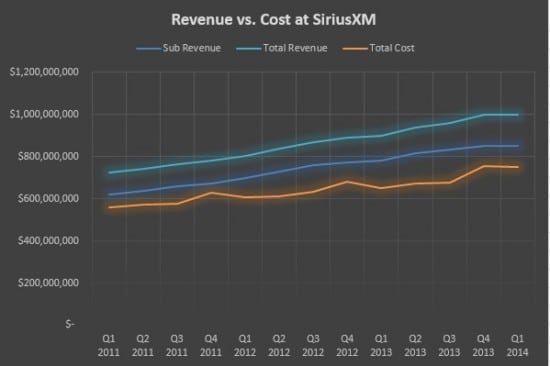

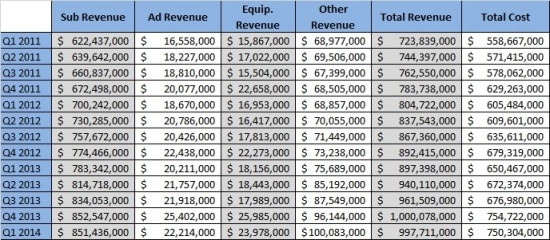

Comparison Of Revenue and Cost On SiriusXM

Just a quick note as to why valuations might be on the minds of the street. Over the past three years we have always seen the cost side of SiriusXM’s business show a nice little decline from Q4 to Q1. This year that pattern has shifted. While slight, it is enough to make someone wonder if the business model is flattening just slightly. In addition, the most recent quarter was the first time in a few years where revenue actually went down quarter over quarter.

I understand that free cash flow still looks good, but the revenue and cost side are what help deliver better free cash flow. This is simply a quick note showing the story of why some on the street may approach SiriusXM more cautiously than before. Long story short…Revenue was slightly down and costs did not go down like they normally do. Stay Tuned!

well this stock is in a freefall. when do they step in with the buyback and the officers buying!

w matt….

They are certainly authorized to start buying again. They have $1.7 billion left in the current program.

They likely had to tap the credit facility to hand $340 million to Liberty.

That would leave them with $600 million in available credit and $121 million in cash.

I suspect that another debt offering will be announced sooner rather than later. They need to borrow a billion to by back in an opportune fashion.