft criticized for not being profitable. This is indeed true, but realistically this does not change whether or not Pandora and Sirius XM compete. They do. If someone wants to debate the level of competitiveness that is fine, but Pandora does indeed compete with Sirius XM as well as terrestrial radio. The simple existence of Pandora, profitable or not, exerts pressure on all audio entertainment providers. While the business side of this debate is compelling, it is the consumer perspective where things get very interesting.

Pandora is a essentially a “free” service (they do have a premium subscription tier). The company uses revenue from advertising to help offset costs, thus consumers are exposed to ads while listening as compared to a pure subscription model that offers no commercials, but instead charges a premium directly to the consumer. People oft associate Pandora as a service embraced by teens that “have no money”. This stereotype could not be further from the truth, and is oft attributed to satellite radio fans trying to “explain away” Pandora as a competitive force. There actually should be little worry from SIRI investors, as there is plenty of room for several audio entertainment services. The truth is that Pandora has numerous customers, many of which simply find that what Pandora offers meets their needs.

A criticism of Pandora is that they offer only music and can not match the superior non-music content offered by satellite radio. First things first…Sirius XM does indeed have superior non-music content. Whether Pandora enters the non-music arena, which is costly, may not matter. Is the combination of Pandora and iHeartRadio, or even terrestrial radio, a threat?

Consider a professional 30 year old man from Boston who has a 20 minute commute to work. Is paying for Sirius XM a prudent move for this man? Perhaps not. He has to consider that Sirius XM will cost him $12.95 for the base service, an additional $2.99 so he can listen on line at work, plus another $1.50 or so in royalty fees. This equates to over $17 per month. Compare that to the combination of “free” Pandora and terrestrial, or even iHeartRadio. This man can get his music fix on Pandora while getting his talk, sports and news fix from terrestrial or even Clear Channel’s iHeartRadio.

This is a classic example of someone who simply finds that satellite radio, while very good and compelling, is not worth the cost. Remember, about 55% of those exposed to satellite radio choose to not keep the service after a free promotional trial that comes with their car. This means that these people are finding another way to get audio entertainment. It used to be a choice of satellite or terrestrial. Now with the advent of smart phones and connectivity to the car dashboard, Internet radio has entered the promised land of the automobile, joining local radio and satellite. So at this point we have $17 per month vs. free.

Our 30 year old Bostonian can get his Boston Bruins fix from Sports Radio WEEI 850 AM, His news and talk fix from other local stations or one of iHeartRadio’s 750 channels, and his music fix from Pandora. If commercial free music is his gig, he can pony up $3.99 per month to get Pandora One. and combine commercial free music with commercial supported terrestrial or iHeartradio.

I know the next argument. “But the guy has to have a data plan and a smartphone. Data plans cost money. Welcome to reality. First, he is going to have a smartphone and data plan anyway. It is just the way it goes. The same dynamic that has satellite radio consumers perceiving that they are only paying $12.95 per month for Sirius XM will happen with Pandora. People do not associate the data plan as a cost coming from Pandora. It is really that simple. If they have a smart phone already, they simply look at Pandora and iHeartRadio as services available through that device. The cost of the data is not associated with these services in the mind of the consumer. Think of it this way. If you pay $50 per month for Internet access do you associate that fee as being part of the cost of the Amazon.com book you just bought for $9.95? Do you associate the cost of your Internet access with the Ebay auction you just won? The answer is no.

The first question satellite radio needs to tackle is how much money they can get out of their subscribers, and whether or not Sirius XM even wants to attract consumers interested in Pandora for their audio entertainment solution. Right off of the bat I would say that Sirius XM indeed has interest in the Pandora crowd, so long as they pay at least some money. Pandora is getting some people to subscribe at $3.99 per month. Sirius XM offers cancelled subscribers the chance to get 5 months for $25 (equating to about $5 per month). This shows me that at least on some level the satellite radio provider wants business even if the consumer is paying 60% less than the typical price. However, this is a fine line and Sirius XM does not want to butcher their Average Revenue Per User (ARPU) line in order to do it….at least not yet

What will determine the actions of Sirius XM will be churn, and take rate. If churn (existing customers cancelling the service) rises, it could be an indication that people find other audio entertainment solutions more compelling. If the take rate (people who sign up for the service after a promotional subscription that came with their new car) drops, it could be an indication that consumers do not find value in the service at the current price, or they again have another solution to meet their needs. As smartphones and dashboard integration continue to infiltrate the automobile marketplace, churn and take rate will be two very important metrics to watch. The impacts will not be instant. Remember, it has taken Sirius XM YEARS to get into about 40 million cars. Similarly, it will take years for 40 million smartphone connectable cars to be on the roadways. This dynamic is just now beginning to unfold.

What we know from the traditional data is that 45% of those exposed to satellite radio elect to become self paying subscribers. We also know that about 25%, on an annualized basis, of the self paying subscribers leave the service every year. This is the data we have to work with as we analyze the impact of Internet radio in the dashboard over the coming months and years. Sirius XM’s answer to this “threat”, at least in part is Satellite Radio 2.0 which promises to have some “Pandora-like” features. At the point that Sirius XM releases their 2.0 product we will have the battlefield established.

Will consumers pay close to $20 per month for Sirius XM or find some less expensive combination of other services to fill their audio entertainment needs? Personally I think that a combination such as Pandora and iHeartRadio is compelling, especially to those that spend less time in their cars. Toyota’s new Entune system Pandora and iHeartRadio front and center for consumers with app icons literally sitting right next to each other. What this will boil down to is content, how much money a consumer is willing to spend, and how much advertising they are willing to listen to.

CONTENT IS KING

Sirius XM has the best content on radio right? That is the popular mantra. The company does have a very robust offering that can appeal to many people across the nation. The big question is how appealing is it to your average consumer. Although all of these services offer hundreds of channels, the reality is that most people actively listen to less than 10 channels. Sirius XM’s Howard Stern is a huge draw for the satellite radio company, but in contrast Rush Limbaugh is a huge draw that iHeartRadio can boast. Sirius XM has NASCAR Radio, but if I am not a NASCAR fan does it really matter to me? Mel Karmazin has always stated that he would rather have and pay for top talent and find a way to make money on it than to have to seek out a way to compete against it. Top tier talent that can draw dollars away from consumers is hard to find. It is top tier content with national appeal that sets the stage, and while we all love to talk about the vast array of content only a select few personalities really make the difference.

In January of this year Bubba The Love Sponge left satellite radio. It was also the same time-frame that Dr. Laura was introduced to satellite on an exclusive basis. Churn for that period remained at 2.0% (normal for the company). The fact is that Bubba and Dr. Laura, both great content, did not move the needle at all in terms of subscribers. There was no mass exodus when Bubba left, and no huge influx of subscribers when Dr. Laura cam on board. They are both great content, but not differentiators.

One argument I would make is that even though top tier difference makers in content are rare, the overall package of content is compelling. This is where Sirius XM has an advantage. It is expensive though. In 2010 Sirius XM spent nearly $306,000,000 on non-music programming an content. That equates to $15.30 per subscriber per year, or 10% of what an annual subscription runs. Consider that the Stern channels eat up about $100 million per year, Major League Baseball about $60 million, the NFL at about $30 million, Oprah at $20 million, and $210 million out of that $306 million is gone. All of the other compelling content, including the NHL:, NBA, NASCAR, CNBC, Fox News, CNN, ESPN, Martha Stewart, Rosie, Covino & Rich, Opie & Anthony, Jamie Fox, Blue Collar Comedy, and dozens more are left to divvy up about $100 million. While that is still a sizable sum, it demonstrates that some pretty compelling content can be had without a massive price tag.

Sirius XM has been good at keeping a lot of this content on board, but there are “defections” that happen that are fan favorites. Recently Bill Mack left satellite radio, and the comments under my article show the frustrations of listeners. When it appeared that Rosie was leaving there were similar comments. Ultimately Sirius XM found a way to keep Rosie content.

This premium content is a double edged sword. Getting a top tier performer is the first key. Supplementing it with other compelling content is what makes the overall package compelling. Doing all of this requires a lot of work and near constant negotiations. Being in the non-music content business is a long and arduous process that the likes of Pandora can not do overnight. However, Pandora may be perfectly happy sticking to music only and letting consumers turn to iHeartRadio, terrestrial radio, and even satellite radio to get the rest.

DOES COST PLAY A ROLE?

Forget the state of the economy for a moment. Even in the worst of times Sirius XM has been able to be a success. That is a credit to Mel Karmazin and his management of the company. In their best days Sirius XM approached a 50% take rate in the auto channel. This most recent quarter we saw the take rate come in at 45%. The company attributes most of this drop, never really that big on a quarter over quarter basis, to the influx of newer OEM partners that are still in the learning curve. While certainly that is a part of it, the economy has had some impact too. However, even if only 2 points were attributable to the economy, that is an impressive feat.

Cost plays a much bigger role than many may think. A full 55% of those exposed to satellite radio with a new car do not keep the service. In addition, the company loses about 550,000 subscribers per month while adding about 700,000. This means that there is a big pool of consumers that simply do not find value in what Sirius XM offers. This also means that there are plenty of potential listeners for terrestrial radio and Internet radio, and ultimately why both of these other mediums (terrestrial and Internet radio) will succeed.

Without even considering satellite radio churn let’s look at this with a real life example:

-100 Cars get manufactured

– 60 come with satellite radio (Sirius XM has between 60% and 65% penetration into new cars)

– 27 promotional subscribers elect to keep the service (45% take rate)

– after the promotional period there are 73 cars seeking other forms of audio entertainment and 27 keeping satellite.

You can see with this example that there is indeed plenty of room for terrestrial and Internet radio. Even if these two platforms split the remaining pie, it would mean that 27% went satellite, 36.5% went to Internet, and 36.5% went to terrestrial. The good news for SIRI investors is that this model already makes Sirius XM profitable.

The real question is what is the sweet spot for cost? Obviously the vast majority of consumers find that satellite radio is not compelling enough to separate them from a $20 bill each month. Is it better to get a higher price from fewer people, or to get more people with a lower price? Only time, and the competitive landscape will bear that out.

The whole new dynamic here is that consumers will now have three dashboard choices instead of 2. Terrestrial (AM/FM/HD), Internet (Pandora, Slacker, MOG, and Cloud services), and satellite. Instead of satellite competing with one opponent (terrestrial) in the car they are now competing with two (including Internet radio). What used to be a choice of satellite or a consumers local market terrestrial offerings (sometime quite meager in terms of selection), is now a choice of satellite, local terrestrial, or a massive selection of content via the Internet.

Satellite radio will come in at a minimum cost of about $14.50 per month (including royalty fees) and almost $17.50 per month if you want to stream over the net. Other services can range from free (terrestrial, iHeartRadio, MOG, Pandora, and Slacker) to about $10 a month for Mog or Slacker On-Demand.

The real question is whether any particular service, or combination of services deliver the content that consumers want. Yes, if you want Howard Stern you need to have Sirius XM, and if you want Rush Limbaugh you need terrestrial, but outside of these top tier names, what will satisfy consumers?

I am a satellite radio subscriber that also listens to a smattering of terrestrial radio (Sports Radio WEEI in Boston), Slacker, and my iTunes library. In my case Sirius XM is a big winner. There are however people who find a free Pandora combined with terrestrial and something like iHeartRadio compelling. The new dynamic is this:

Let’s assume you live in a market that has 12 FM stations and 10 AM stations. Out of these 22 stations you only like and listen to 2. In this situation satellite radio may be a compelling solution. Now add Internet radio into the mix. You suddenly have access to 750 channels on iHeartRadio, and customizable music on Pandora at no cost to you. Will that compel you to leave satellite radio? For some the answer will be yes. It boils down to how much money your audio entertainment is worth. The addition of Internet radio to the dashboard is new. There simply is not yet enough data to draw a conclusion. However, we already know that satellite radio is not a good value to over half of those exposed.

CONCLUSION

I oft get harassed by overly passionate satellite radio fans for “having the gaul” to even mention Internet radio on this site. I have been characterized as having a “belief” that Internet radio will be the death of satellite, and even been accused of being a Sirius XM basher. The fact is that I have NEVER stated that Internet radio will kill satellite radio. What I have stated is that Internet radio will exist, succeed, and perhaps even prosper. My stance is that there is plenty of room for success in satellite, terrestrial, and Internet radio. What is obvious to anyone that looks at the audio entertainment landscape with an un-jaded eye is that there is indeed room for several players.

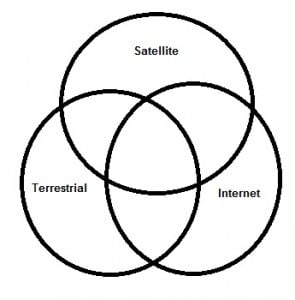

Pandora (as well as other Internet radio providers) and terrestrial radio compete with satellite radio. Until now the dynamic has been satellite radio eroding the terrestrial radio market share. Now, companies like Pandora are also working to erode that share. This is not a major concern to the satellite radio core as yet. People that pay up to $20 per month for Sirius XM are in a different category than those that seek out free, or less expensive alternatives. Think of it as an overlap. Each type of service will have their core group of users. In this respect there is no threat of competition. Where the competition happens is in the areas of overlap. The three circles can shift to favor one service over the others, or a combination of services.

Pandora (as well as other Internet radio providers) and terrestrial radio compete with satellite radio. Until now the dynamic has been satellite radio eroding the terrestrial radio market share. Now, companies like Pandora are also working to erode that share. This is not a major concern to the satellite radio core as yet. People that pay up to $20 per month for Sirius XM are in a different category than those that seek out free, or less expensive alternatives. Think of it as an overlap. Each type of service will have their core group of users. In this respect there is no threat of competition. Where the competition happens is in the areas of overlap. The three circles can shift to favor one service over the others, or a combination of services.

This is the competitive dynamic I oft speak of. The audio entertainment landscape is not an either/or situation. None of these players will dominate the world no matter how much passionate fans of satellite, terrestrial, or Pandora may want. Even at its peak terrestrial radio’s Clear Channel did not have everyone listening.

For Sirius XM the trick is not letting their own loyal audience erode because of the advent of some pretty compelling Internet radio offerings. So long as they can keep their core subscribers, and add to that core they will be doing fine. They could even raise prices like they have discussed in quarterly reports. However, if their churn increases, or the take rate begins to suffer, the pricing elasticity may not be there. As I have said before, there is plenty of time for satellite. Internet radio in cars is brand new and will take years to reach penetration levels that satellite radio already has. The ultimate look of the overlapping circles will not really be determined for at least another year, and will continue to shift thereafter.

In the end the threat of Pandora and terrestrial, or any combination of other audio entertainment is limited to the overlapping areas of the circles and not at the core of satellite. This is a stark contrast to terrestrial radio which is seeing its core erode. The key for satellite, and Pandora for that matter is continued growth of audience, and BOTH can accomplish that without any meaningful loss of their core.

Position – Long Sirius XM, No Position Pandora

great article

Thank you for the kind words

I am not saying you have the gaul to question SiriusXM or point out the threats from Pandora. Au contraire. Valid points all.

HOWEVER….what about flipping things around and pointing that high powered perception on Pandora alittle?

Now that they have gone public with an IPO (some would say a desperation move)….you have to consider that its only a matter of time that they will HAVE to add more commercials and raise their subscription fees to stay viable. YES…there is more competition for Sirius now in the car….BUT Sirius is not the only one threatened. So is Pandora! Do you really think they can maintain “free” or have so few adds? Yes….doing so enabled them to capture the lions share of internet radio listeners….but now the chickens have come home to roost so to speak.

They have shareholders now. They will be under ENORMOUS pressure to perform in the eyes of those shareholders. I.E….they will HAVE to change to survive. And remember….there are NO barriers to enter their so called area. Spotify, MOG, SLACKER and thousands of other potential threats are nipping at their heals. NO….they cant stay “free” forever….at least not with so few commercials. And if not, they will definitely have to raise their subscription rates like other internet radio companies already have.

Again, i dont knock you for bringing up Pandora in relation to Sirius…..but please….start picking apart Pandora alittle too.

There is a reason why people paid for Sirius. And although you seem to down play its content…i think you overemphasis your point a bit. People DO like the variety. Will EVERYONE listen to NASCAR? Of course not. But that is what VARIETY is all about. And Sirius has variety like nobody else.

And yeah, Sat radio 2.0 WILL be a big deal. Especially if they add Pandora like features to please that young instant gratification tech crowd. Then Sirius will have both the variety AND what the young ones seem to like. While Pandora and its ilk will have just what they have. And as i pointed out, THEY will be under enormous pressure to raise their prices and amount of commercials to stay viable.

Remember….every quarter Pandora will have to report their earnings….just like Sirius now.

Competition is good. But please….Pandora will have to compete now too. So alittle more even handed coverage is in order. Pick Pandora apart too. Yeah yeah yeah…weve all heard about the 90 million “registered” users….but come on. We all know that includes EVERYONE who has ever checked out the app. Pandora will have to show REAL numbers that count towards their bottom line every quarter. Not just these impressive sounding but ultimately meaningless numbers. Heck, Sirius could triple their numbers too if they included EVERYONE who ever tried Sirius! Lol

Competition is good. I say Bring it! All this talk aboit Pandora entering the car? What about Sirius entering the mobile world with 2.0?

It goes both ways. 🙂

I believe Pandora will raise prices. I have stated that in the past. I am not being critical of either company as I believe that both will not only survive, but do well.

There is indeed a barrier to entry for Internet Radio and it is substantial. Saying there is no barrier is foolish at this point. If there was no barrier Spotify would already be available in the U.S., and Pandora outside the U.S. Getting licensing is not an easy thing to do.

No, a company would not need to spend billions on satellites, but getting the record labels on board is no easy task. Getting into dashboards with apps is no easy task. The fact is that there will not be “thousands” of Internet radio companies competing and being viable. There will be a handful.

Mel throws out some good rhetoric on the subject but you need to take it with a grain of salt. Pandora could double the number of ads and still have substantially less than terrestrial radio.

There will be articles critical of Pandora, but at this moment there is not a lot to work with.

Just watch. As soon as siri bottoms and starts north watch all the positive hyping articles Osbourne will start printing. Look back at his articles in relationship to siri share price. As soon as we hit $2.44 all of a sudden articles turned negative, this POS, PREDICTED SLOW DOWN IN AUTO sales, slow down in subscribers, increased churn rate, higher competition,

Pandora IPO, poor management, lack of innovation, marketing. Go back and look. Just an observation.

Geronimo….

Interesting…..first I am a pumper, then I write negative pieces. Which one do you want?

There was an auto sales slowdown in may. I warned about but also said as long as 1 million cars sell siri would be fine.

I am critical of marketing

I did not predict higher churn. Read my q2 preview

Another point. Slacker is what? $9.99 a month? And Spotify even more? More realistic pricing model and one Pandora will be forced to adopt sooner than later. That brings the price VERY close to SiriusXM’s base price. When faced with THAT kind of choice….suddenly Content DOES play a huge factor. And price becomes less of one. If someone could get ALL of Sirius’s content AND the ability to customize radio stations which they might in Sat 2.0…..then Pandora at $10 suddenly aint such a deal. Or “FREE” Pandora with 4 times as many commercials either.

Look at both sides of the fence my friend. Sirius has competition. But so does Pandora!

Pandora brings with it a whole new way of listening to music…yeah….but remember….Sirius competed with free and GREW when it was only it and terrestrial.

Like i said, competition is GOOD for us all.

I agree 100% that P will have to raise its price. There is no other way for them to survive. Then we will see what is going to happen on a level playing field in terms of price vs. content. Also, it is not serious to claim that P is for everybody. P has absolutely and clearly defined demographics with a clear domination of the have-nots, including kids, students, those who cannot afford any fee in general… and misers whose basic principle in life is not to pay for anything if it is feasible no matter what quality they can get for free. They do not care as long as it is free. Once P starts charging as little as a penny, the miser group would drop out in a split second. I disagree with the way Spencer is showing the overlap of P with siri. In reality, at best one core Sirius user or even none would switch to P and the same relates to P. They have be and large different demographics. It would be very interesting to watch what is going to happen when Pandora starts charging everybody, say, $6.99 a month. I am curious what would 90 million subs turn into.

I will pay for Sirius xm till I die

You are in the core for satellite radio.

Well-written analysis.

But those 3 rings remind me of Ballantine Ale . . . I think I’ll go have a beer!

http://www.youtube.com/watch?v.....re=related

Me too. Pandora has a long way to go to to match Sirius’s content. While it would take very little effort for Sirius to add Pandora like features to Sat 2.0…..remember….NO BARRIER into that space.

Ultimately i see the one with the best content AND the ability to customize stations winning this war. And Sirius has the head start IMHO.

In the future, i see those people who like creating their own stations being able to do so via VOICE COMMAND. Imagine driving along and saying CREATE STATION…then saying the song or artist and BAM! Youre listening to it. Say another artist and BAM! New station created. Say BUY SONG or FAVORITE SONG and BAM! Its bought and downloaded or saved as a favorite. In this fast paced instant gratification world we live in, this tech will fly.

But so will the desire for CONTENT. And Sirius has that in spades.

I am very excited by Sat 2.0 and the future.

GreenMeanie…..

Be careful with this “no barrier to entry” mantra. It has been decisively proven to not be an accurate description of offering a viable Internet Radio service.

Consider that even a company as MASSIVE as Google has not been able to close a deal with record labels.

Consider that MONTHS after announcing their intent to enter the U.S. market that Spotify is still not here.

If anyone wants to debate about the barriers to entry for a viable Internet radio company being non-existant they will lose and lose in a BIG way.

The point Mel is trying to make is that it would cost a lot for someone else to launch satellites, vs. virtually nothing to stream over the net. Some overzealous Sirius XM faithful take that to mean that anyone can start an Internet Radio business.

This is not at all what Mel means, and more realistic people out there realize this. The fact is that a VIABLE internet radio company requires tens of millions just to stream their first song.

Pandora paid $10 million per month in their last quarter in ROYALTIES alone and another $9 million per month for operations!

$20 million per month is a substantial barrier.

Will someone get pandoras CEO or Tim on there blogtalk radio show

Dumb! Dumb! Dumb! This is the same as saying the following. Stay w me, please. if I were looking for a collared nice polo shirt for my dad for Father”s Day, I ought to go to Wal Mart as opposed to my depertment store for a Ralph Lauren shirt. I mean, I would save $50 at least if I get a generic brand at Wal Mart as opposed to Ralph Lauren. So, it would be worth it to save money and shop there. Now, answer me an unbiased question, please. Is Opera Winfry stil on Sirius? Did she move to Pandora,Sirius, or quit? If she moved away from it all, than congrats to her for being smart. I can”t be dishonest and act like I have tuned in to Sirius recently, bc I haven”t. I do however know that Howard Stern has been and is still on. Now, I would rather spend .55 a day on listening to him alone than pay for some crappy free service. It is the last 30 minutes of power hour and I wil be more than happy to get in on the quality as to why Sirius is better than (gag me to even say) Pandora? Really? What have you been smoking who disagree with me? If you are drug free and are already long in the stock of pandora, you are excused for wanting to disagree w me. Being due to t fact tht no one hates loosing money more than me and we all make mistakes.

Bad analogy. It would be like getting a better shirt for $50 cheaper at Walmart. I listen to the radio for music and a lot of the internet radio guys deliver a better quality sound as well as a better way to listen to music.

Does Sirius XM offer Oprah and comedy? Sure but, I just don’t care.

Internet radio has a ways to go because…….

My Sirius starmate connection is messed up so until I change the radio I thought why not use my phone app to my line out in the radio, good idea huh, that’s what I thought but the data service keep losing the connection and the audio was less than par. So it just made me realize that with all the smart phones being used for Pandora and others it will just drive you crazy in the long run. Hate to say it but I would rather listen to regular radio if that was my only other choice. God bless satellite radio.

Oh my phone service is Verizon one of the best here in New York….

True. Maybe i was a little too flippant in saying it was a piece of cake to start up one of these internet radio companies. Iromically that actually makes my point better….that these internet radio competition have MANY uphill battles themselves. They arent like some monolithic impervious threats. They are vulnerable too. Pandora having to go public is indicative of that. And as you agree, Pandora WILL have to raise prices soon to stay viable….ala Slacker and Spotify which both charge $10….which seems to be the minimum viable base price. Again….such pricing practically equals Sirius’s but without the content of Sirius. That is why Sat 2.0 is so interesting. Exactly HOW MUCH will it mimic what Pandora does? Because with the price playing field equalizing over time…it will come down to content and what features a service offers. If Sirius dominates the content AND can mimic what internet radio does….um….it really bodes well for Sirius if you ask me.

Because if Pandora is forced to raise their rates which they will have to we agree…MANY of their leech like adopters will invariably drop off and look for another “free” host…..which i think will get harder and harder to find.

The commercial aspect of pandora while tolerable now….will also get worse. Will it become as bad as terrestrial? Only time will tell. But even half as bad would be annoying for many many people. And if they turn to the pay model…and its raised to $10….again…we come to a very interesting choice.

Sirius has an edge, but as you point out, they cant get complacent. But neither can Pandora! It cuts both ways. Personally, i have complete faith in Mel. His track record in radio is great. True the landscape has changed…but Mel aint stupid. Sat 2.0 will deliver IMHO.

Gonna be an interesting last half year thats for sure.

I am getting tired of hearing about Satellite Radio 2.0 and what people think it will be. All we know for sure is what Mel has said and that equals zzzzzzzzzzzzzzzzzzzzzzzzzz! Pause? rewind? MAYBE,MAYBE MAYBE custom station. How Mel could say “maybe we will offer custom stations if they find that is something the subscriber would want” still blows my mind. MAYBE? It needs to be way more than just me being able to listen to the Gale King show whenever I want.

Which Ipad will Apple be on by the time this thing gets released?

Satellite radio 2.0 will include on-demand

What does “on demand” even mean? Nowhere has Sirius ever said on demand will be what everyone assumes it will be. Sirius has ONLY referenced that PROGRAMS will be on demand. Gale King, Mad Dog, etc. Mel said MAYBE custom stations. MAYBE.

On demand is getting the content you want when you want it. Sirius XM demonstrated it at CES in january. They also confirmed it in public at the annual meeting.

Help me out please. I have scoured the Internet and I can’t find 1 article referencing anything that Sirius demonstrated at the CES, little lone something 2.0 related. In fact, all I kind find is people complaining about what a no show Sirius was at the CES. Where can I read about the demonstration you are talking about? The only thing I can find is the Alpine radio that has nothing to do with 2.0

Puddy……

You wont find anything. Sirius XM’s presence at CES was virtually non-exustent. The company did demonstrate some 2.0 features to OEM’s, etc.

If you dug hard you will see some features of 2.0 discussed on the web.

it was sad to read the Sirius VP stating that on-demand will only be on the internet side. The new radios he talks about sounds just like the radio I already have. What on these new radios are going to make people want to buy them? The only update sounds to be the internet. Why has it taken so long to just update a website? I am curious as at what you saw demonstrated? A website? Where is the game changer?

I keep hearing about Satellite Radio 2.0, but have zero confidence it will be a game changer. Why do I have zero confidence? Because they just released a “new and improved” web player that frequently drops audio, kicks me out, or sometimes won’t even let me sign in. If this is a showcase of their web and mobile expertise, then I see absolutely nothing good coming as a part of “Satellite Radio 2.0”. In fact, their “new and improved” web player led to me dropping my service. I used to listen primarily at work via the web player. Since it no longer reliably or consistently works, I unsubscribed. (I never had problems with their old player.) Then, I figured since I’m only in my car for 30 minutes a day (round-trip commute), I might as well drop my receiver’s subscription, too.

The unique content that made me a fan of Sirius in the first place is also becoming more scarce. My favorite type of talk radio is the so-called “shock jock” stuff — Stern, Bubba, and Opie & Anthony. Stern adheres to a 4-hour show now and is only on 3 to 4 days per week. Bubba’s show is no longer on Sirius. And, if I want to listen to Opie & Anthony, I have to pony up an extra $4 per month, bringing my total monthly cost to $21 (Sirius Premier + online + royalties). It just wasn’t worth it anymore.

I want to like Sirius. In the beginning, I loved it. I visit sites like this as well as some of the fan forums because I want to keep up with the company. I hope that they’ll someday get their act together and become something special once again. There is so much potential there, but they’re wasting it.

So, I guess in my mind, you can say that Sirius’ biggest competitor is themselves. I only listen to Pandora because Sirius’ web play no longer worked. I have no desire at this time to use a smart phone in my car, so I listen to my own music off a thumb drive. I’d like to listen to “shock jock” talk radio again, but the current amount of this type of programming on Sirius isn’t worth $18.45 a month (Sirius Premier + Royalties).

I agree, the web player is horrible. Anyone who thinks Sirius can develop anything close to Pandora or Slacker needs to look no farther than the web player or app. The app crashes twice, everytime I load it, before it will play one complete song. These articles talking about what 2.0 is going to be are crazy. People are talking about video service, cellular service, internet service, buying live concerts, buying concert tickets, buying items off a QVC radio channel, etc.. These people are nuts. Check out the web player and explain to us how a 2.0 version of that is going to blow people away. Currently, I’m a listening to 80’s on 8. I wonder what is on 7. Let me get my mouse and place the cursor over the 1/16th of a inch bar representing #7, that is right next to over a 100 other bars that look the same, and find out. Ok I am doing it. Opps i put it on the 6, well let’s move it. Oh oh now I am on the 9,oh wait now I am back over the 8. Well wouldn’t be great if you could see what was playing on all your favorites at one time? Sirius doesn’t think so. Wouldn’t be great if you could tag songs and bands to be alerted when they come a Sirius station? Sirius doesn’t think, so even though JVC did in 2004 when they made my first Sirius player. 2.0 is going to be more Latin channels and a pause button.

Puddy…..

Satellite Radio 2.0 will include On-Demand, additional channels, and some Pandora-Like Features. That is the product in a nutshell.

Video – Wishful thinking by some over exhuberant satellite radio fans. Not part of 2.0. The company has enough trouble keeping up sound quality withy their spectrum. Adding more video (on to of the three cartoon channels) simply will not happen.

Cellular Service – The result of a really overactive imagination. Not a part of Sirius XM’s plans.

Internet Service – Again, an overactive imagination by someone. Sirius XM does not have the spectrum for this. Will not be part of 2.0

Buying Live Concerts – The company already broadcasts live concerts often. They will continue to do so. Video of live concerts…..not likely to happen for the reasons outlined under the video comment above

QVC – over exuberant talk of people seeking out synergies with Liberty. Not a part of 2.0

I agree that there are people overhyping 2.0. It is sad that this happens, but what can we do other than find people we trust who tend to be accurate and not full of hype

66% of those exposed to Pandora find it uncompelling as a free offering, and to talk about penetration, Pandora is available on every device, of those who like it 10% feel it is worth $3/ month. That is a truthful assessment, is it not? There is also no true measurement as to the age of the users, yet logic dictates that teenagers are indeed the core demographic, with a substantial pre-teen contingent as well. All three “radios” have been available in my car for the last 3 years, and I choose to avoid terrestrial completely, sporatically listen to Internet radio, consistently listen to podcasts, and finally…pay for satellite. And of course I consider myself…Every man… Infact, when I step on my scale at home, the digital read out says…”one at a time please!”

I’m having difficulty with your 20 minute commute argument, Spencer. Most people spend a lot more time in their cars than just commuting. Commuting may be only half or even less of their vehicle usage. Americans also use their vehicle for a number of other purposes, including, e.g., errands, vacations, going out, shopping, and just about anything not work related that is done outside of the home. It seems your point, is, that because his 20 minutes commute is so short, that it just doesn’t bear paying for satrad. Consider this: We know he’s in the car at least 40 minutes a day, five days a week. Add on another 40 minutes a day just for errands and anything else. Add on another couple of hours driving time for the entire weekend. This comes out to about 520 minutes a week, or almost 9 hours/wk. That’s a lot of time to wish one wasn’t having to listen to commercials. One last point: I used to live and work in Boston. If you can get to work there in 20 minutes or less, consider yourself lucky.

Birdhouse….

The example I used was actually based on someone I know.

Satellite radio us used by less than 20% of the market.

I get and somewhat understand your arguments but one I flatly think you lost your mind: “What I have stated is that Internet radio will exist, succeed, and perhaps even prosper.”

Hell no will Pandora or any other internet radio service with their flawed business model. What is the major difference between terrestrial and internet radio? Royalty fees are MUCH higher for internet companies. And 2nd, Internet Radio does not own their own delivery system. So HELLO. If you do not have a smart phone ur out of luck. Additionally, terrestrial radio doesn’t have those issues. They also dont have customization but well, radio stations are somewhat profitable.

Have you heard of the FORMER and now dead internet radio sites: Ruckus Networks, Immemb, etc. are all gone & so will Pandora, Slacker, etc.

Say Pandora gets double “registered” (inactive) users to 180M and doubles “active” user to 70M from the 35M (they “claim”). They still will be losing money. More subs means more loses. Its the dumbest business model ever. Reminds me of so many Dot Coms in the early 2000’s.

I have an article coming out at seeking alpha monday that you will want to check out.

I’ll look forward to reading it.

ok, now im might get flamed for saying this, BUT, honestly if it werent for SiriusXM content (talk, sports, etc) they would be dead in the water, BECAUSE, their music channels SUCK BADLY, omg their playlists are so tight I feel like I cant listen to their music channels for more than 30min without switching to howard stern, cnbc, etc… I feel like in terms of strictly music, Sirius is FAR behind the likes of Slacker and MOG, where honestly I dont think I hear the same song maybe more than 2 or 3 times a day, rather than 2x an hour.. I think if Sirius invested a little less on content (or simply renegotiate most of their contract lower, maybe let some go like oprah, etc) and focus a little more on their music. I feel like Music is what draws people to the service initially and then, they discover all the other things siri has to offer.

Tony….

You wont get flamed from me. I really appreciate Slacker and use it a lot

yeah, they need to cut the fat on content a bit, beef up the music, and in the process maybe save 20-30m a year on programming costs…

I think this article was great. I am a Sirius XM defector. I was all in for Sirius XM for the longest time. Our family swore by it.

But now I have an iphone and I am one of the guys you talk about. I have a 45 minute commute each way to work. I use iHeartRadio to listen to Jim Rome and the ESPN Radio app, a 1 time $2.99 fee. I also use Pandora for music, or just listen to one of the iHeartRadio stations.

I also bought the MLB 11 app for just $14.99. There are my home & away feeds for MLB games.

There is nothing I cannot get from these apps that I miss from Sirius XM. The other content I never got into.

Great site…keep up the great work.

Edward J, Bought this app to listen to Cubs games at work. Worked great until the last update. Now I can’t listen to any games. Very disappointed for a 15 dollar app. For the price it should work EVERY TIME!

Please address how the current wireless infrastructure will support these internet radio platforms in an automobile. Another issue is user interaction. I find it nearly impossible for this form of media to ever be implemented successfully in a car. You can not text while driving…. why does anyone think Pandora / Slacker / etc. access through a cellphone will ever be allowed? Voice activation? Please…. I will not be talking constantly in my car to hear the music I want. I am interested in your take.

Hughes….

It already happens. Your smartphone connects to the dash seamlessly when you enter your car. You run Pandora off of an app on the stereo system of your car just like you would satellite or AM/FM radio.

The voice systems are already happening. Check out MyFordTouch at the Ford website, and Entune at the Toyota site.

Never discount the progress that can be made in technology. Texting in your car is definitely a no no. But people could work around this and just make sure all their stations are preset on their cell phone before entering their car. Then, like i mentioned and you poo pooed….VOICE command could be implemented. YES, you’d have to “talk” to your cell phone or dashboard….but it is definitely a solution….and one that i could see being used more and more in the future. Especially with all the laws about cell phone use. Voice command is a technology that isnt going away.

Having said that, it will take awhile for this set up to become as simple and streamlined as using your SiriusXM installed radio in your dashboard…but you have to think forward. Also keep in mind that SiriusXM is going to aggressively be moving into the internet/smartphone arena with Sat 2.0

I think this is a good thing….AND necessary. More and more people are using their smartphone for all their mobile needs. Just look at Flip cameras. They were all the rage for a bit, but technology is making them obsolete. Apples next iphone is rumored to be getting an 8 mega pixel HD camera. The trend is for the smartphone to be an all in one device. So it only stands to reason that listening to radio on it will become a part of that too more and more.

SiriusXM can do voice commands too. And they can create the ability of customizable radio stations as well. If this is becoming a huge part of how the young listen to music…it would behoove SiriusXM to explore it as well. And i think they will. Doesnt mean they should abandon their current model…and they wont. But nothing wrong with incorporating it into their current model. In fact, this makes perfect sense. Because it is much easier for Sirius to adopt some of these features, then for Pandora and its kind to offer the kind of content Sirius does. So SiriusXM would then stand out from the pack even more. Theyd have it “all” so to speak.

And as many have talked about above…Pandora will definetely be raising their prices to stay viable. Most of the other viable internet radio companies charge a base rate of $10…a rate very close to SiriusXM. So if price becomes a non comparison issue going forward, and SiriusXM not only does what Pandora can do and provide all their unique content….which do you think most people would choose?

Of course, many things can change…and Sirius has to stay on the ball and change with it…but they really do have a great advantage into the future. Sat 2.0 should be the first salvo shot across the bow. Should be interesting!

Hooking the smartphone up to the dashboard is still a cumbersome and awkward set up for many people. But more and more people will do it. And i am sure that Pandora will aggressively try to do what Sirius did, and get included in the dashboard on more models. SiriusXM has the jump there. But needs to become more of a presence in smartphones and on the internet. Which it looks like they are doing with Sat 2.0 …..so BOTH companies have their work cut out for them.

I may have missed it somewhere, but does Clear Channel have to pay royalty rates on the music streamed thru the IHeart app? If so, how could that possibly be profitable? If they don’t, why not?

Yes, Clear Channel does pay royalties to stream on the net.

They get revenue with advertisements

If that is the case then how is this not a money loser for ClearChannel since day 1? Before I got Sirius and I listened to welfare radio it seems to me the vast majority of ads were local based. How is ClearChannel going to squeeze more ad dollars out of Toms Muffler Shop in Iowa by telling him someone in Arizona may hear it on the Internet? this would appear to be a worse business model than Pandora. There is no way there is enough national ad dollars out there to support this, case in point Pandora. If there was that much money in it Sirius would be making a fortune in ad revenue.

They run ads on their streamer a-la pandora.

We do not know what the Internet side of Clear Channels business does. It is not disclosed.

The overall business of Clear Channel, inclusive of iHeartRadio seems to do well.

They run ads on their streamer a-la pandora.

We do not know what the Internet side of Clear Channels business does. It is not disclosed. Consider though that Clear Channel runs a lot more ads than Pandora.

The overall business of Clear Channel, inclusive of iHeartRadio seems to do well.

I downloaded the IHeart to see what was going on. I messed with it for around 30 minutes and some things caught my eye. 1) I didn’t see one ad scroll or popup anywhere. Also, your screen goes black on your Iphone/Ipod after 15 seconds so you would never seeb a ad. On Pandora the ad jumps up as soon as you start it. I don’t know how Iheart makes money on adds if they never run them. 2) I went to the genre section and clicked 80’s & 90’s. They have 6 stations that were being fed from around the country and all 6 are a version of the SAME station. Tulsa GenXradio, St Louis GenXradio, etc..

My first look at IHeart reminds me of HD radio which was basically more of the same junk already on welfare radio, just packaged different.

I will give the IHeart app props though, it didn’t crash on me. That is something my Sirius app has never done.

OK, update on this. At work, I went to the actual IHeart website to try it that way. On the website there are zero ads. Clicked on the player to listen to one of the stations. I choose a country station in New Mexico. “Big 107.9 Albuquerque”. When it first loaded up a 15 second banner ad for “Brake Masters” with “7 convenient Albuquerque locations” popped up. Since I live about 1500 miles from Albuquerque this really isn’t a ad targeted to me. After that 15 seconds I never saw another add. Roughly 15 minutes later I clicked the “Eagles Radio” station. I thought if any of these would have ads it be one of these specialty stations. Clicked it, first song on the “Eagles” station was a Lynyrd Skynyrd song, which is interesting in itself. No ad popped up though like last time. Instead, there is a banner ad at the bottom right that never goes way. Guess what is on the ad in that banner ad? It is a “Brake Master” ad. I have now listened to 5 songs on the Eagles station and that ad has not changed yet. Also still have not heard a Eagles song on the Eagles station. I am missing something. If Clear Channel is paying royalties on the music stream it isn’t being funded by ads on there. No way is Pandora losing money and somehow Clear Channel has figured out to make money off ad dollars from “Brake Masters in Albuquerque”. I thought Clear Channel was on the verge of bankruptcy a couple years ago? I hope they kept notes.

For me, the deciding factor is going to be customer service. It is nearly impossible to get any help with my account (eg., adding another radio, continuing a trial subscription) either online (two attempts) or via “Listener Care” (phone, two attempts). You would think with the statistics you quoted, siriusxm would be trying to keep their current subscribers.

Pandora may compete with the “Music” offerings of Sirius. But that’s about it. Now that both AT&T & Verizon are metering their bandwidth, I think I can pick the winner. That would be the company that is making money. But if I wanted to listen to just music only, which I don’t, I rather dock my iPhone.