A Deeper Look at May 2011 Auto Sales and Sirius XM

The May auto sales numbers are now in the books. The negative headlines told the story for the auto sector, but the news for Sirius XM differs in that the month of May delivered over 1 million cars sold, which is a key number for Sirius XM. It is no secret that Sirius XM is closely tied to the auto channel. It is through trial and promotional subscriptions bundled with new cars that most people experience Sirius XM, and thus, where the company garners the bulk of their new subscribers.

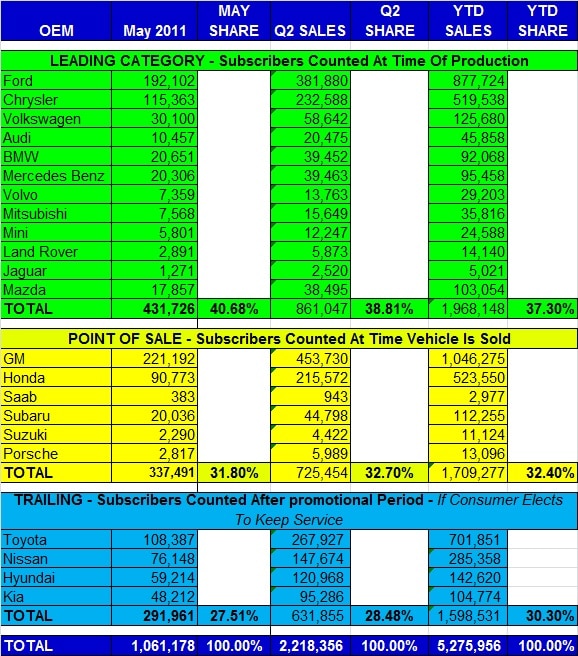

While bad news in the auto channel had its impact on Sirius XM, Savvy investors realize that the sales numbers were enough to allow Sirius XM to have a good quarter. With two months gone in Q2 auto sales currently stand at over 2,218,000 units, well above the 1 million per month average satellite radio investors want to see.

Perhaps the most interesting dynamic in May was the shift in the promotional subscriber pool. As SiriusBuzz readers know, we categorize the OEM channel into three distinct groups, LEADING, POINT-OF-SALE, and TRAILING. The “Leading” group (green in the chart) are auto manufacturers that deliver promotional subscribers to Sirius XM at time of production (up to two months before a person buys the car). The “Point-of-Sale” (yellow in the chart) manufacturers deliver subscribers when a consumer buys the car. The “Trailing” (blue in the chart) manufacturers only deliver subscribers after the three month trial and only if the consumer elects to become self-paying.

The shift that transpired in May was that the “Leading” category now accounts for over 40% of the market as it relates to satellite radio. What this means is that these manufacturers are selling more cars, and producing cars to replenish their inventory. Thus, the Sirius XM gross subscriber additions number in Q2 will be quite healthy by this shift.

During the Q1 conference call Sirius XM’s David Frear spoke of a pool of 1 million potential subscribers in the pipeline, The pool he was referring to was the category we call “Trailing”. These are potential subscribers because the company has received no revenue for these promotional periods. The “Trailing” category in May accounted for 27.5% of the market. What this means is that the pipeline that contained 1 million potential subscribers only a month ago is not being replenished as fast as it once was. This translates to leaner gross subscriber additions from this category in Q3 and Q4.

In a perfect world we would like to see a market share balance of about 33.33% each between the three categories. That balance allows for steady and predictable growth and avoids the see-saw effect on the subscriber numbers. One dynamic that the street will watch aside from subscriber numbers is Average Revenue Per User (ARPU). The “Leading” category is counted as a subscriber because Sirius XM has received a payment for the subscription at the time the car was produced. For example, Ford pays Sirius XM for a 6 month promotion. That payment is booked as deferred revenue on the financial reports. Deferred revenue is a liability on the balance sheet and does not become revenue until the service is actually being delivered to the end user. A bump up in the “leading” category has a negative impact on ARPU. This happens because as the car sits on the dealer lot it is being counted as a subscriber even though no revenue is being booked. For the period of time that the car sits on the lot is is contributing $0 per month to ARPU. If the number of $0 contributors increases substantially it begins to move the ARPU needle downward.

The bottom line is that the month of May saw car sales of over 1 million units and that is great news for Sirius XM investors. The more detailed look into the mix provides the insight that subscriber numbers for Q2 (short term) will see a boost while the potential subscriber pool is filling up slower and will impact Q3 and Q4.

Position – Long Sirius XM Radio

Good analysis. Keep up the good work!