In Depth Analysis Of May 2010 Auto Sales And What It Means To Sirius XM (SIRI)

The May 2010 auto sales are in the books, and the month fared better than most analysts thought. The big winners for the month were the U.S. Auto makers, but the import brands also had predominately positive numbers as well. Only a select few brands saw sales go down. Overall 1.1 million vehicles were sold in May. The real question for satellite radio investors is what it all means to Sirius XM.

The May 2010 auto sales are in the books, and the month fared better than most analysts thought. The big winners for the month were the U.S. Auto makers, but the import brands also had predominately positive numbers as well. Only a select few brands saw sales go down. Overall 1.1 million vehicles were sold in May. The real question for satellite radio investors is what it all means to Sirius XM.

Before going into some specific analysis, it is important to review how the OEM channel contributes subscribers to satellite radio. The different manufactures all have their own deals with satellite radio. There are several types of subscribers that are delivered, and understanding this mix is important as readers view the auto sales data:

PROMOTIONAL SUBSCRIBER

Most people tend to think that all new cars equipped with satellite radio come with a promotional subscription. In many ways this is true, but only from the consumer standpoint. From the standpoint of counting subscribers, some new cars equipped with satellite radio are not promotional subscribers. When Sirius XM details their subscriber base they use two main categories. Self Paying Subscribers and Promotional Subscribers. Promotional subscribers in this context are subscriptions for which the company is receiving revenue (be it revenue or deferred revenue). This would include OEM’s such as GM, Ford, Chrysler, Mercedes Benz, BMW, Volkswagen, Audi. Most of these OEM’s were the early adopters of satellite radio, and the company shares revenue with them. These companies pay for the promotional subscription and get rewarded via revenue share if the subscriber converts to self paying.

Promotional subscriptions that are not counted as subscribers during the trial period include makers such as Toyota, Nissan, and Hyundai. A buyer of these cars gets “free” satellite radio for a trial period (usually 3 months), but will not become any type of counted subscriber unless they become self paying. Think of these as the Sirius XM investing in a radio installation (SAC – subscriber acquisition cost), in hopes that free service for 3 months will convince the end user to elect to become a self paying subscriber. These types will never show up in churn because they are not counted as subscribers.

SUBSCRIBER AT PRODUCTION

Among the promotional subscriptions that are counted as subscribers are what is sometimes referred to as parking lot subscriptions. They gained this name because even though a car may not have been purchased yet, it is still being counted as a subscription. This is the case for Ford and Chrysler. In their deal, Sirius XM pays a subsidy for the radio installation. Once the radio is installed on the production line Ford and GM buy a subscription from Sirius XM. With Chrysler it is a 1 year subscription. With Ford it is typically 6 months. For Sirius XM this represents deferred revenue. The benefits are that the company has a “dedicated” subscription for a long period of time, and during the period from production to sale, these satellite radios are churn proof. With Ford taking a bigger and bigger market share, and announcing production increases, the subscriber roles will benefit. To better understand impacts, every Ford that was sold in May was already counted as a subscriber prior to the sale. In some cases, a car that sold in May could have already been on the subscriber roles for 3 months. Thus with these OEM’s, it is production and not sales that trigger the subscription.

SUBSCRIBER AT SALE

This type of subscriber applies to deals like the one with GM. The satellite radio is installed, and the promotional subscription starts at the time the car is sold. This impacts of this deal are shown directly each month in the car sales for that given month. A GM sold in May counts as a subscriber in May. This is perhaps the “purest” way to count subscriptions, and makes tracking easier. The news loves to report sales on a monthly basis, but production is far less reported.

SUBSCRIBER AFTER TRIAL

This is where Toyota, Nissan, Hyundai, etc. are counted. After the free 3 month trial a consumer faces a choice point. If they choose to become a self paying subscriber they are counted in the roles. If they decline the service, they are not counted. It is all as simple as that. Thus, a Toyota sold in May can not possibly become a subscriber until 3 months from now. This is a trailing effect.

Now that the basis of subscriptions has been outlined we want to understand the mix. The balance of this mix is what gives consistency in subscriber growth. I have stated for years that 1,000,000 car sales each month is the magic number. In fact, it has been my mantra when discussing the OEM channel. Getting into deeper detail, the mix of manufacturers and their market share is also important. This additional detail is important now because of the way the market share is shifting.

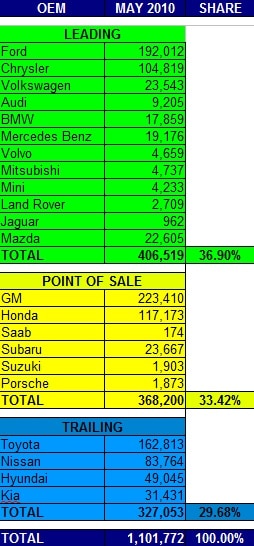

To better discuss this I will term the promotional subscribers into three categories. LEADING (i.e. Ford), POINT OF SALE (i.e. GM), and TRAILING (i.e. Toyota) as I discuss this section of the May auto sales. Looking at the May sales, it is interesting to note that Toyota’s slump and Ford’s resurgence have effectively shifted the balance slightly into the LEADING category. Having a balance for Sirius XM works well in the long term. This balance gives the company insulation and security in the ups and downs of the OEM channel. With the shift to a heavier weight on the LEADING category there is shorter term benefit to Sirius XM in terms of subscriber numbers. Understanding this dynamic is important because this imbalance should continue next month, and as production increases, the longer term promotional subscribers will outweigh the shorter term ones. On the flip side, the trailing subscriber benefit we would see three months from now is lower than it might have otherwise been. Overall the trade off is giving Sirius XM longer term subscribers, which is good, but the additional factor is that Ford gets a revenue share while Toyota does not.

To better discuss this I will term the promotional subscribers into three categories. LEADING (i.e. Ford), POINT OF SALE (i.e. GM), and TRAILING (i.e. Toyota) as I discuss this section of the May auto sales. Looking at the May sales, it is interesting to note that Toyota’s slump and Ford’s resurgence have effectively shifted the balance slightly into the LEADING category. Having a balance for Sirius XM works well in the long term. This balance gives the company insulation and security in the ups and downs of the OEM channel. With the shift to a heavier weight on the LEADING category there is shorter term benefit to Sirius XM in terms of subscriber numbers. Understanding this dynamic is important because this imbalance should continue next month, and as production increases, the longer term promotional subscribers will outweigh the shorter term ones. On the flip side, the trailing subscriber benefit we would see three months from now is lower than it might have otherwise been. Overall the trade off is giving Sirius XM longer term subscribers, which is good, but the additional factor is that Ford gets a revenue share while Toyota does not.

Some additional interesting facts from May’s auto sales rest with the top ten sellers.

Ford F – Series PU —— 49,858 – LEADING

Chevrolet Silverado PU — 33,690 – POINT OF SALE

Toyota Camry / Solara — 29,295 – TRAILING

Honda Civic ————-28,458 – POINT OF SALE

Honda Accord ———–27,835 – POINT OF SALE

Toyota Corolla / Matrix –26,953 – TRAILING

Ford Fusion ————-22,381 – LEADING

Nissan Altima ———–21,950 – TRAILING

Chevrolet Malibu ——–21,722 – POINT OF SALE

Hyundai Sonata ———21,195 – TRAILING

In the top ten category there is a distinct shift and the LEADING category has fewer participants, but the sales of the Ford Pick-Up truck far outweighs everyone else by a healthy margin. The importance of seeing the top sellers rests in the 60% penetration rate that Sirius XM has in the OEM channel. Sirius XM seems to do best in mid to top tier cars, as well as trucks, SUV’s and cross overs. Looking at the top 10 sellers, they are all good candidates for high satellite radio penetration. Sirius XM stated that they are focusing carefully on the penetration rate by not only brand, but model. By understanding the market, they can increase conversion rate. As an investor, readers who better understand the OEM channel are armed with knowledge that is usable and meaningful.

Stay tuned to SiriusBuzz for in depth analysis on the OEM channel that goes above and beyond.

Position – Long Sirius XM Radio

Spencer,

The piece is unique in the rarity of shedding light how siri gets subs. I assume these are the historic schemes that the company inherited. The question that lingers for me is the radios themseloves and associated siri expenses. I tend to think that the costs of the radio itself and its installation are passed on with a mark up to a car buyer like it would be with a CD player or a navigation system. I understand that may be in early days when sat radio was an exotic piece of hardware that OEMs would question or simply reject, both companies had to pitch in but now this should not be the case. I wonder what your take is on this matter and what kind of subsidies siri could pay to OEMs.

Thank you for the kind words. Every deal differs. Many oem’s do show an additional charge for the radio or service. Sirius XM does pay chip and installation subsidies as well as revenue share in some cases. Having covered the OEM channel as it relates to satellite radio longer than anyone else, you can find a lot of data right here in our archives.

Let’s get ready to rumble!!!

Very informative article Spencer…great breakdown! My only question concerns fleet sales. Any idea what portion of May’s numbers involved this type of sale sale? and, I have been told that fleet sales do not include satellite radios…is that correct? Thanks.

Fleet sakes are good for sirius XM. Included in fleet sales are rental car companie, and private businesses large and small. Yes, many government cars come stripped down, but a substantial portion of fleet sales include satellite.

Thanks Spencer! That’s good to know…others have indicated otherwise…now, I feel much better because I always know you do your dd!

Awesome report Spencer. I like how another site owner writes that he trained the other offshoot sites.

Interesting….I have been covering satellite radio for years in sattelite standard and then here after I merged with SiriusBuzz. I was not an offshoot of any site, nor was I trained by anyone from another site. I have covered the OEM channel for years as it relates. To satellite. People ate entitles to an opinion I guess, but that does not make it right…cheers

I believe Brandon is talking about KOAT and and to some extent SRPG, Satwaves was a total offshoot of Sirius Buzz. KOAT was a total offshoot of Satwaves. SRPG is really a offshoot of both Sirius Buzz and Satwaves. To be honest if Sirius Buzz was never here chances are that none of the others would have been ether.

P.S. As an example Orbitcast never really took off and really Satellite Standard (Tyler) and Charles had to team up to bring the site called Sirius Buzz together to make the site that everyother site copies off of. Dont believe me just take a look at the other sites set ups. When you do you will notice they all seem to have something very familure to them.

Tyler, While 1 million used to be the number for positive subscriber numbers being reported that has changed considering the formula has changed. For instance back some time ago while the penitration rate was down below the 50% number retail made up for that because there was way more of that then there is now. Now while retail has fallen off penitration is much higher then it used to be. The point is that because of those factors 1 million is not the MAGIC number and 900,000 is closer to the magic number then 1 million is as to when positive sub numbers will be reported or not.

I stick with 1 million because it delivers enough promotional subscribers to absorb any bumps in the road. 900k is cutting it too close. We want the company to be over 150k when they announce subs each quarter

I believe 900,000 gives enough leeway with a penitration of 60%. We have seen that even with Jan. and Feb. numbers coming in way under even 900,000 and Mar. coming in at 1.05 million that they were able to show 170,000 new subscribers. Now if you were to average out all 3 months that average would have been way under even 900,000. Of coarse I think the fact that they had a terrible 1st quarter last year which meant less of a loss in churn in this year but really the average of those 3 months was about 880,000 in OEM sales per month and even with that they had 170,000 increase in subs for the quarter.

I think with a 60% penitration and a normal all-in churn 900,000 is being more then conservative enough. If and only if I believe churn turns worse, then I would add that to any correction to OEM sales numbers.

John…

I see where you are coming from, but if you consider things across the board, you want 1 million. Last quarter was 900k, but setting royalties aside arpu suffered to bring churn down to 2%. 1 million delives enoughh promotional subs to take care of churn while letting around appreciate, or at least getting enough volume to keep goo overall revenue.

900k getss you across the rivr, but you are wet. 1 million gets you across the river and all metrics are happy

Tyler I see what you are talking about, except I totally disagree with the, all other metrics are happy. Another reason I like 900,000 is it makes all the other metrics happier then 1 million does. As you know each new subscriber has a cost to SIRIXM and their other metrics. 900,000 allows SIRIXM to grow all be it slower but in a less costly way. It gives SIRIXM time for the old subscribers to pay for the new ones coming on line. I believe people are sick to death of SIRIXM always losing money and while they also dont like them losing subscribers. On the other hand they are very happy if the company at this point just gains a few subscribers (50,000 to a 100,000 per quarter) and still shows better cash positions.

Tyler,great information! Question:as the year progresses doesn’t the penetration rates have more positive weight towards the end of the year? At the beginning of the year 09’s were still being sold and as the year ends the 2011’s come more into play, which I would think that in itself should help the penetration rate creep up. Is this already factored into your thinking?

Neal….

The company is already at 60%. They could see a small bump in that number, but I do not think it will be very material in nature for this years numbers. I do bear penetration rate in mind.